I boost my dividend portfolio returns by trading options to generate additional income which I can then deploy to buy more dividend paying stocks.

My main strategy of trading options is based on three pillars:

Trading the wheel: I sell puts with a relatively short time to expiration on stocks that I would not mind owning. If the price and the premiums are aligned with my objectives, than I enter into a trade. I keep it limited to 3-5 open trades. If the option expires worthless, I keep the premium and look for new opportunities. If the share price drops below the option strike price at expiration and I get assigned, I start to sell calls until they are called away. In some cases I close the put option before getting assigned if the risk – reward picture to be able to sell calls is not in my favor.I do not use the options wheel strategy anymore as of 2022!- Selling put options on companies I have on my radar for my dividend growth portfolio but may be above the price I am willing to pay. Selling put options allows me to set the price I’m willing to pay. As a result, I get paid while waiting for the share price to drop!

- Selling options far OTM for companies that have a high IV rank and offer a good return / risk profile. I may only take one side with a short put or short call or use the short strangle to benefit from premiums on both side of the current market price of the underlying.

- Selling covered calls on stock for which I hold the shares in my portfolio to boost my income. Not only do I collect dividends but also option premiums. The underlying thought is that if the share price increases above the strike price I am not too concerned of selling the shares. I also work this way when I do not have the conviction for a company anymore.

Risk Management

It is important to be fully aware of the risks of any investment and trading strategy. By selling options the maximum loss is potentially to the total value of the underlying less any premium obtained. I trade with a margin account with collateral of my dividend stocks. I limit my exposure to a clearly defined range and trade options that are typically out-of-the-money.

One of the most difficult parts of options trading is to define a risk level, especially when selling naked options with undefined risk strategies. As the potential loss can be significantly higher than the premiums collected and the margin requirements increase when trades move against your position keeping enough free margin to manage positions is crucial. Additionally, option prices increase with increased volatility and as such, my exposure targets are adjusted to the VIX. The lower the VIX the lower my open positions and vice versa.

Having clear boundaries and targets set up, keeping disciplined and trading without emotions, staying away from all these great opportunities in the market when its not the right time will help to stay consistent and bring in profits.

Options Cash Flow and Secured Income

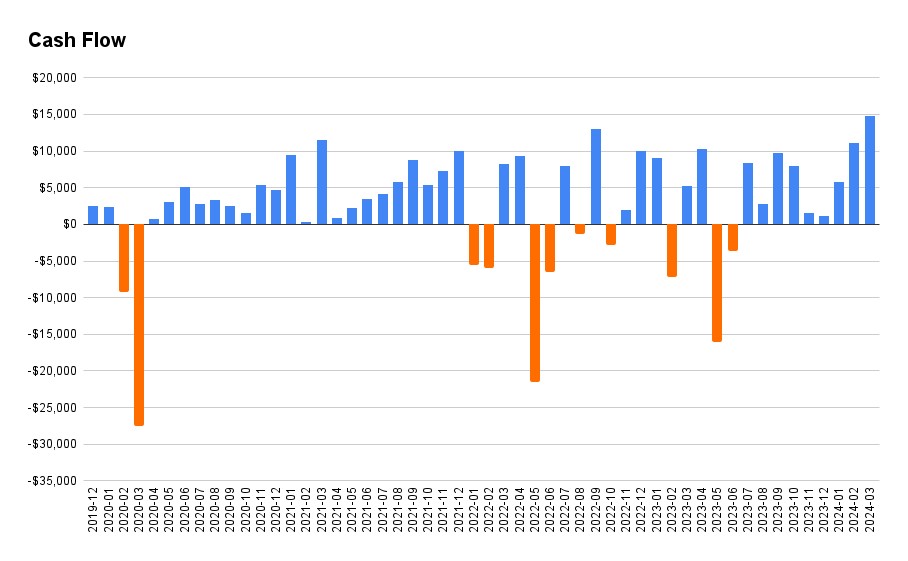

When trading options there is a difference between the cash flow and secured income. The cash flow shows you the net effect of opening positions which means selling or buying options. When you sell an option you immediately receive the premium for said option – a positive cash flow. When you buy an option you pay immediately the premium – a negative cash flow.

Additionally, when you close positions before expiration you buy back sold options and sell bought options. Again, these are all transaction that generate cash flow, either positive or negative.

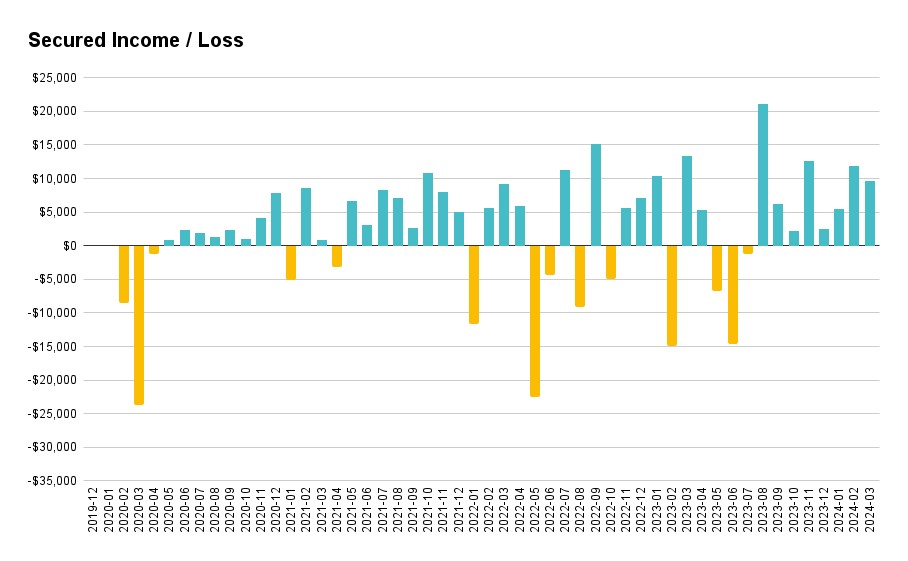

Only when an option expires, you are called or assigned or you close an option before expiration you actually secure income or incur a loss.

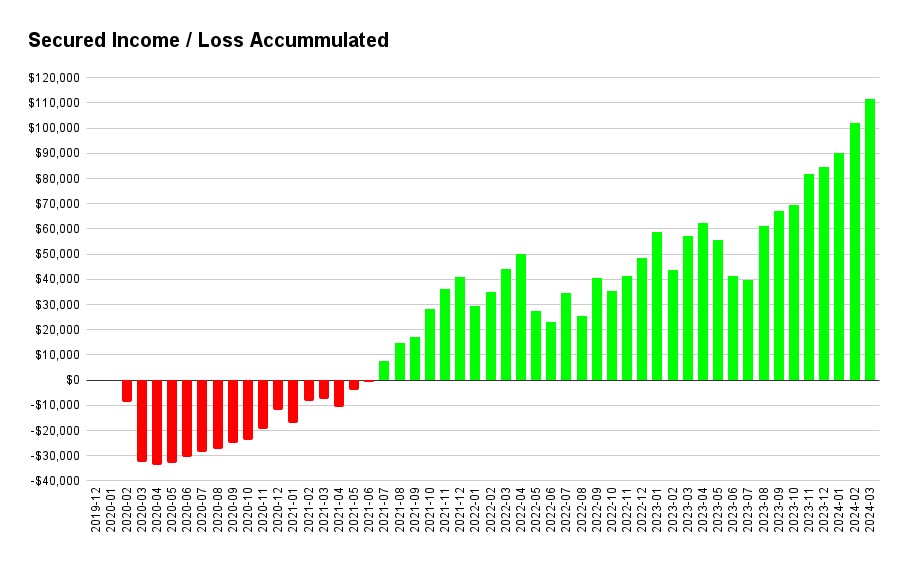

Here is the evolution of my trading on a monthly basis since December 2019:

Cash Flow Chart

Secured Income / Loss Chart

Secured Income / Loss Accumulated Chart

I started badly with the market crash in 2020 hitting shortly after I initiated options trading. For that reason, I needed the rest of 2020 and the first half of 2021 to recover these losses.

At the same time, the evolution also shows that my strategy works for me. The trend looks good but there is too much volatility caused by some heavily impacting losing trades. I still learn to improve my risk management.

However, risk management is vital and I have realized that my exposure and risk level is to high. For that reason, I will adapt my strategy and reduce my margin level for future operation, also considering the VIX volatility index level. One of the most difficult things though is to limit my options exposure and trade ‘small’.

Trading Journal

Here you can follow all my trades, I typically update them within a few days after the trading options. The ones marked with status “Open” are still pending expiration.