On this page I update the details about the dividend income received during the year as well as the total dividend income evolution. For each individual stock the dividends received are shown by month. The foundation for this dividend income is my Dividend Growth Portfolio.

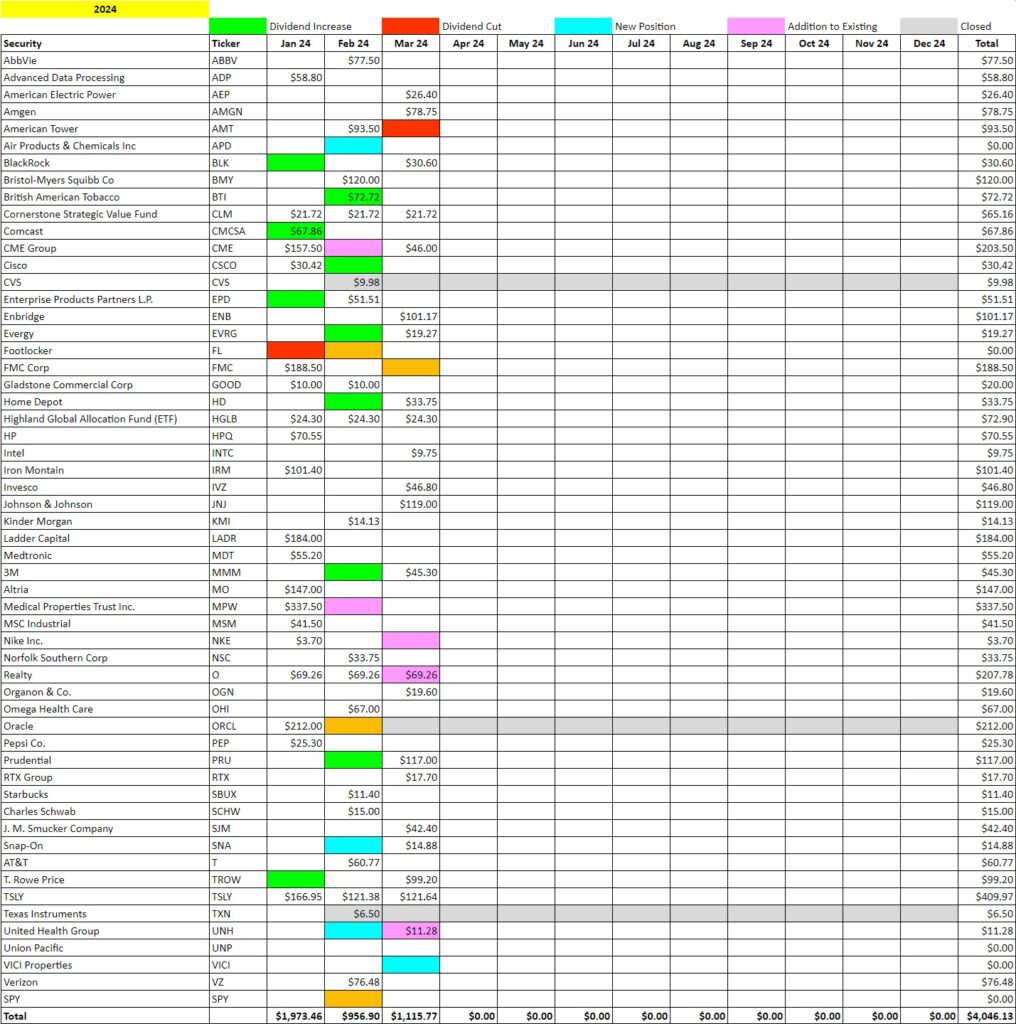

Dividend Income by stock and month

Updated: 31 March 2024

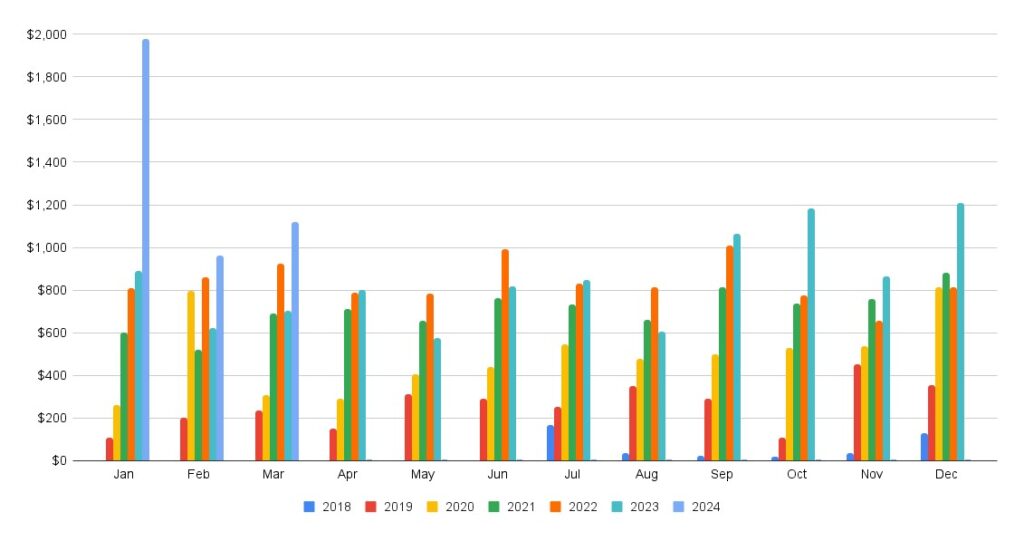

My total dividend income evolution is shown in the chart below on a monthly basis. I started my journey in 2018. My target is to reach $3,000 per month by 2035 and $5,000 per month by 2040. That would be a PADI of $36,000 in 2035 and $60,000 in 2040 respectively. I count on the significant impact of the compound interest for my dividend income based on my dividend reinvestment strategy.

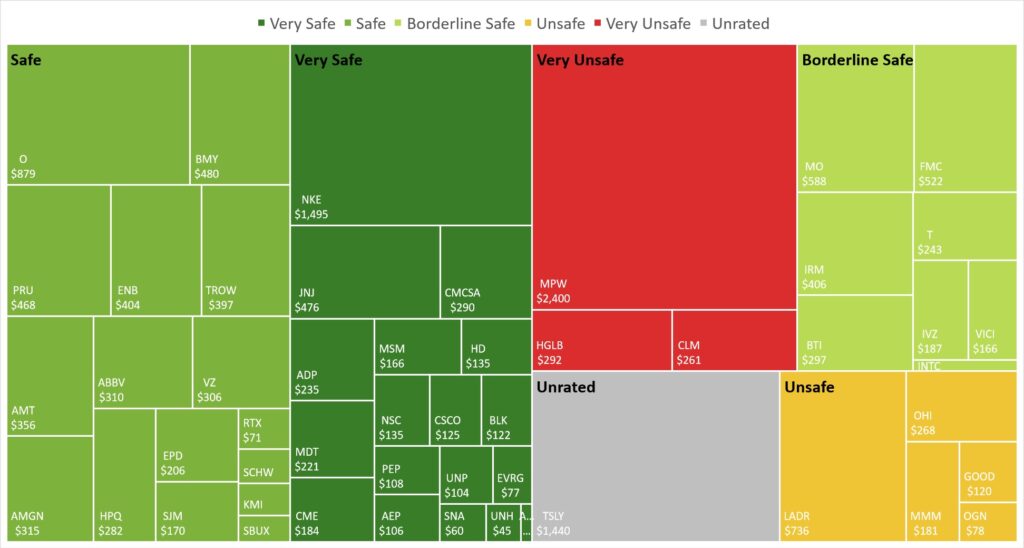

Here is another view of my current income distribution by dividend safety score classification as per the Simply Safe Dividend categories. The objective is to focus on dividend stocks that have a low risk of cutting their dividends which can be found in the very safe and safe category. The exposure to companies that are likely to cut their dividends should be reduced.

Please consider that I share my personal dividend growth journey and it should only illustrate how I generate passive income over time from dividends. There are many investment strategies and by no means this page is meant to discredit any other method, primarily because each individuals’ personal and financial situation is unique as well as the risk tolerance and targets are different.

As such, I would encourage you to see this site with my dividend income evolution as a motivational factor for your own journey. When it comes to dividend growth investing there is no get-rich-quick scheme, just continues investing in high quality dividend growth stocks over long periods of time. The great thing though is that the longer you stay invested the more noticeable the compound effect becomes.

Very interesting DGJ! My first target 🎯 will be 2k$ a month, that would be a good start! But 3k or even 5k would be even better! Need to save up + invest more for this for the future! 📈💲💰

Hi, these are my personal goals. Everyone needs to find what works for them and I am sure you can grow the snowball over time. DGJ

Hi

Thank you for sharing this valuable knowledge. How many shares do you need own get dividends? What’s your investing app?

You can start with as little as one stock that pays dividends. Though I do recommend to diversify over at least 15-20 stocks or an dividend ETF.

It looks like you are just starting. I recommend to read first about it, then see if it will work for you. A good starting point is this blog and my blog roll.

When considering dividend growth investing make sure you don’t get caught in the yield trap. Rather focus on quality businesses with a healthy payout (probably lower yield) and count with time on your side. This strategy is not a get-rich-fast one, it’s the compounding effect over years.

Any broker will do.

Thank you for reply back . Yes I had just started to learned about dividends and stocks . I’ll definitely check your website regularly to learn more from your experience. As I do follow you Twitter as well .

Congratulations!! It´s a very good portfolio. Which is the quantity from your money every month , that you decide for increase your portfolio?

Regards,

Hi Juan Luis, thanks for your comment on my portfolio. I feel though the number of holdings is getting a bit too large (+50 is difficult to track and identify under-performers). However, if I am convinced that there is still growth potential and/or the dividend compensates I hold the stock.

Right now I deploy about $1,500 to $3,000 plus any option premiums I collect. If appropriate I do use my margin.

How do you feed so many positions…..and how many or much did you start each with .

Hi Herbert,

I fuel my dividend growth portfolio with savings, dividend income and gains from options trading. When I start a position I typically deploy $1,000-2,000 to have a solid entry. I add to positions only if they are undervalued. As such I do not increase many of my positions at the moment because I opened them after the Covid crash in 2020 and I do not consider them undervalued. They have to grow organically.

DGJ

Great work and congratulations on disciplined investing.

Is it possible to get online copy of your tools.

The increase in January and its comparison with January 2023 does not follow the gradual trend of previous years, since it more than doubles the previous year. Without a doubt there you must have made a significant investment of new capital, perhaps from the sale of a property. Congratulations in any case for the boost that all this gives to your journey.

Hi Santiago, thanks for your comment. I did not actually add a lot of money but had decent option premium income over the last year. The significant dividend increase is partially due to options assignment on $FMC and $ORCL. $MPW is a bet on the long run. There is risk but the potential to recover nicely if they do not declare bankruptcy. There is some concentration of payments in January. Not every month will look the same.

Thank you for your sincere response. I also had MPW, but I had to admit that it was a mistake, I no longer felt comfortable with it, so I sold it with heavy losses, which I however compensated fiscally by also selling NVO and GOOG, which accumulated strong profits. Lesson learned (I hope) to try to buy only the highest quality businesses in the future

We all develop and grow in our investment journey. I have also learned that the growth and compounding effect of truly great businesses is the cornerstone of a long-term strategy. The underlying business growth is what fuels returns via price appreciation, dividends and absorbing other companies. And there will always be mistakes, but over time fewer and fewer.