We are off to a great start into 2022 and the Dividend Growth Journey has high expectations to make this another great dividend growth year. With the current market uncertainty around raise of interest rates, inflation, political tension and the economy direction it is great to have a more stable strategy of dividend investing as long as the underlying companies are of a high-quality nature.

In January I received $804.38 in dividends from a total of 21 companies. Six of my holdings raised their dividends.

I sold two positions in January: Huntington Ingalls Industries, Inc. (HII) and Dropbox (DBX) and did not add any new stocks. Margin requirements left me without any buying power.

My Projected Annual Dividend Income (PADI) has increased to $10,211 at the end of January. The goal for this year is to reach $13,000 while having a cash neutral rather than buying on margin. However, it will be very difficult as I have still a significant level of margin to cover first.

My options trading has heavily impacted my return with significant realized losses and still several challenged positions open. As I use margin for my options trading it clearly limits the possibilities to add to my dividend positions as the account balance has to be established first.

Dividend Income

It is time to review the earnings of my dividend growth strategy. Out of the companies I invest in 18 companies did pay me a dividend in January. This is truly passive income. Here are the details:

Advanced Data Processing (ADP) – income of $31.20

Cardinal Health (CAH) – income of $29.45

Cornerstone Strategic Value Fund (CLM) – income of $36.16

Comcast (CMCSA) – income of $32.50

Cisco Systems (CSCO) – income of $27.75

Gladstone Commercial Corp (GOOD) – income of $12.53

Highland Global Allocation Fund (ETF) (HGLB) – income of $24.30

HP Inc. (HPQ) – income of $25.00

Iron Mountain (IRM) – income of $61.85

Ladder Capital (LADR) – income of $160.00

Altria (MO) – income of $162.00

Merck (MRK) – income of $69.00

MSC Industrial Direct Co., Inc. (MSM) – income of $37.50

NetApp (NTAP) – income of $12.50

Realty (O) – income of $14.79

Oracle (ORCL) – income of $9.60

Phillip Morris (PM) – income of $37.50

PPL Corp. (PPL) – income of $20.75

MO and LADR are my main contributors with $162 and $160 respectively but their overall percentage has dropped to 40% of my January dividend income.

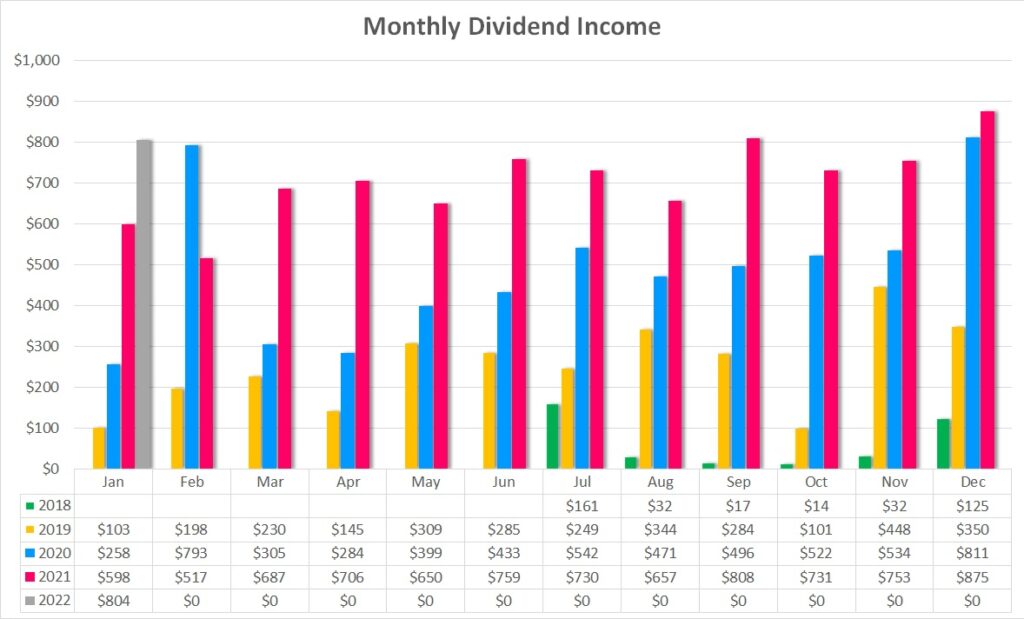

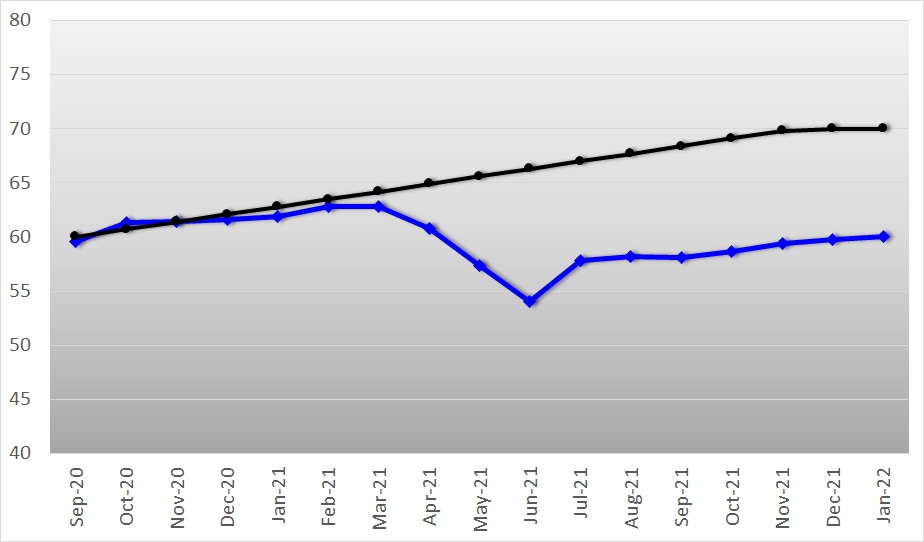

Overall, I like the way the dividend income looks and the chart confirms that I am going in the right direction.

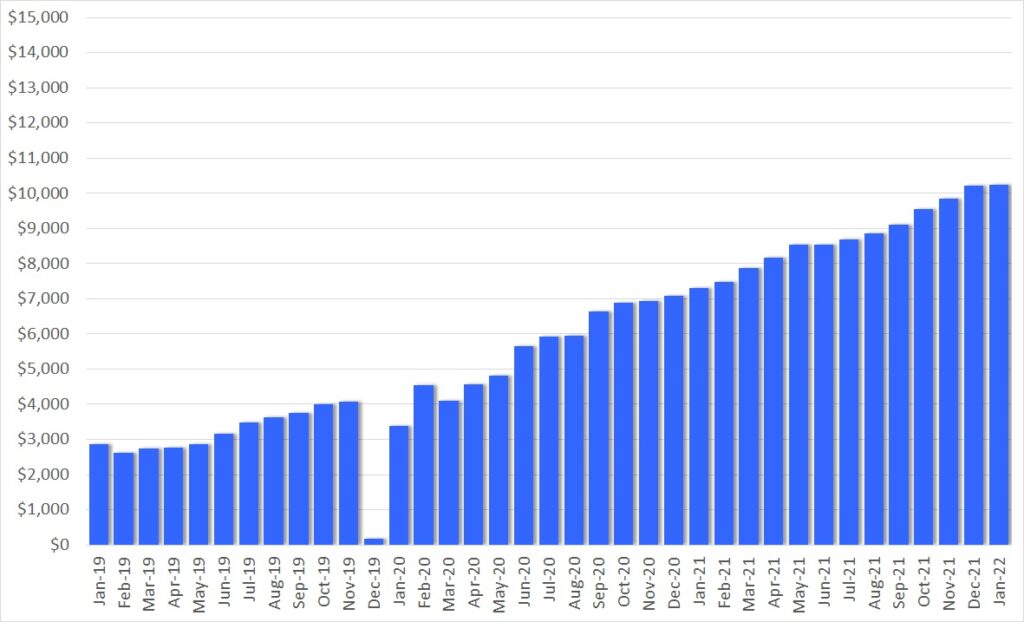

The above chart shows my monthly dividend income over time. In January 2022 I received $804.38 compared to January 2021 with $598.42 of income. This is an increase of $205.96 or 34%.

During 2021 I had increased my position in CMCSA and MRK as well as opened new positions with CLM and HGLB. I sold GAIN as part of being called on a call I had sold. Dividend raises played their part, too.

Check out my current Dividend Income table for 2022 and the full overview of all the stocks. You can find there all the historical tables since 2019.

Dividend Changes

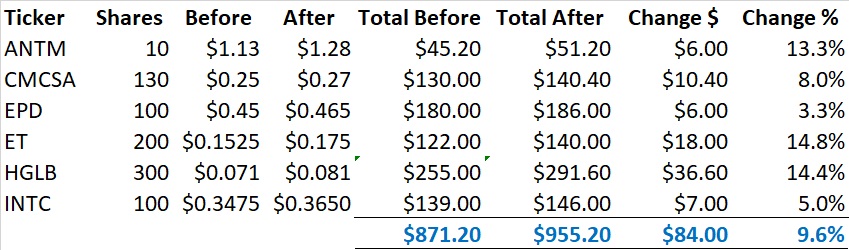

In January there have been in total six dividend increases in my portfolio. The table below summarizes the total impact of $84.00, with a weighted average increase of 9.6%.

This is exactly what I am looking for as a dividend growth investor. Trying to beat inflation is a key element of dividend growth investing. With an inflation rate north of 6% I am happy to see that right now I am outpacing it.

As a result of this change, my PADI increased by $84.00. At a yield of 3.0%, to achieve this dividend income I would have to deploy $2,800 of my hard earned money. But this is not necessary. The dividend increases take care of it and that’s the beauty of dividend growth investing and the compound effect in action. Reinvesting these dividends makes the snowball grow larger and larger over time.

The Dividend Growth Portfolio

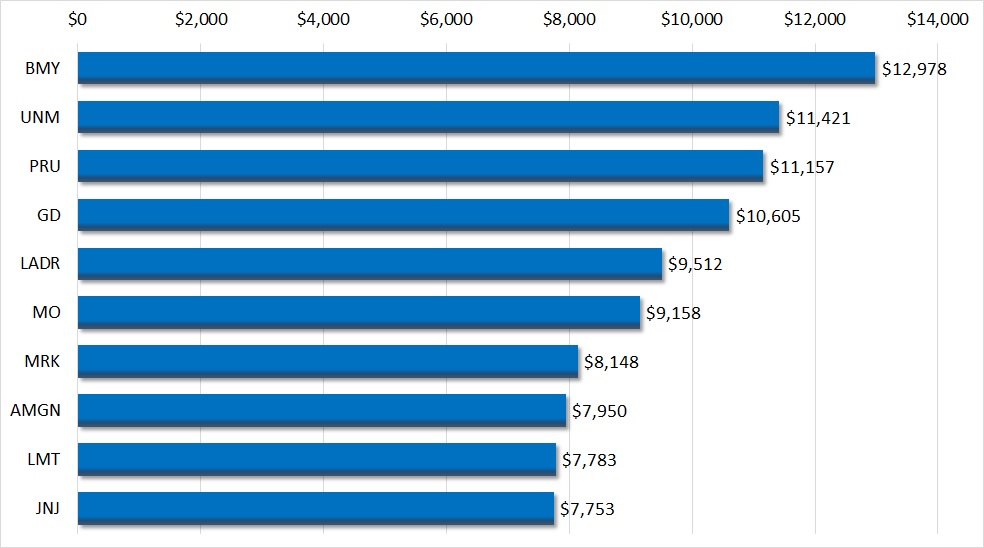

In the Dividend Growth Portfolio I hold 58 different companies. Here is an overview of the status as of January 31st. I have excluded the stocks that I are part of my wheel strategy on which I got assigned.

Here is the Top-10 holding overview. In total, these 10 stocks make up 35.4% of my dividend growth portfolio. BMY in the top spot makes up 4.77% of my portfolio value. JNJ as the number 10 still accounts for 2.85% of the portfolio value.

Purchases

With the markets dropping significantly one might think it is the right time to deploy money and buy dividend paying stocks. However, I got caught up in having to deal with margin requirements for my options positions.

As a result, I did not make any purchases during the month of January. I am sure the situation will improve over the next months and I will continue to add high-quality undervalued stocks to my dividend growth journey portfolio.

Sales

There have been two sales in January. Typically, when I decided to sell I close a position all together. This time it was no different.

The first stock which I sold was Dropbox (DBX).

I bought 50 shares of DBX on Jan, 4th, 2021 for a total of $1,109.26 with an average cost of $22.19 per share. One year later, on Jan, 21st, 2022 I sold these shares for $1,198.77 and generated a profit of $89.51 or 8.1%.

The second stock I sold was Huntington Ingalls Industries, Inc. (HII).

I bought 10 shares of HII on Jan, 25th, 2021 for a total of $1,836.42 with an average cost of $183.64 per share. One year later, on Jan, 24th, 2022 I sold these shares for $1,903.54 and generated a profit of $67.12 and further $34.60 in dividends. The total return is $101.72 or 5.5%.

I still hold GD and LMT in my portfolio which represent about 4% and 3% respectively of my dividend growth portfolio.

My open order to sell PPL has not yet been filled as the price stays below $30. My limit order is at $30.55 to sell.

Additionally, I consider selling my full position in INTC which is 100 shares. I currently sell covered calls against it. I bought back the January call with a loss and rolled to February and increasing the strike price to $55 for the same amount. Full disclosure: at the time of writing I had closed the February call for a 50% profit and sold a new one at the beginning of February with the same $55 strike price.

Check out my current Dividend Growth Portfolio and the full overview of all the stocks I hold in it. You can see now two sections: the dividend portfolio and the holdings on stock option wheel trading.

Dividend Safety

One of the key metrics for my future passive income is how safe it is. For this reason I track my portfolio average Dividend Safety Score. For this score I use the weighted dividend safety punctuation from Simply Save Dividends combined with the dividend income of each of my stocks. The higher the score the safer the dividend income.

Dividend Safety Score

For December, the Dividend Safety Score increased to 60.0 for my dividend growth portfolio, a change of 0.2 points compared to December.

This increase is due to the dividend increases mostly with a dividend safety score well above my current average. At the same time ONG did now get a rating from Simply Safe Dividends and it came in at a score of 50, dragging a bit my average.

I consider the score of below 60 as not acceptable end and my target is a score of 70. So, as of now I am at my borderline lower level. My goal for 2021 is to bring the score to 65 points. It will be a difficult target to achieve.

Nonetheless, I will keep focusing on adding high quality stocks for the foreseeable future. My plan is not to sell low rated stocks but instead re-balance to high scoring ones when deploying more money. The overall target of an average score of 70 remains.

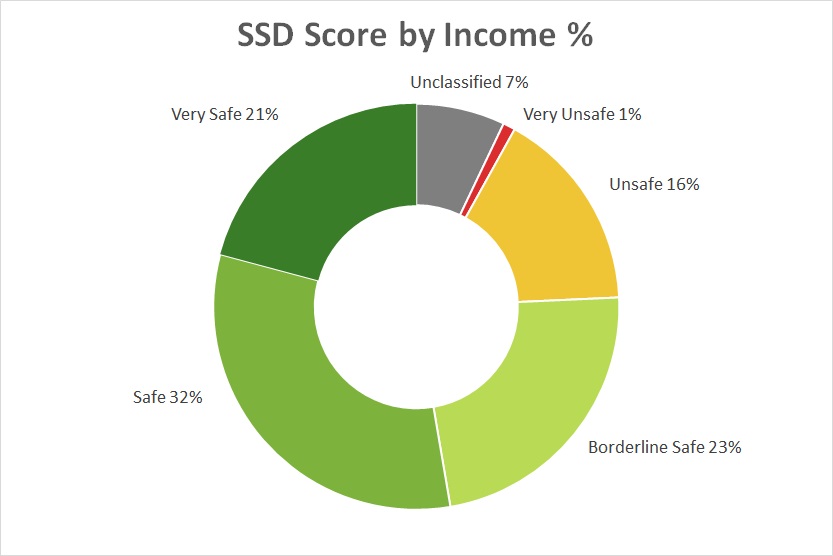

Let’s look at the actual distribution. I use the same classification as Simply Safe Dividends as it makes it easy to spot the categories. You see that I also created an unclassified category.

The different categories and their respective score ranges from very unsafe to very safe are:

In my portfolio now more than half or 53% of my portfolio is in the Safe and Very Safe category which has very little risk of being cut. Another 23% is Borderline Safe. The remaining 17% are Unsafe or Very Unsafe. 7% are unclassified and have a score of zero. I need to monitor especially the unsafe positions closely.

In January there has been no significant shift between categories. The safe part of the pie chart just keeps growing slowly but surely.

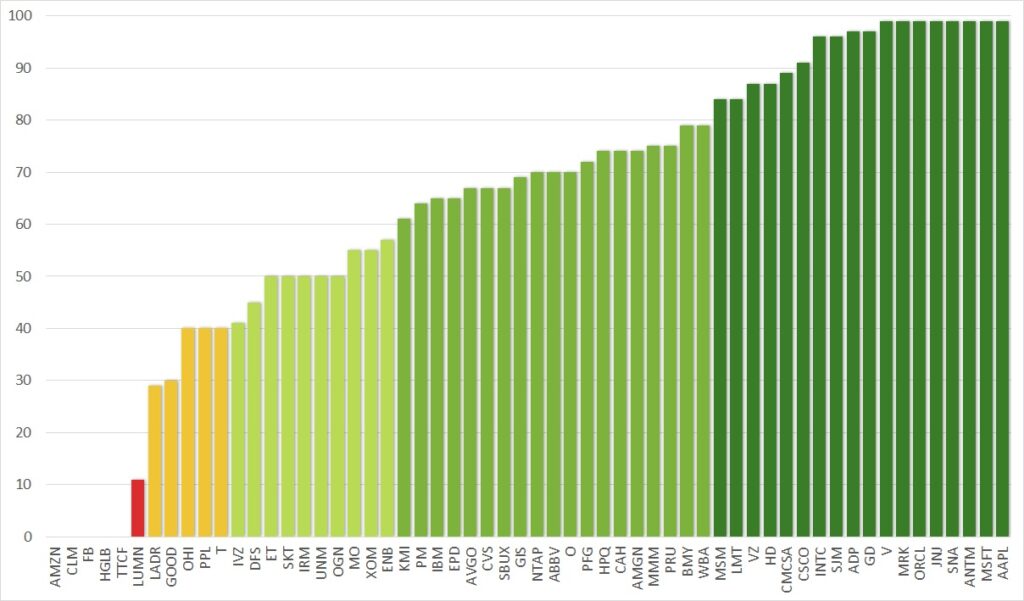

Dividend Safety Score Stock by Stock

For each individual stock in my portfolio the current score is as follows:

I hold now 18 companies in the highest category of Very Safe, of which 8 actually have the highest score of 99. Another 19 companies is the second highest category Safe. After selling HII this number has dropped by one. Overall, my portfolio contains many high quality dividend stocks with a safe dividend score.

On the other end we see the red alarming light with LUMN (formerly CTL). It is only a small position and I am not concerned about this one.

LADR as it is my largest position for dividend income and as such gives me the most exposure to a potential dividend cut. PPL is smaller positions and has a risk of a dividend cut. My sell order is placed as mentioned before.

AT&T (T) remains in the portfolio for now. The future spin-off setup is now out. AT&T investors will receive a 0.24 share of the new media company – Warner Bros. Discovery (WBD) – for each AT&T share once the deal closes, expected in the second quarter of 2022. At the same time, it is expected that AT&T’s post-close annual dividend per share to be $1.11, down 47% from the current payout of $2.08 per share.

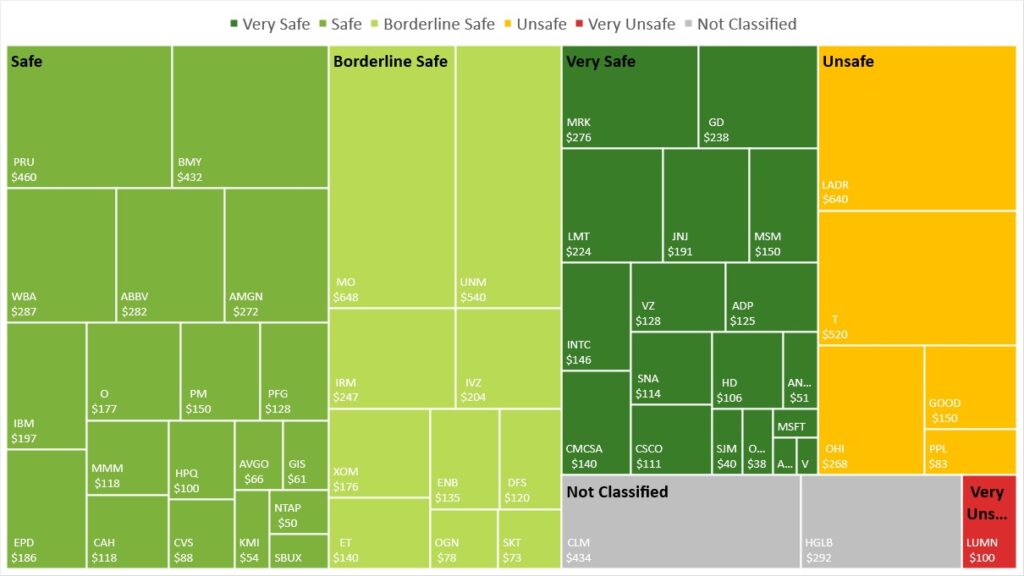

Dividend Safety of Income Distribution

When combining the dividend safety score with the income the picture looks as follows:

You can see that the largest group is the Safe category, followed by the Borderline Safe one. However, the Very Safe category continues to grow and has become a sizable portion of my portfolio. I am very happy with this and expect this one to grow over time.

With T and LADR having in the Unsafe category, its size is substantial. I will sit the AT&T spin-off out but already diversified into VZ at the end of 2021. The dividend cut by 47% is now planned. I have not considered it yet in my PADI as it is not officially the new payout. LADR I bought at a very good time and would expect no mayor issues for now.

Dividend Safety and Yield

Another way of looking at the dividend safety is by yield and score. For each of my holdings I compare these values to visualize the figures which clearly lets you draw some general conclusions.

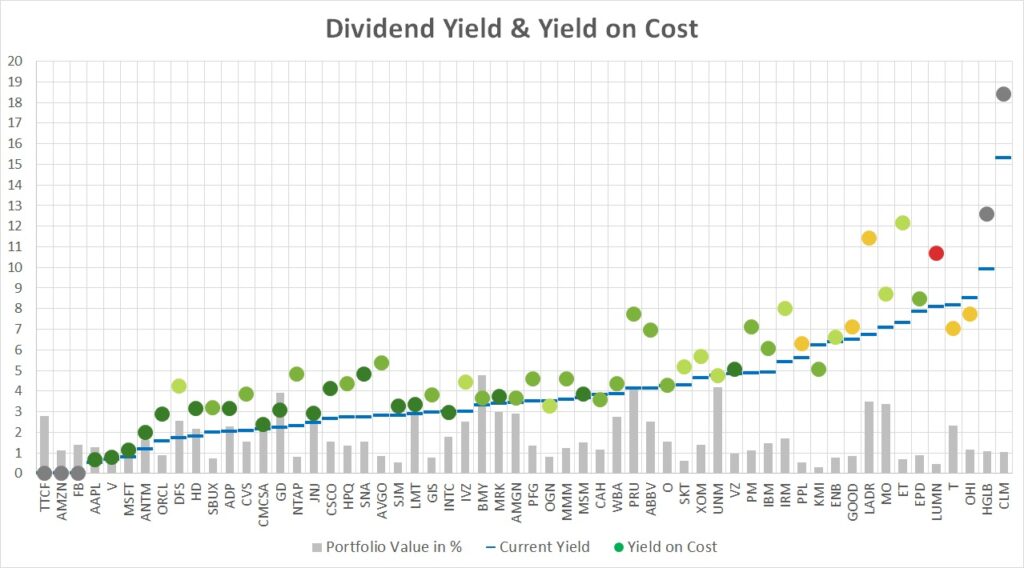

The dots represent my yield-on-cost with the color of the dividend safety score. The blue lines indicate the current yield of these stocks. The grey dots represent companies that either do not pay a dividend or are not covered by SSD. The light grey bars represent the percentage of the stock value in my portfolio.

There is a clear correlation between yield and safety score. On the left hand side (apart from the grey dots) we have the low yield, high safety score companies. The further we go to the right, the lower the dividend safety score becomes but it typically comes with a higher yield.

If the blue line (current yield) is below the dot (yield on cost) it means that either the stock has appreciated in price or the dividend was raised or both. Companies recovered quite nicely after the lows in March 2020 and most of my stocks have a lower current yield than my yield on cost.

On the left hand side you see the high quality stock with a high dividend safety score. They typically pay only a low to moderate dividend. However, most of them have relatively high dividend growth rates.

On the right hand side you can also see the extreme values that stocks can take on. CLM, HGLB, LUMN, ET and LADR have a yield on cost of above 10%. CLM after the raise for 2022 is even close to 20%. However, one of my goals going forward is not to chase the yield as we can so clearly see that it comes with a lot of risk. Still, if I see an opportunity I am open to explore it.

Over time, I would like to see the left zone to experience a push upwards of the dots as dividend increases impact on my yield-on-cost.

At the same time, my continuous adding to the positions typically increases the average cost and lowers the yield-on-cost.

Projected Annual Dividend Income (PADI)

My Projected Annual Dividend Income (PADI) increased to $10,247 in December compared to $10,211 at the end of 2021. This is a rise of $36 or 0.4%.

My target for 2022 is to reach $13,000 in forward looking annual dividend income. This means on average I need to add $232 of income per month. For January this number has been significantly below due to the failure of generating additional options income and no investment in dividend stocks.

The increase in January came exclusively from dividend raises of the holdings in my portfolio. Unfortunately, the sale of HII did have a negative effect.

My journey continues to invest in high quality dividend growth stocks. I maintain myself firm to invest in undervalued stocks. I need to watch my options exposure and if markets drop it increases the opportunities to buy high-quality stocks at a lower price.

Portfolio Dividend Yield

The current yield of the shares in my portfolio is 3.76%, an increase of 0.16 compared to December. The stock market has distanced itself from the highs and this pushes the current yield up.

The investment yield for my dividend growth portfolio is 4.67%. For this yield I compare the current dividend income with the purchase price of the underlying shares. A small increase by 0.05 points.

My yield on cost (YoC) has dropped this month to 5.63% by 0.04 points, because of the net impact from selling my HII position.

Conclusion

The dividend income for January was $804.38 from 18 different companies, a 34% increase compared to January last year. My PADI stands at $10,247. In order to hit my 2022 target I need to contribute more money or generate options income.

The dividend safety score of my portfolio is 60.0, an increase of 0.2 points but still significantly below my set overall target of 70. For 2022 the target will be to reach a score of 65 points. My analysis has shown that 53% of my dividend income is categorized as safe, but there are still a few stocks with a high risk of being cut, and AT&T (T) has already announced that it will reduce its dividend by about 47%.

If you find the information provided helpful and inspiring please consider subscribing to my email list and you will never miss another update. I am also happy to receive comments either on the stocks I hold or other views you want to express. Thank you for having taken the time to read this post.

Disclosure: At time of writing long on all above mentioned except for those I stated to have sold my position

Disclaimer: I am not a professional investment or financial advisor. The information presented on this site represents my personal dividend growth journey and it is for informational purposes only. Opinions expressed are my own and should NOT be relied on or taken as investing advice. I have no knowledge about your personal situation and before you make any investment decision you should exercise due diligence and must do your own research. Always consider seeking advice from a professional financial and tax advisor.

Looks like a great portfolio for consistent earnings. Are you reinvesting all of the dividends?

Hi, thanks for the comment. Yes, I do reinvest my dividends. I do not drip but collect dividends and reinvest into the best options I consider at any moment in time.

Looks like we share a few names paying us both. I’m still not sire what to do about CAH. It’s been a real stinker for a while now. Sure the dividends are rolling in but share price has been in the dumps for a while now. Thanks for sharing.

Thanks DivHut,

I found your portfolio some time ago and always consider it an inspiration. I would agree on CAH – it has not yet delivered but prospects look better. It can stay undervalued only for so long and eventually reverts to its mean.