The year 2021 has been a great year for my dividend growth journey. The portfolio hit all-time highs and dividend income is constantly growing. Additionally, the income from trading options is boosting my return.

The Dividend Growth Portfolio

In the Dividend Growth Portfolio I hold 61 different companies. Here is an overview of the status as of December 31st. I have excluded the stocks that I are part of my wheel strategy on which I got assigned.

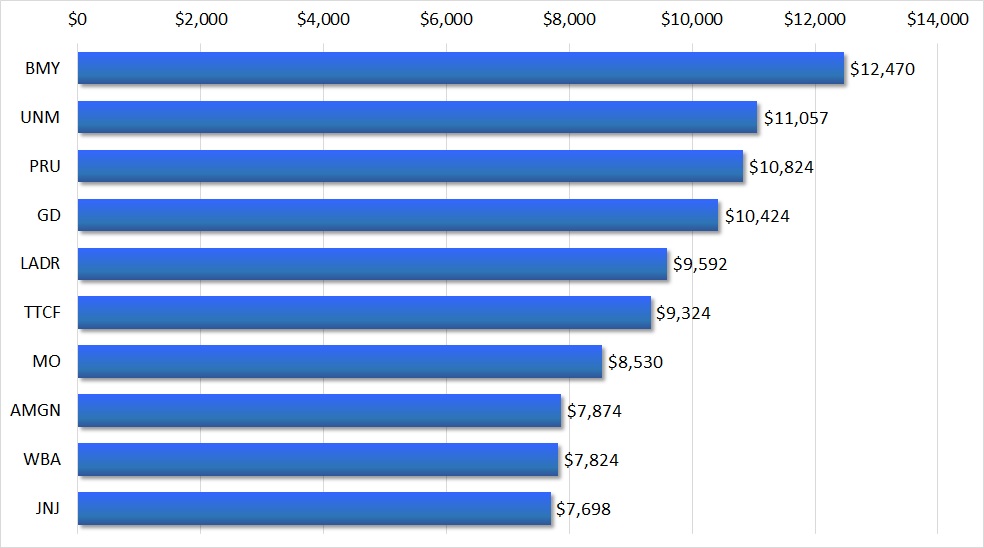

Here is the Top-10 holding overview. In total, these 10 stocks make up 34.4% of my dividend growth portfolio. BMY in the top spot makes up 4.48% of my portfolio value. JNJ as the number 10 still accounts for 2.77% of the portfolio value.

Portfolio Statistics

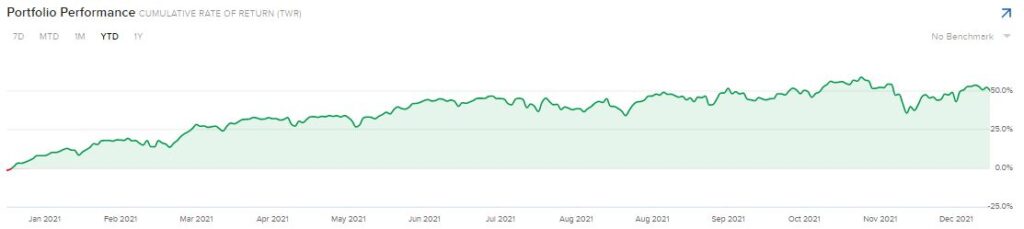

The year 2021 was a year of full surprises and with a steep learning curve. I managed to have a fantastic overall portfolio return of 49.66%. Especially the first half of the year the performance was stellar.

As you can see below I outperformed the S&P500 Index (light green), MSCI World (dark green) and Berkshire Hathaway (yellow). Similar to my portfolio, BRK had a great performance during the first few month and then the returns plateaued.

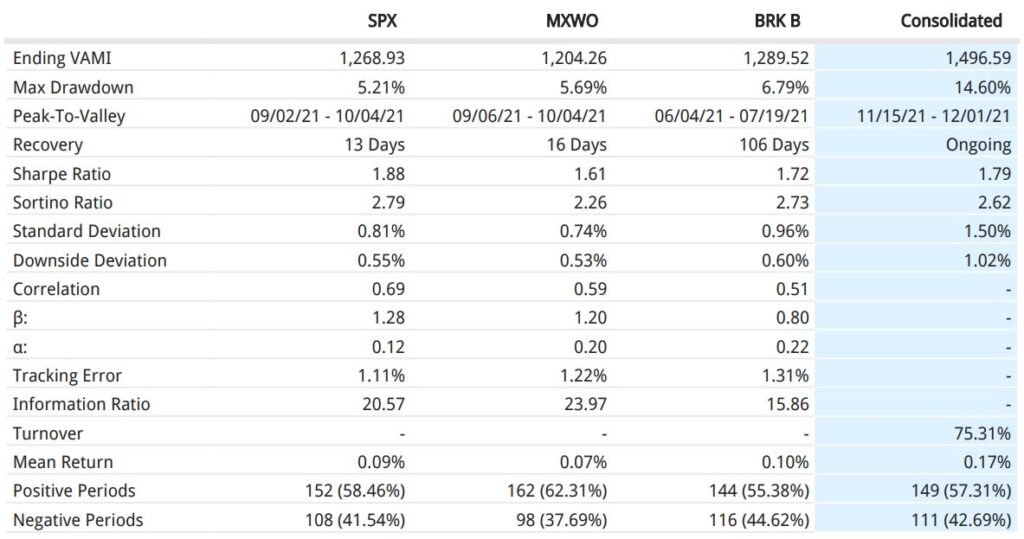

When we look at the key statistics we can see that my portfolio shows more volatility and has a higher risk compared to the other three. The reason for this is the options impact and at any given day the movement in my account value is amplified.

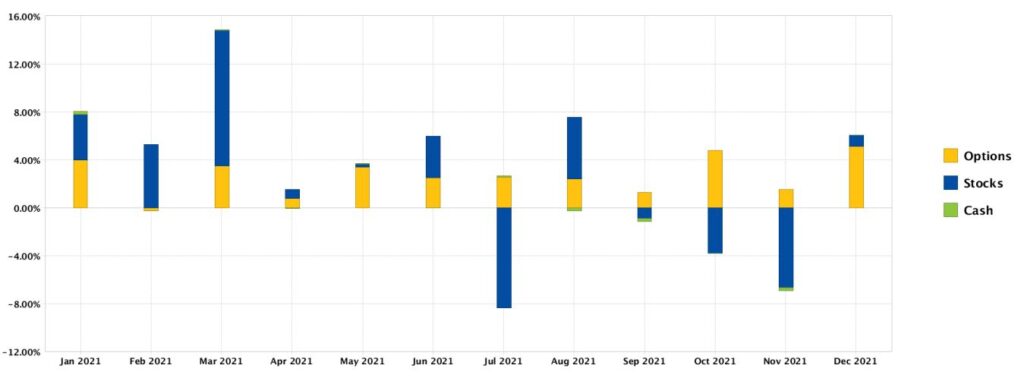

In the chart below you can see that the options income played a significant part for the overall portfolio performance. Stocks contributed nicely in the first half of the year but under-performed in the second.

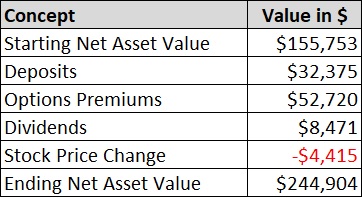

Overall numbers for my portfolio are as follows:

You can see that option premiums with almost 53k$ accounted for most of my portfolio net asset value increase during 2021, followed by cash contributions with 32k$. Dividend income added another 8k$. Sadly, my stock values dropped by 4k$. Some speculative stock option wheel assignments had huge losses (RIDE, NNDM and PLTR), being actually compensated by my core holdings.

Both my contributions and the options premium have allowed me to invest more in dividend paying stock than initially anticipated at the beginning of 2021.

Dividend Income

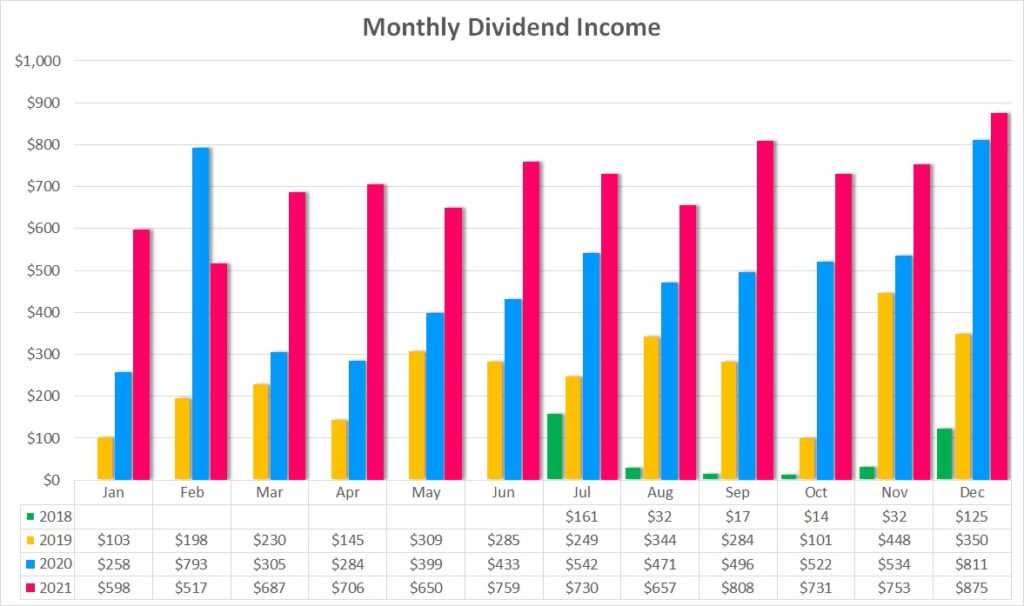

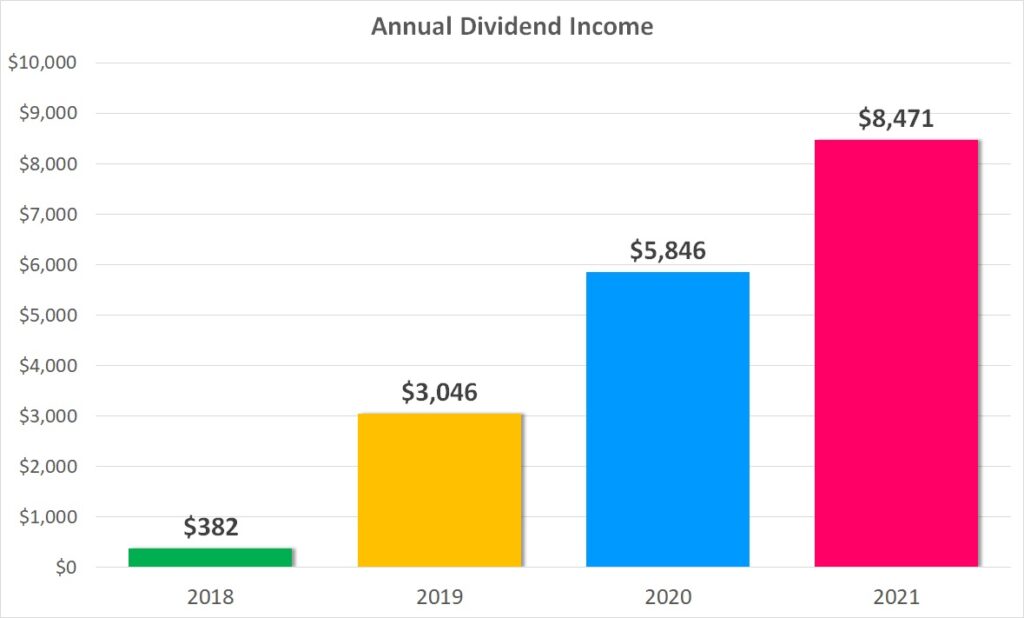

During 2021 I collected in total $8,470.52 in dividends from 56 different companies and two funds. This is an increase of $2,624.74 or 45% over last years’ result which totaled $5,845.78.

My monthly income grew constantly peeking in December with $875 of dividend income. In the chart below one can appreciate the nice upward trend in 2021.

My total life-time accumulated dividend income has added up to $17,744 since 2018.

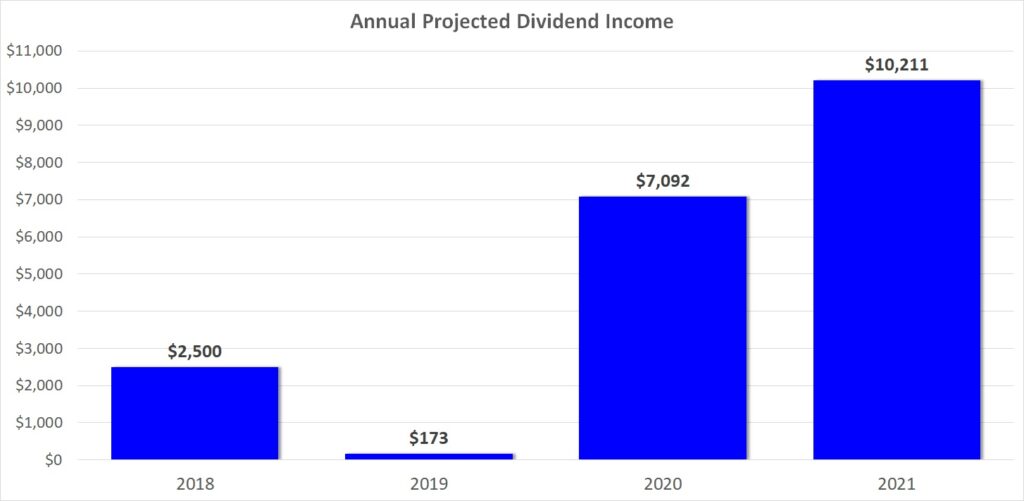

My Projected Annual Dividend Income (PADI) has increased to $10,211 at the closing of the year 2021. My original target for 2021 was $8,600 and I managed to reach it already in July. But hitting the $10k mark was completely unexpected. I am so happy to have reached this milestone.

This means that right now I will receive on average $851 of dividend income every month. However, this value should grow over time due to dividend raises of the companies paired with additional money deployed into dividend growth stocks from a) reinvesting dividends, b) further contributions and c) gains from options trading.

Dividend Increases

An essential part of the dividend growth strategy is the ever growing dividend payments from the holdings in my portfolio. Of the 56 companies and two funds that paid me dividends in 2021 no less than 43 increased their payouts during the course of the year. As I sold two of these companies GAIN and MDT basically just before they announced the dividend increase I will not include them in the overall calculation.

The full year calculation is based on the number of shares I held at the time of the dividend raise. I did acquired more shares of some of the holdings and added also new ones.

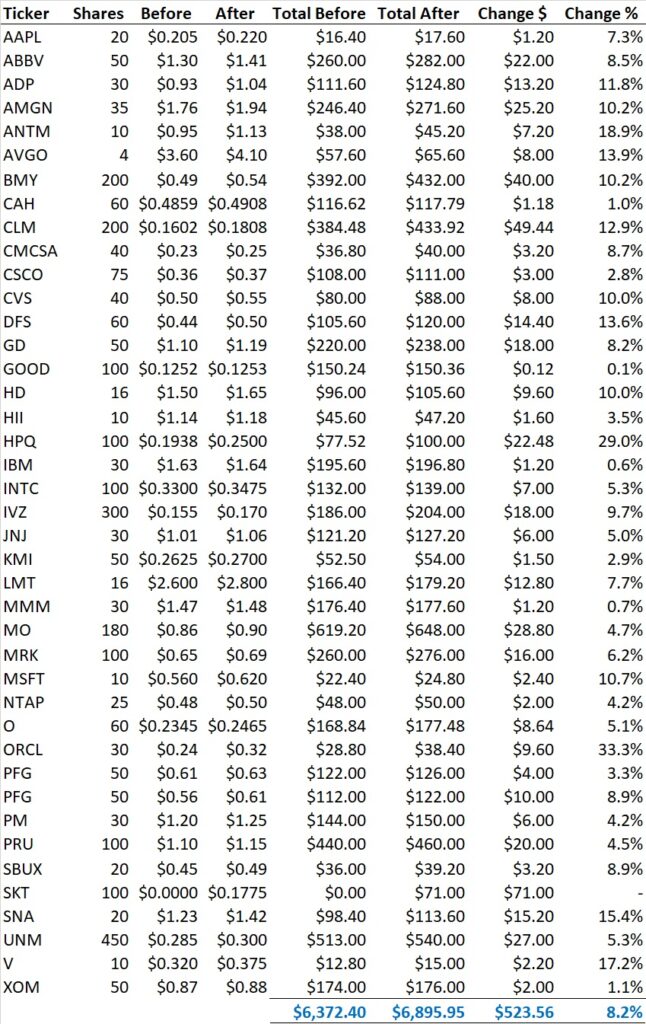

The table below summarizes the total impact of $523.56, with a weighted average increase of 8.2%. I am very happy with this result as it even outpaces the currently high inflation.

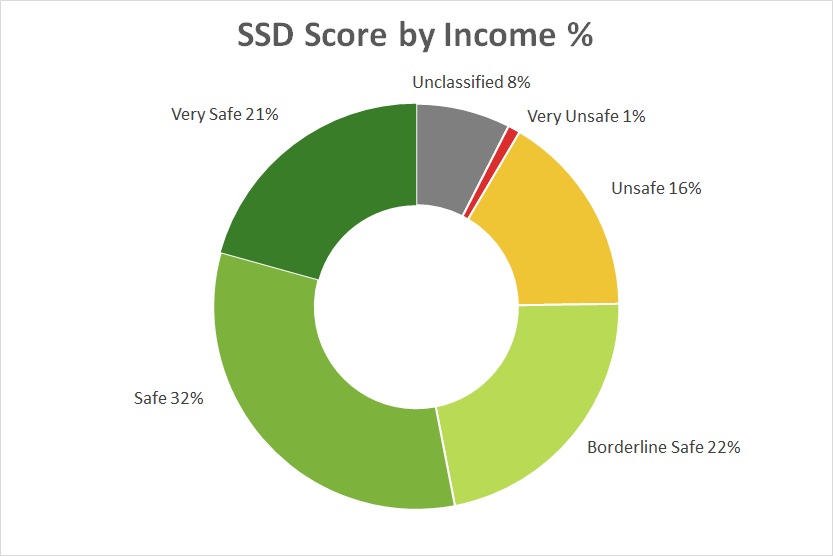

Dividend Safety

One of the key metrics for my future passive income is how safe it is. For this reason I track my portfolio average Dividend Safety Score. For this score I use the weighted dividend safety punctuation from Simply Save Dividends combined with the dividend income of each of my stocks. The higher the score the safer the dividend income.

The different categories and their respective score ranges from very unsafe to very safe are:

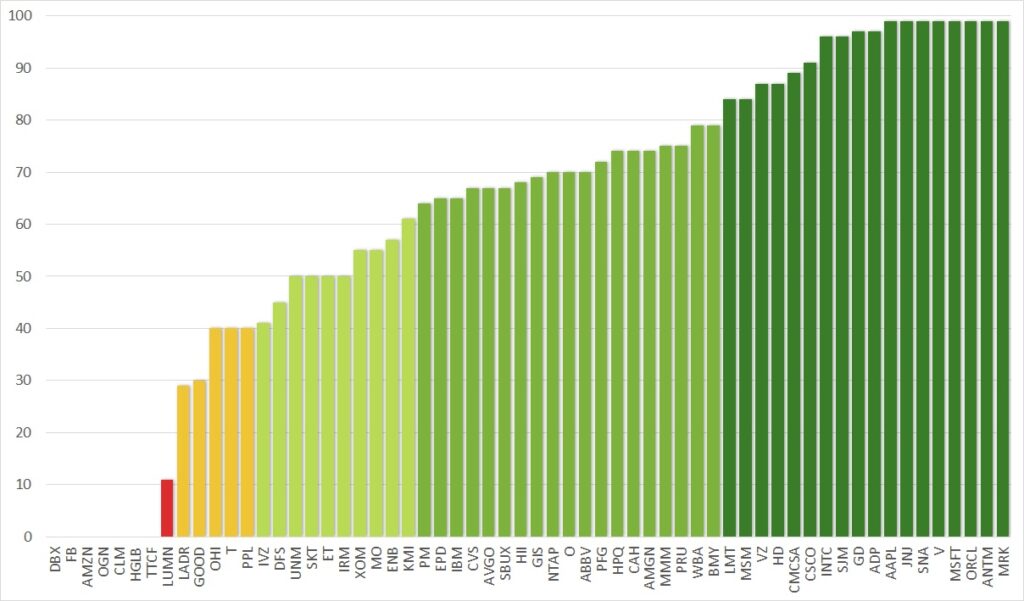

For each individual stock in my portfolio the current score is as follows:

I hold now 18 companies in the highest category of Very Safe, of which 8 actually have the highest score of 99. This month Verizon Communications Inc (VZ) joined this group. Another 20 companies is the second highest category Safe. Overall, my portfolio contains many high quality dividend stocks with a safe dividend score.

On the other end we see the red alarming light with LUMN (formerly CTL). It is only a small position and I am not concerned about this one.

LADR as it is my largest position for dividend income and as such gives me the most exposure to a potential dividend cut. PPL is smaller positions and has a risk of a dividend cut. My sell order is placed as mentioned before. AT&T (T) remains in the portfolio for now.

Conclusion

The year 2021 was a fantastic year for my dividend growth portfolio. I was able to collect $8,471 in dividends and obtained more than $52k in options premium, part of it at the expense of unrealized loss carrying stocks.

My PADI has surpassed the $10,000 mark and this is the key metric for me for this portfolio. Steady and upwards. A nice growth of 44% year over year.

As we already know the start of 2022 is very challenging. However, the Dividend Growth Journey continues…

If you find the information provided helpful and inspiring please consider subscribing to my email list and you will never miss another update. I am also happy to receive comments either on the stocks I hold or other views you want to express. Thank you for having taken the time to read this post.

Disclosure: At time of writing long on all above mentioned

Disclaimer: I am not a professional investment or financial advisor. The information presented on this site represents my personal dividend growth journey and it is for informational purposes only. Opinions expressed are my own and should NOT be relied on or taken as investing advice. I have no knowledge about your personal situation and before you make any investment decision you should exercise due diligence and must do your own research. Always consider seeking advice from a professional financial and tax advisor.