We already closed the third quarter of the year and now head towards the end of 2021. How time flies when you are having fun. Should we have fun when following the dividend investing strategy or must we expect a boring steady investing life?

I have been so busy during the holidays that I just did not manage to give an update on the August figures. For this reason, I decided to join the August and September report in one post. Here we go.

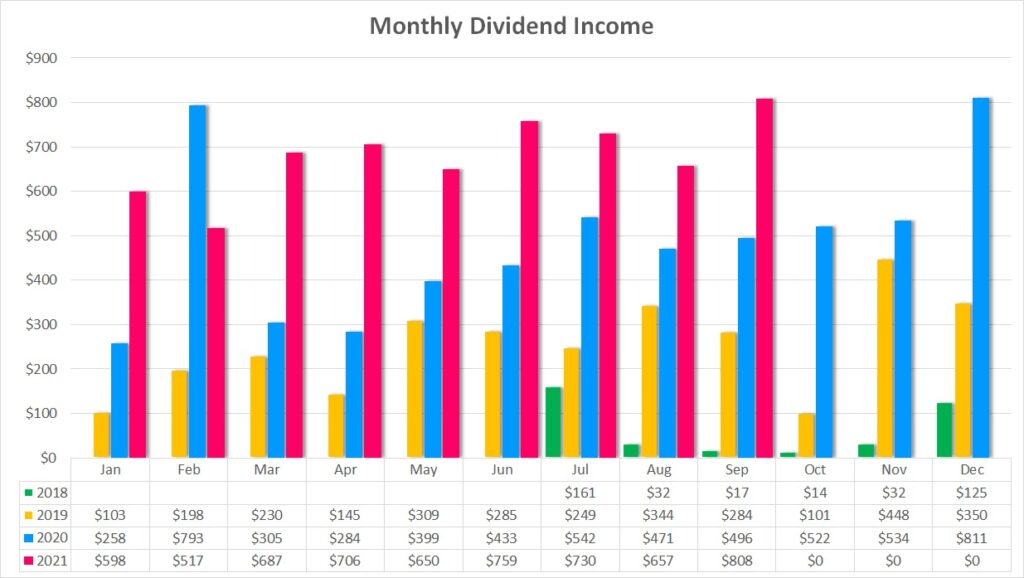

In August I received $656.54 in dividends from a total of 17 companies. The second quarter of each month is my lower dividend income month and still I see a nice upward trend looking at the last quarters.

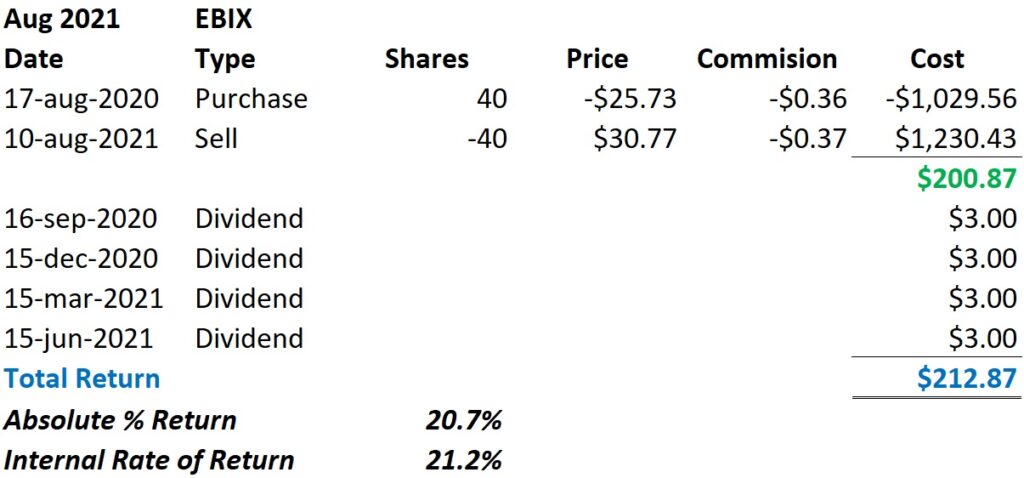

I tend to be a buy-and-hold investor and focus more and more on high quality dividend growth stocks. However, when there is a significant change to a companies’ outlook I consider selling. This has been the case in August. I sold all my 40 shares of Ebix Inc. (EBIX).

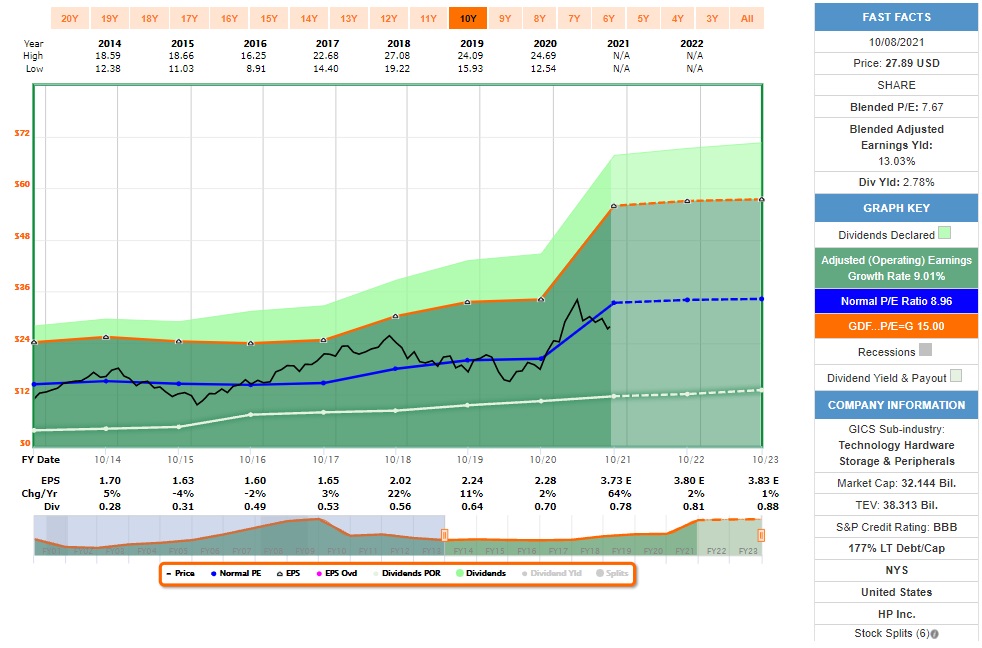

At the same time, I added new positions with Amgen Inc. (AMGN) and Amazon Inc. (AMZN) and added a few shares to existing positions like Lockheed Martin (LMT), HP Inc. (HPQ) and Merck (MRK).

September was another highlight month. I hit a new divided income record with $808.28 collected. This is what I am aiming for. Continuous dividend growth and visible results. When investing for growth tracking only the return can get easily out of sight. With dividends you get that cash return right into your pockets.

I added to my Bristol-Myers Squibb (BMY) position and started a new position with J.M. Smuckers (SJM). The focus remains on undervalued, high quality dividend stocks.

By the end of September SSD reports my Projected Annual Dividend Income (PADI) with $8,983 though they seem to track dividend increases with a certain delay. When I added these increases I surpassed the $9,000 mark by September 24th. I blew my 2021 target right out of the water. The $8,600 seem so far in the distance. I could not have imagined this at the beginning of the year.

The wheel options strategy continues and I made a few nice trades. However, there is a big cloud over my head which is called Lordstown Motors Corp. (RIDE). The stock basically keeps falling and falling and my losses (so far unrealized) keep growing. There was a small window at the end of September to close the position and take a small loss and close that chapter. I missed it and the position is still there. I will be trying to sell covered calls as best as possible.

Dividend Income

It is time to review the earnings of my dividend growth strategy. This is truly passive income. My August Dividend Income in detail:

Apple (AAPL) – income of $4.40

AbbVie (ABBV) – income of $65.00

Bristol-Myers Squibb Co (BMY) – income of $29.40

Cornerstone Strategic Value Fund (CLM) – income of $32.04

CVS Health (CVS) – income of $20.00

Energy Transfer (ET) – income of $30.50

Gladstone Investment Corp (GAIN) – income of $7.00

General Dynamics (GD) – income of $59.50

General Mills (GIS) – income of $15.30

Gladstone Commercial Corp (GOOD) – income of $12.52

Highland Global Allocation Fund (ETF) (HGLB) – income of $21.30

KinderMorgan (KMI) – income of $13.50

Realty (O) – income of $14.13

Omega Health Care (OHI) – income of $40.20

Starbucks (SBUX) – income of $9.00

Tanger Factory Outlet Centers (SKT) – income of $17.75

AT&T (T) – income of $130.00

Unum Group (UNM) – income of $135.00

T and UNM are my main contributors with $130 and $135 respectively. No new contributors this month and also no mayor changes to May. Just the dividend increase from UNM. I received $656.54 in August.

In September I marked a new record with $808.28 in dividends received. 27 companies paid me (also a new record – too many stocks?). Here is my dividend income in detail:

Amgen (AMGN) – income of $8.80

Anthem (ANTM) – income of $11.30

Broadcom (AVGO) – income of $14.40

Cornerstone Strategic Value Fund (CLM) – income of $32.04

Discovery Financial Services (DFS) – income of $30.00

Enbridge (ENB) – income of $33.11

Gladstone Investment Corp (GAIN) – income of $10.00 (including a $3.00 special dividend, the second for this year)

Gladstone Commercial Corp (GOOD) – income of $12.52

Home Depot (HD) – income of $26.40

Highland Global Allocation Fund (ETF) (HGLB) – income of $21.30

Huntington Ingalls Ind. (HII) – income of $11.40

International Business Machines (IBM) – income of $49.20

Intel (INTC) – income of $34.75

Invesco (IVZ) – income of $51.00

Johnson & Johnson (JNJ) – income of $37.10

Lockheed Martin (LMT) – income of $41.60

Lumen (LUMN), formerly CenturyLink (CTL) – income of $25.00

3M (MMM) – income of $29.60

Microsoft (MSFT) – income of $5.60

Realty (O) – income of $14.13

Organon & Co. (OGN) – income of $19.60

Principal Financial Group (PFG) – income of $31.50

Prudential (PRU) – income of $115.00

Snap-on (SNA) – income of $24.60

Visa (V) – income of $3.20

Walgreens Boots Alliance (WBA) – income of $71.63

Exxon (XOM) – income of $43.50

PRU and WBA are my main contributors with $115 and $71.63 respectively. J&J has increased a bit. First time contributor is OGN after the spin-off from Merck (MRK).

Overall, I have a nice split across many of my holdings and reduce the impact of any potential dividend cuts.

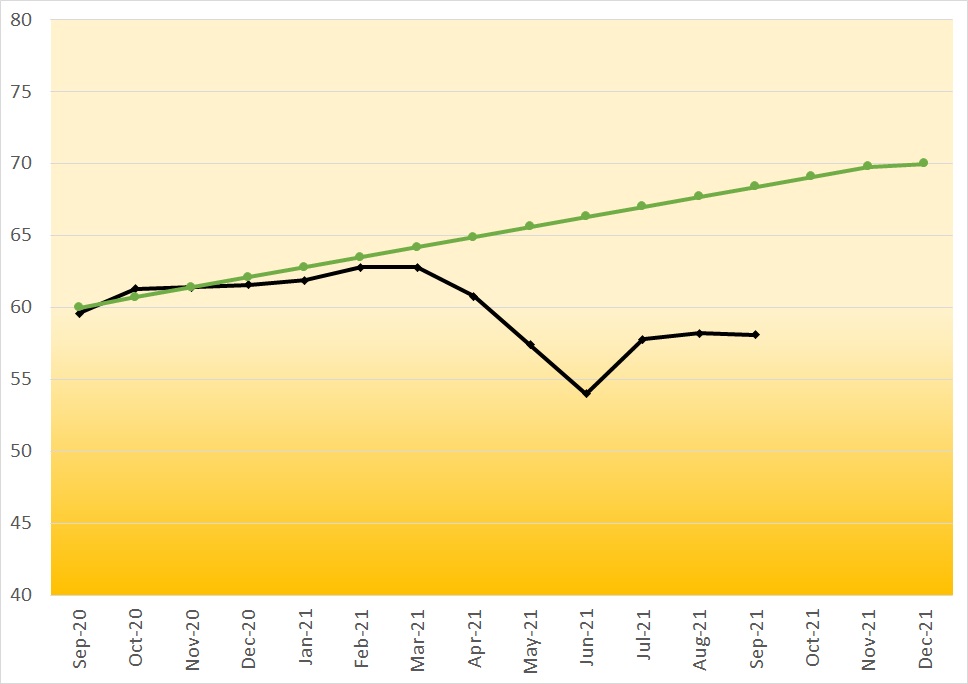

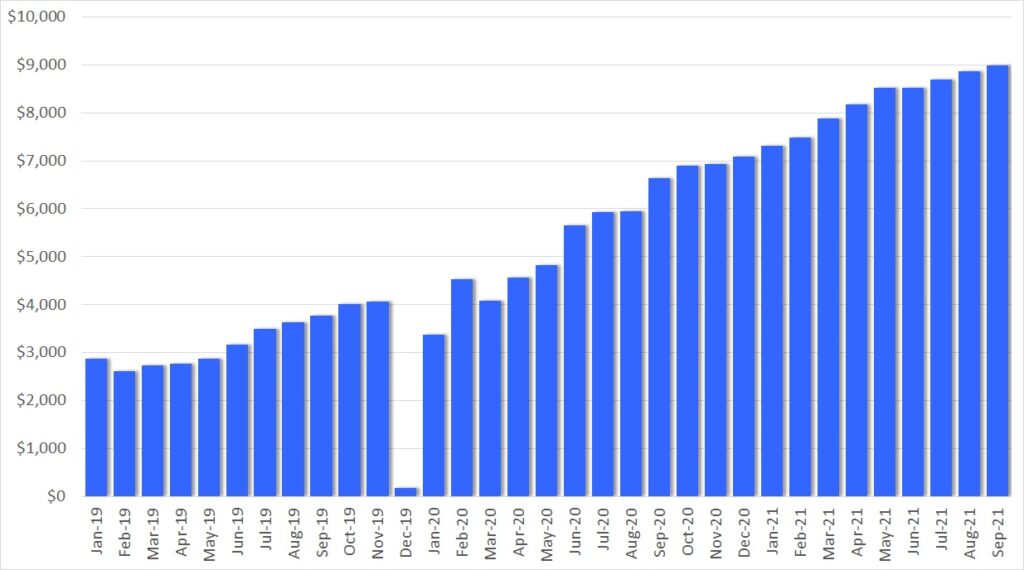

The above chart shows my monthly dividend income over time. In September 2021 I received $808.28 compared to September 2020 with $495.71 of income. This is an increase of $312.57 or 63%. This is still a great growth rate and I expect to keep pushing myself.

Year over year I managed to increase my income from $3,979.00 in the period January to September 2020 to $6,111.33 in the same period in 2021. That is an increase of $2,132.33 or 54%.

Check out my current Dividend Income Table for 2021 and the full overview of all the stocks.

Dividend Changes

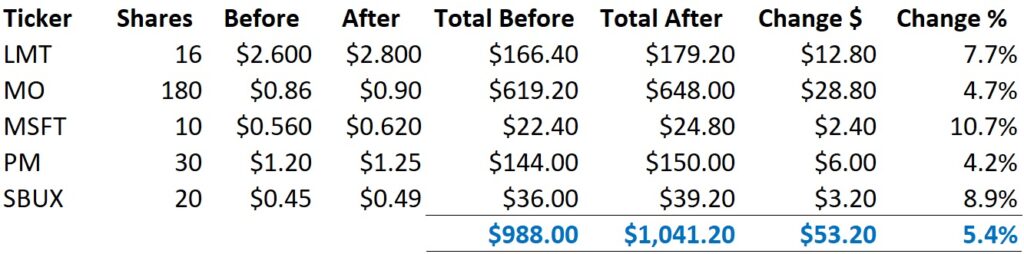

In August and September there have been five dividend increases in my portfolio. The table below summarizes the total impact of $53.20, with an average increase of 5.4%.

LMT increased their dividend by 7.7% which is fully in line with expectations.

MO surprised me quite a lot. I expected an increase of one, maybe two cents. They decided to raise their dividend by 4.7% from $0.86 to $0.90. Very much appreciated.

MSFT increased their dividend by 10.7%, very much in line with their historical dividend growth.

PM also did not disappoint. A 4.2% increase is more than I expected.

SBUX also continued their road to increasing their dividends steadily, an 8.9% increase this year.

As a result of this change, my PADI increased by $53.20. At a yield of 3.0%, to achieve this dividend income I would have to deploy $1,773. But this is not necessary. The dividend increases take care of that and that’s the beauty of dividend growth investing and the compound effect in action.

The Dividend Growth Portfolio

In the Dividend Growth Portfolio I hold 59 different companies. Here is an overview of the status as of October 1st. I have excluded the stocks that I hold for my wheel strategy.

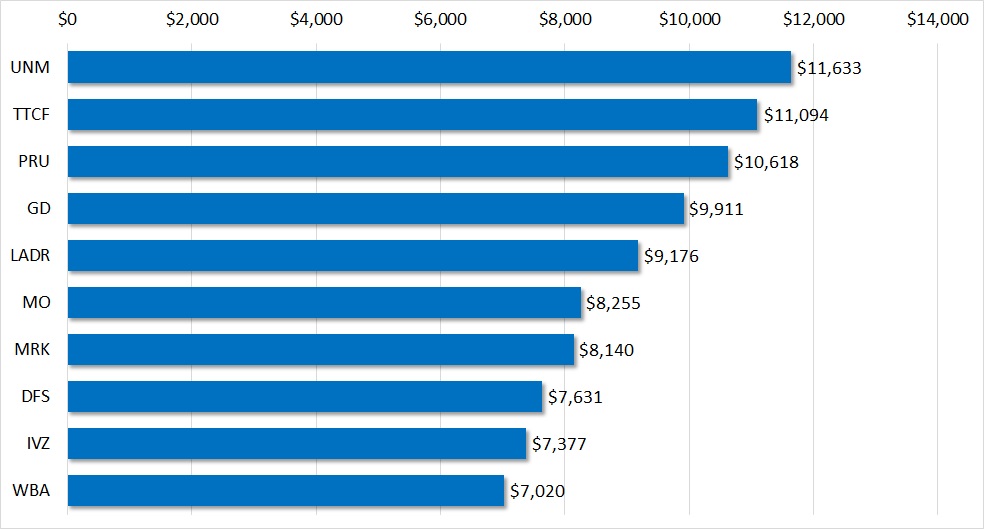

Here is the Top-10 holding overview. In total, these 10 stocks make up 37.5% of my dividend growth portfolio. UNM is ranked first with 4.81% and PRU is the one with the most appreciation ($5.0K), followed closely by DFS ($4.9K). TTCF is a growth stock and does not pay any dividends. T has dropped out of the Top-10 and WBA has replaced it.

Purchases

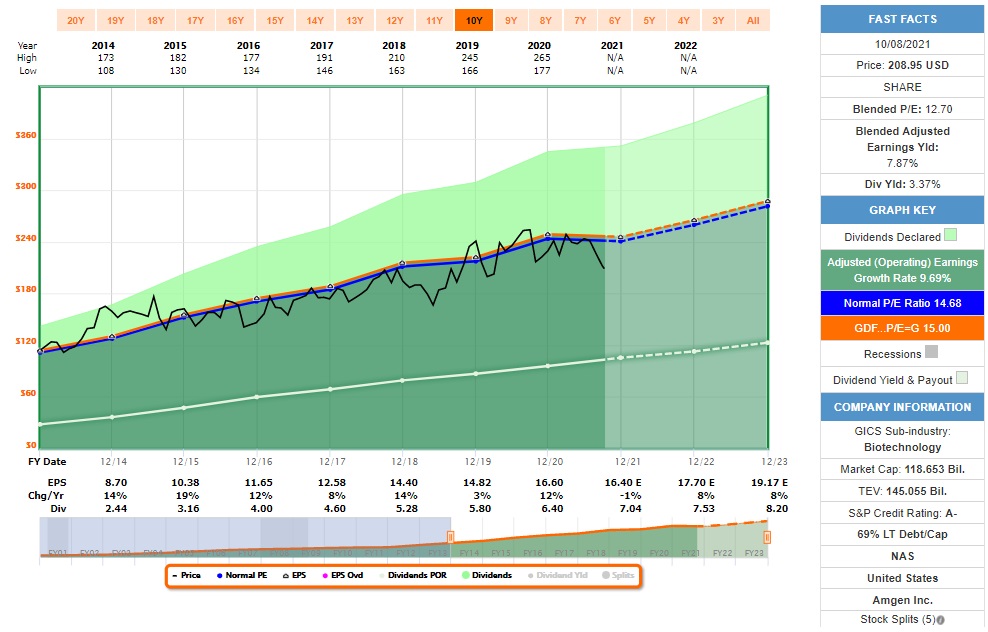

In August and September I followed to my main strategy and added to four existing positions of high quality dividend growth stocks. Additionally, I opened postions in two new stocks: Amgen (AMGN) and J.M. Smucker (SJM). Finally, I added a share of Amzon.com (AMZN). With new maximums reached surely the overall market is richly valued but my main focus is to only invest in undervalued stocks to take advantage of the margin of safety. Amazon I consider a growth story that at some point in the future will pay a dividend.

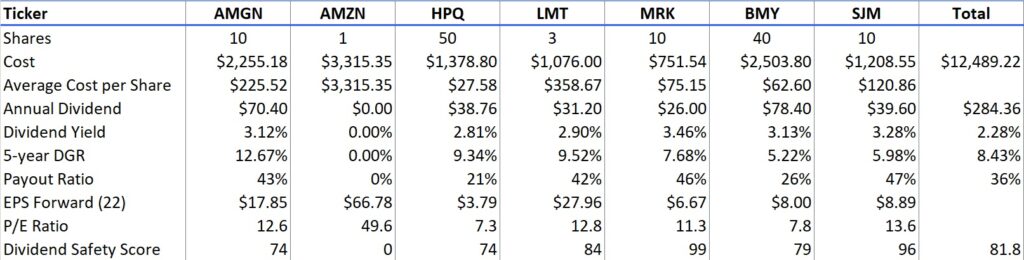

Amgen Inc (AMGN)

Amgen is a leader in biotechnology-based human therapeutics, with historical expertise in renal disease and cancer supportive-care products. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm’s therapeutic oncology portfolio with Nexavar and Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), and Lumakras (lung cancer). Amgen’s biosimilar portfolio includes Mvasi (biosimilar Avastin), Kanjinti (biosimilar Herceptin), and Amgevita (biosimilar Humira).

Source: FastGraphs

Amazon.com Inc (AMZN)

Amazon.com Inc is a leading online retailer and one of the highest-grossing e-commerce aggregators. Retail related revenue represented approximately 83% of total, followed by Amazon Web Services’ cloud computing, storage, database, and other offerings (12%), and advertising services and cobranded credit cards (6%). International segments constituted 27% of Amazon’s non-AWS sales in 2020, led by Germany, the United Kingdom, and Japan.

Source: FastGraphs

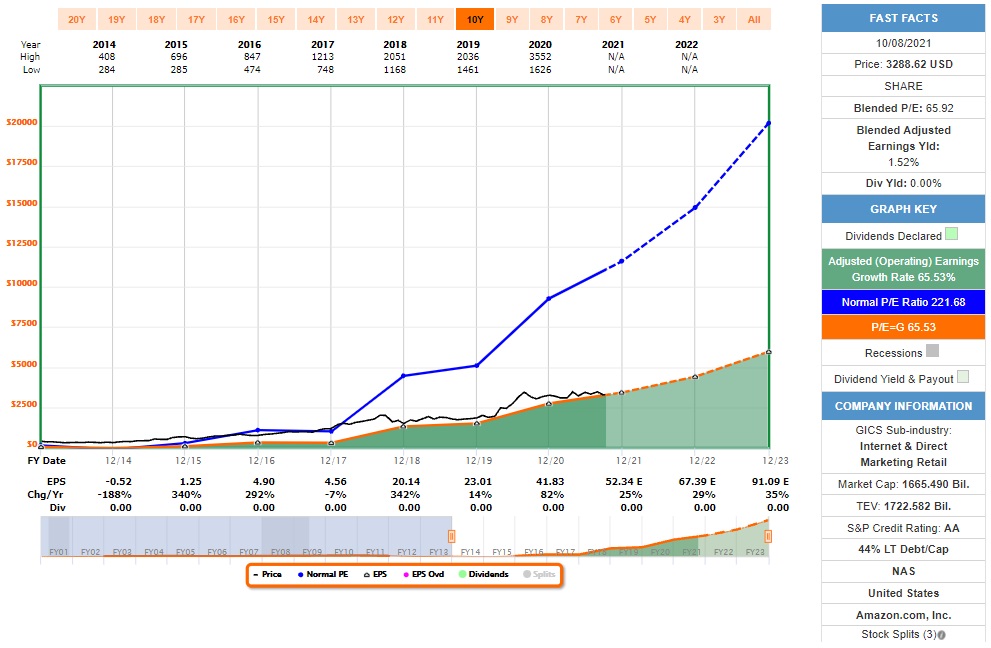

HP Inc (HPQ)

HP Inc. is a leading provider of computers, printers, and printer supplies. The company’s three operating business segments are its personal systems, containing notebooks, desktops, and workstations; and its printing segment which contains supplies, consumer hardware, and commercial hardware; and corporate investments. In 2015, Hewlett-Packard was separated into HP Inc. and Hewlett Packard Enterprise and the Palo Alto, California-based company sells on a global scale.

Source: FastGraphs

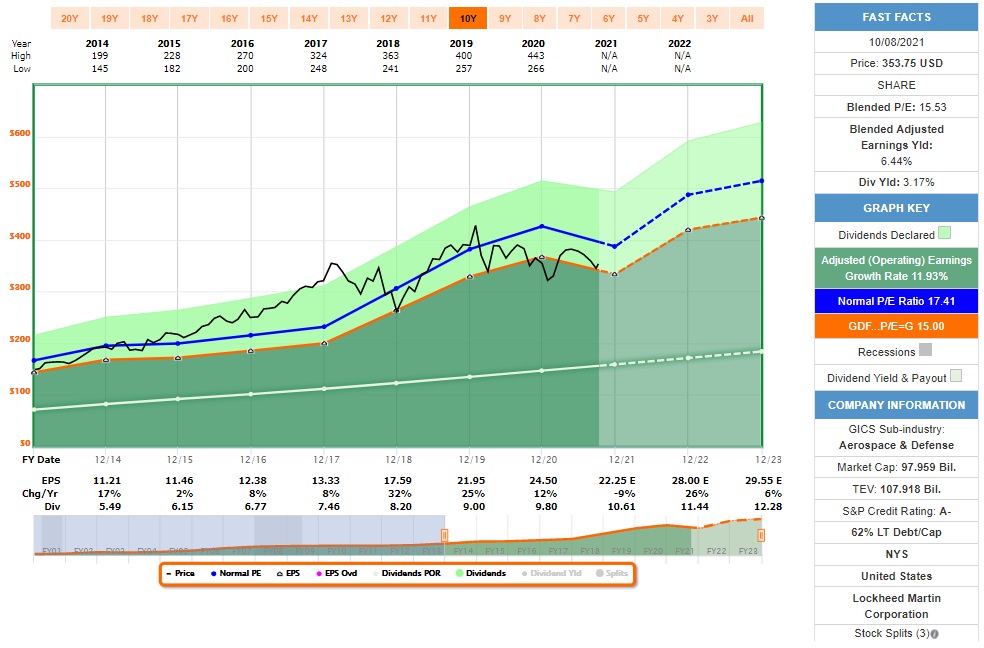

Lockheed Martin Corp (LMT)

Lockheed Martin is the largest defense contractor globally and has dominated the Western market for high-end fighter aircraft since being awarded the F-35 program in 2001. Lockheed’s largest segment is Aeronautics, which is dominated by the massive F-35 program. Lockheed’s remaining segments are rotary & mission systems, which is mainly the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.

Source: FastGraphs

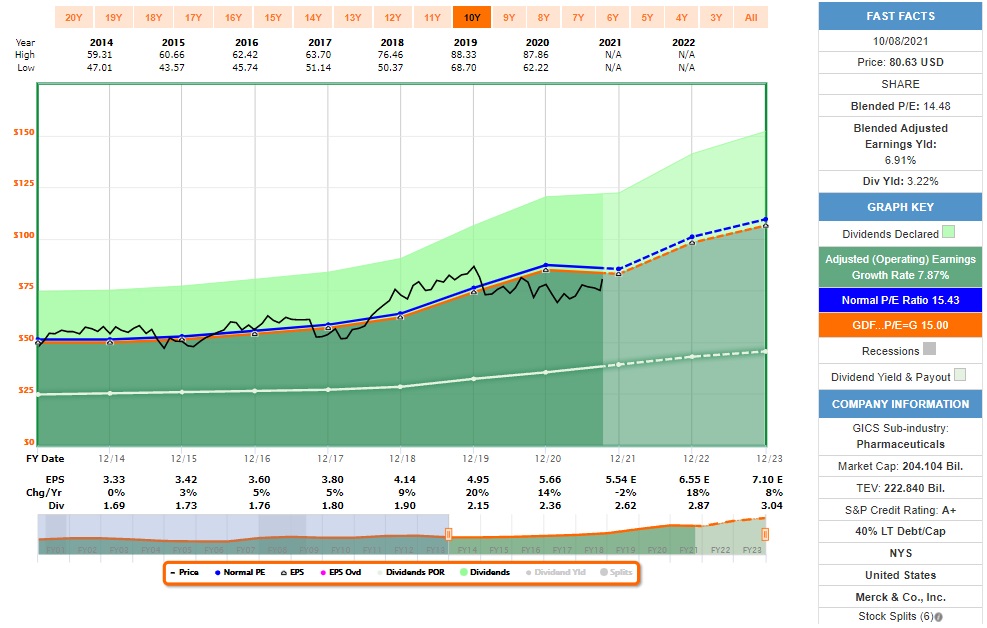

Merck & Co Inc (MRK)

Merck is a leading pharmaceutical company that makes products to treat several conditions in a number of therapeutic areas, including cardio-metabolic disease, cancer, and infections. Within cancer, the firm’s immuno-oncology platform is growing as a major contributor to overall sales. The company also has a substantial vaccine business, with treatments to prevent hepatitis B and pediatric diseases as well as HPV and shingles. Additionally, Merck sells animal health-related drugs. From a geographical perspective, close to 40% of the firm’s sales are generated in the United States.

Source: FastGraphs

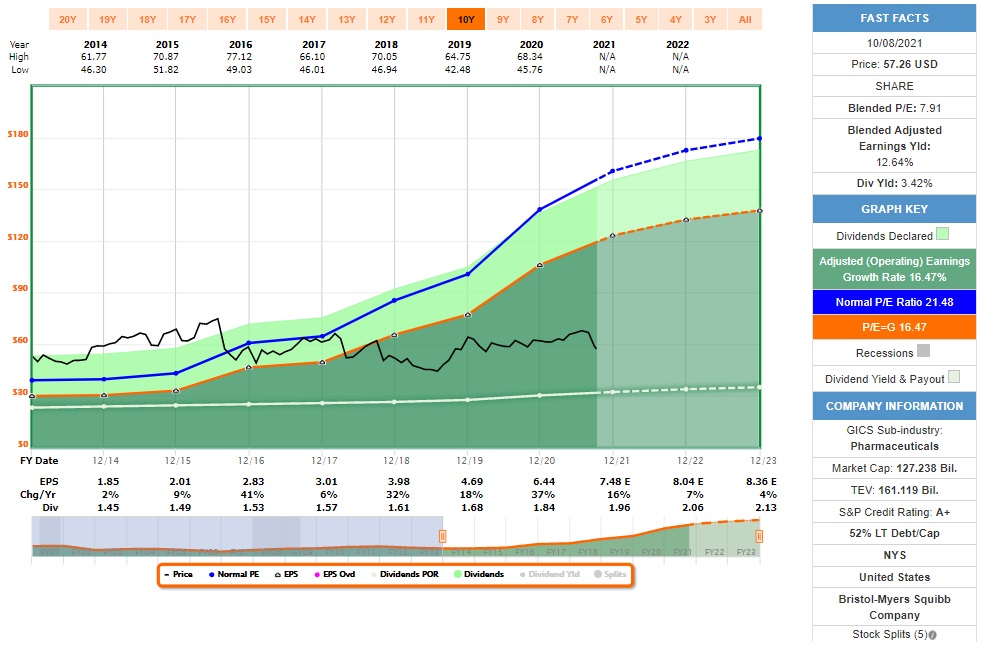

Bristol-Myers Squibb Co (BMY)

Bristol-Myers Squibb discovers, develops, and markets drugs for various therapeutic areas, such as cardiovascular, oncology, and immune disorders. A key focus for Bristol is immuno-oncology, where the firm is a leader in drug development. Unlike some of its more diversified peers, Bristol has exited several nonpharmaceutical businesses to focus on branded specialty drugs, which tend to support strong pricing power.

Source: FastGraphs

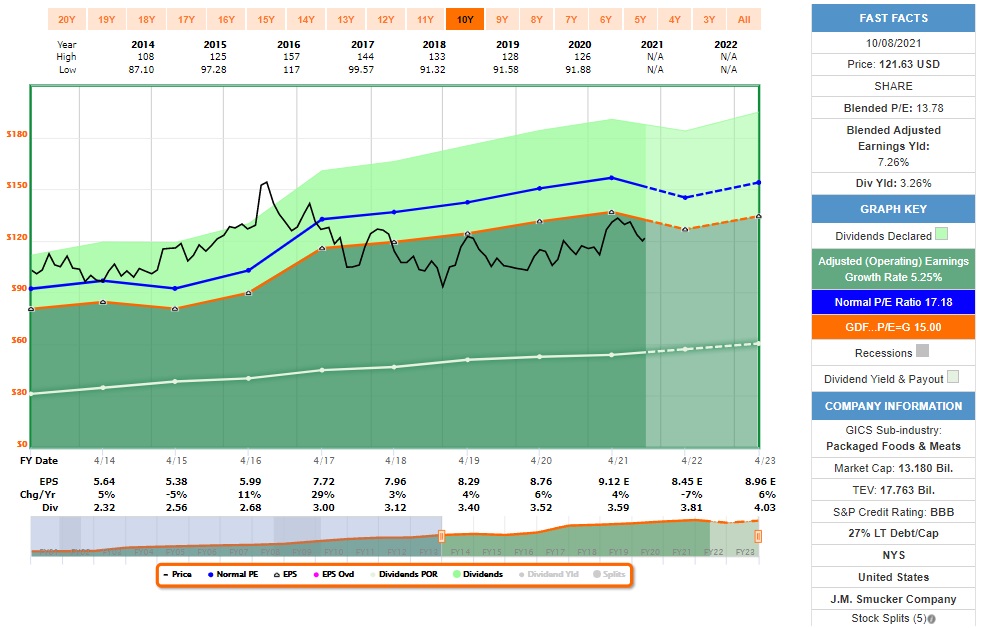

JM Smucker Co (SJM)

J.M. Smucker is a packaged food company that primarily operates in the U.S. retail channel (88% of fiscal 2021 revenue), but also in U.S. food-service (5%), and international (7%). Its largest category is pet food and treats (36% of 2021 revenue), with popular brands such as Milk-Bone, Meow Mix, 9Lives, Kibbles ‘n Bits, Nature’s Recipe, and Rachael Ray Nutrish. Its second- largest category is coffee (33%) with the number-two brand Folgers and number-six Dunkin’. Other large categories are peanut butter (10%), with number-one Jif, fruit spreads (5%) with number-one Smucker’s, and frozen hand-held foods (5%) with number-one Uncrustables.

Source: FastGraphs

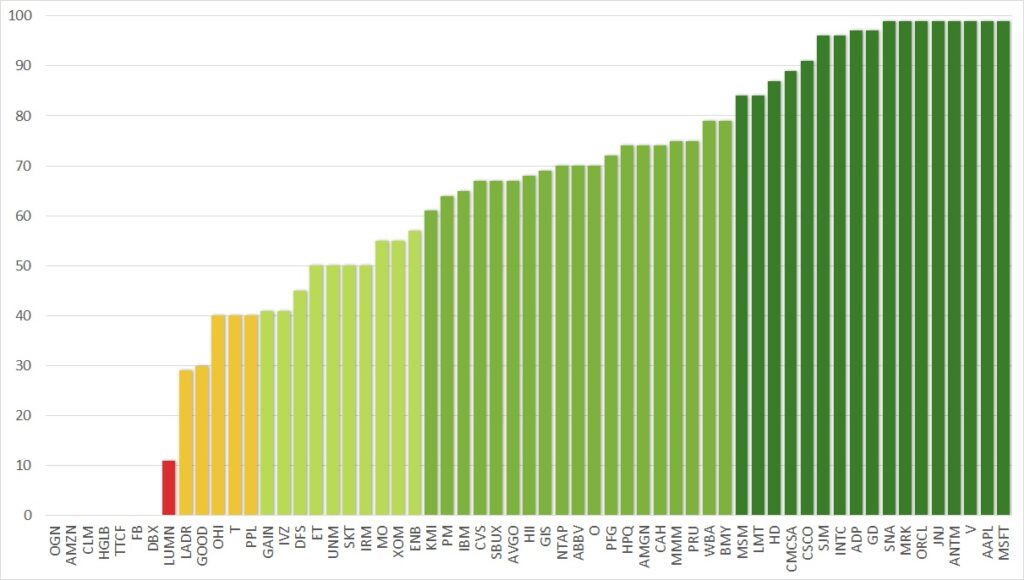

These are the companies I invested in during August and September. I am particularly happy about the high dividend safety score, an average of 82. As you know one of my goals it to build a solid, high quality dividend growth portfolio. The dividend safety is a key element of this strategy.

As a result, I have added $284.36 of dividend income to my Projected Annual Dividend Income (PADI). On an investment amount of $9,173.87 including fees it comes to an average dividend yield of 2.28%. If I exclude AMZN which does not pay a dividend (yet), the starting yield would be 3.10%. For such high quality stocks this is a very good starting yield.

Sales

As already indicated in July I took action and sold Ebix Inc (EBIX) in August.

In February, the news broke that there might be some accounting issues and the stock fell about 40% to 35 dollars.

In an article on https://www.businesswire.com:

According to a complaint filed against the Company, on February 19, 2021, after the market closed, Ebix revealed that its independent auditor, RSM US LLP, resigned because it was unable “to obtain sufficient appropriate evidence that would allow it to evaluate the business purpose of significant unusual transactions that occurred in the fourth quarter of 2020” related to the Company’s business gift card business in India. RSM also stated that the Company’s “internal control over financial reporting was not effective as of December 31, 2020 due to the identification of material weaknesses” related to Ebix’s failure to design controls “over the gift or prepaid card revenues transaction cycle sufficient to prevent or detect a material misstatement.” Further, Ebix and RSM disagreed over the accounting treatment of $30 million that had been transferred into a commingled trust account of Ebix’s outside counsel in December 2020. On this news, Ebix shares fell over $20, or approximately 40%, on February 22, 2021, and have yet to regain their lost value.

I still held on to the stock for quite a while but the risk of overstatement of the revenue numbers made me lose trust in the management and the company. For this reason, in August I decided to close my position of 40 shares.

I generated a return of 21.2% annualized and also had some options sold which generated additional income of $1,781.86 during this year. I do not consider opening any further position nor sell puts on EBIX.

Another candidate for selling is PPL. It has a risk of cutting the dividend. I actually have a sell order placed with my broker but the limit price is above the current share price.

Check out my current Dividend Growth Portfolio and the full overview of all the stocks I hold in it. You can see now two sections: the dividend portfolio and the holdings on stock option wheel trading.

Dividend Safety

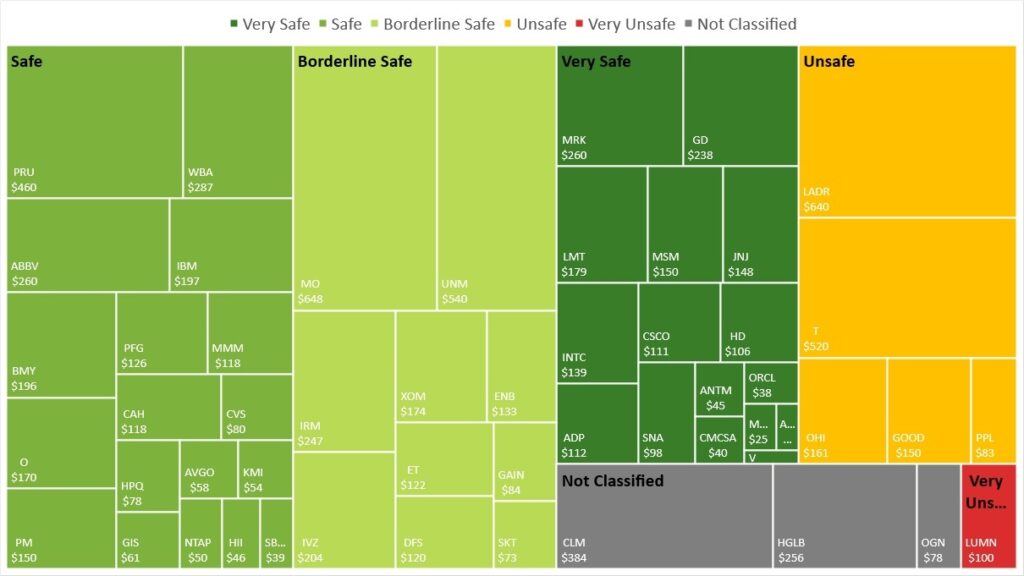

One of the key metrics for my future passive income is how safe it is. For this reason I track my portfolio average Dividend Safety Score. For this score I use the weighted dividend safety punctuation from Simply Save Dividends combined with the dividend income of each of my stocks. The higher the score the safer the dividend income.

Dividend Safety Score

For September, the Dividend Safety Score increased to 58.1 for my dividend growth portfolio, a change of 0.3 points compared to July.

This increase is due to the deployment of money into the above mentioned high quality, high safety score stocks. At the same time, dividend increases of lower scoring stocks in my portfolio pull the average down.

I consider the score of below 60 as not acceptable end and my target is a score of 70. My goal was to reach this target by the end of 2021. However, the investments in alternative assets plus the drop of AT&T’s (T) dividend safety score have pushed this target out of reach.

Nonetheless, I will keep focusing on adding high quality stocks for the foreseeable future. My plan is not to sell low rated stocks but instead re-balance to high scoring ones when deploying more money. For July we are back on this plan.

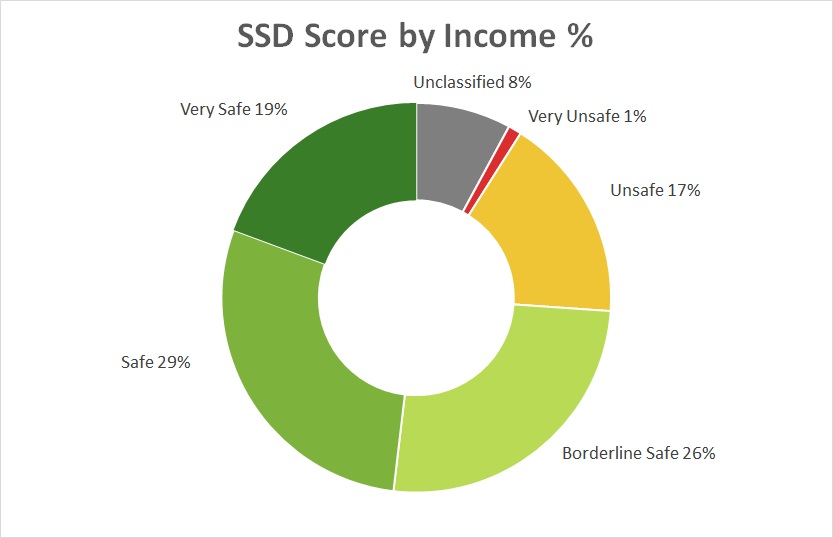

Let’s look at the actual distribution. I use the same classification as Simply Safe Dividends as it makes it easy to spot the categories. You see that the unclassified category has increased quite a bit.

The different categories and their respective score ranges from very unsafe to very safe are:

In my portfolio 48% is in the Safe and Very Safe category which has very little risk of being cut. Another 26% is Borderline Safe. The remaining 18% are Unsafe or Very Unsafe. 8% are unclassified and have a score of 0. I need to monitor especially the unsafe positions closely.

In August and September there has been no significant shift between categories.

Dividend Safety Score Stock by Stock

For each individual stock in my portfolio the current score is as follows:

I hold now 17 companies in the highest category of Very Safe, of which 8 actually have the highest score of 99, and another 19 companies is the second highest category Safe. Overall, my portfolio contains many high quality dividend stocks with a safe dividend score.

On the other end we see the red alarming light with LUMN (formerly CTL). It is only a small position and I am not concerned about this one.

LADR as it is my largest position for dividend income and as such gives me the most exposure to a potential dividend cut. PPL is smaller positions and has a risk of a dividend cut. I consider selling out of this position. I will have to monitor closely if there are any negative signs.

Dividend Safety of Income Distribution

When combining the dividend safety score with the income the picture looks as follows:

You can see that the largest group has become the Safe category, closely followed by the Borderline Safe one. However, the Very Safe category continues to grow and has become a sizable portion of my portfolio. I am very happy with this and expect this one to grow over time.

With T having now in the Unsafe category its size is substancial. I am still not sure what the best course of action is for this stock: holding or selling. LADR I bought at a very good time and would expect no mayor issues for now.

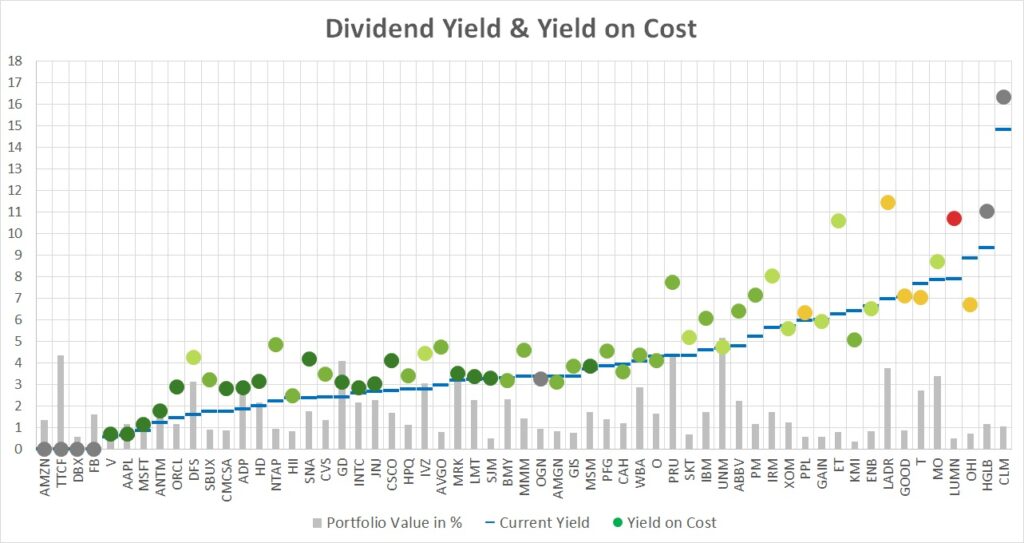

Dividend Safety and Yield

Another way of looking at the dividend safety is by yield and score. For each of my holdings I compare these values to visualize the figures which clearly lets you draw some general conclusions.

The dots represent my yield-on-cost with the color of the dividend safety score. The blue lines indicate the current yield of these stocks. The grey dots represent companies that either do not pay a dividend or are not covered by SSD. The light grey bars represent the percentage of the stock value in my portfolio.

There is a clear correlation between yield and safety score. On the left hand side (apart from the grey dots) we have the low yield, high safety score companies. The further we go to the right, the lower the dividend safety score becomes but it typically comes with a higher yield.

If the blue line (current yield) is below the dot (yield on cost) it means that either the stock has appreciated in price or the dividend was raised or both. Companies recovered quite nicely after the lows in March 2020 and most of my stocks have a lower current yield than my yield on cost.

On the right hand side you can also see the extreme values that stocks can take on. CLM, HGLB, LUMN, ET and LADR have a yield on cost of above 10%. However, one of my goals going forward is not to chase the yield as we can so clearly see that it comes with a lot of risk. Still if I see an opportunity I am open to explore it.

Over time, I would like to see the left zone to experience a push upwards of the dots as dividend increases impact on my yield-on-cost.

Projected Annual Dividend Income (PADI)

My Projected Annual Dividend Income (PADI) increased to $8,983 in September compared to $8,687 at the end of July. This is a rise of $296 or 3.4%.

In large the increase was fueled by newly deployed money with $284 and further $53 by dividend raises. The sale of EBIX reduced my PADI by $12. Additionally, there seems to be a data mismatch with the SSD numbers. On my spreadsheet I already surpassed the $9,000 mark. I will figure it out by the time I publish the next report.

In July I was still wondering if I can hit the $9,000 and there we go. Done! Another milestone hit on my journey to financial independence. But can I get to 10K by the end of the year? I think this is now really out of reach. I do not want to take on more risk with options income and that has typically been the booster I used during the courese of this year.

My journey continues to invest in high quality dividend growth stocks.. I maintain myself firm to invest in undervalued stocks. However, the voices for a potential crash after a final blow off top rally are increasing and getting louder. I will be cautious to see how the markets evolve.

Portfolio Dividend Yield

The current yield of the shares in my portfolio is 3.71%, an increase of 0.11 compared to July. The dividend raises have outpaced the new additions with an average yield of 2.28%.

The investment yield for my dividend growth portfolio is 4.59%. For this yield I compare the current dividend income with the purchase price of the underlying shares. A small decrease by 0.03 points.

My yield on cost (YoC) is higher this month at 5.57%, up 0.31%, because of new dividend and option income as well as further dividend raises. In the background these are slightly offset by unrealized losses on the stocks in the wheel options strategy. As they do not pay any dividends it will only show once I get out of the use of my margin in the account.

Conclusion

The dividend income for August was $656.54 from 19 different companies and for September was $808.28, a 63% increase compared to September last year. My PADI stands at $8,983 and has surpassed my 2021 target of $8,600 by a huge amount.

The dividend safety score of my portfolio is 58.1, an increase of 0.3 points but still significantly below my set target of 70. My analysis has shown that 48% of my dividend income is categorized as safe, but there are still a few stocks with a high risk of being cut.

If you find the information provided helpful and inspiring please consider subscribing to my email list and you will never miss another update. I am also happy to receive comments either on the stocks I hold or other views you want to express. Thank you for having taken the time to read this post.

Disclosure: At time of writing long on all above mentioned

Disclaimer: I am not a professional investment or financial advisor. The information presented on this site represents my personal dividend growth journey and it is for informational purposes only. Opinions expressed are my own and should NOT be relied on or taken as investing advice. I have no knowledge about your personal situation and before you make any investment decision you should exercise due diligence and must do your own research. Always consider seeking advice from a professional financial and tax advisor.

Starting to see quite a few fund managers calling out PRU to the upside…maybe some equity growth to finally go with that dividend growth.

Your yoy growth rate is monstrous! $10K padi is not that far off.

Hi SD Growth,

Thanks for the comment. We’ll see about that 10K milestone…

For PRU I feel they have done most of the recovery and the stock is fairly valued. I will not add any more shares for now.

Happy investing.