The month of July is in the books and it’s been a good dividend income month. I collected $730.28 in dividends from a total of 19 companies. I surpassed again the $700 mark. This is fantastic news.

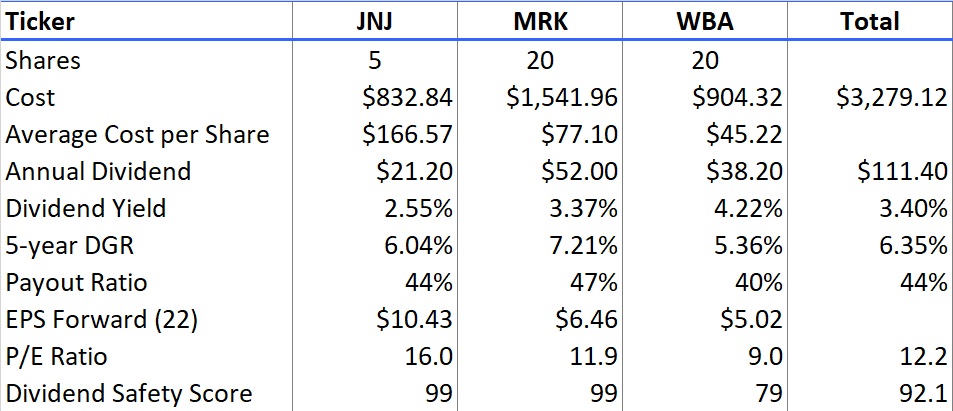

I finally started to pick up again my long-term dividend growth strategy and bought some shares of high quality companies, adding to existing positions of Merck (MRK), Johnson & Johnson (JNJ) and Walboots Green Alliance (WBA). This added $111.40 of new annual dividend income.

Dividend increases of the stocks I hold in my dividend growth portfolio have added also additional $18 to my portfolio income and brought my Projected Annual Dividend Income (PADI) to $8,678. I have officially reached my originally set target for 2021.

I also expanded my options strategy to partially trade the wheel. The idea is to further boost my income which in turn allows me to buy more dividend growth stocks.

Dividend Income July

I really enjoy looking at all the payments throughout the month. It is a confirmation that I am on the right track. Dividend income is truly passive income.

It is time to review the earnings of my dividend growth strategy. My July Dividend Income in detail:

Advanced Data Processing (ADP) – income of $27.90

Cardinal Health (CAH) – income of $29.15

Cornerstone Strategic Value Fund (CLM) – income of $32.04

Comcast (CMCSA) – income of $10.00

Cisco Systems (CSCO) – income of $27.75

Gladstone Investment Corp (GAIN) – income of $7.00

Gladstone Commercial Corp (GOOD) – income of $12.52

Highland Global Allocation Fund (ETF) (HGLB) – income of $21.30

HP Inc. (HPQ) – income of $9.69

Iron Mountain (IRM) – income of $61.85

Ladder Capital (LADR) – income of $160.00

Altria (MO) – income of $154.80

Merck (MRK) – income of $45.50

MSC Industrial (MSM) – income of $37.50

NetApp (NTAP) – income of $12.50

Realty (O) – income of $14.13

Oracle (ORCL) – income of $9.60

Phillip Morris (PM) – income of $36.00

PPL Corp. (PPL) – income of $20.75

LADR and MO are my main contributors with $160 and $154.80 respectively. First time contributor is CLM. I did not collect any more dividends from MDT as I sold my shares before the ex-dividend date.

Overall, I have a nice split across many of my holdings and reduce the impact of any potential dividend cuts.

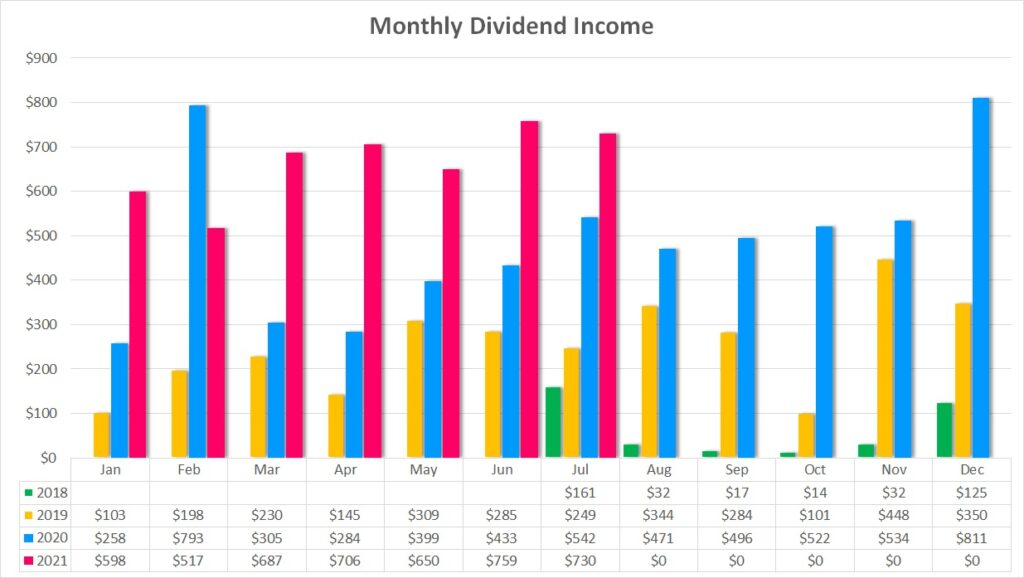

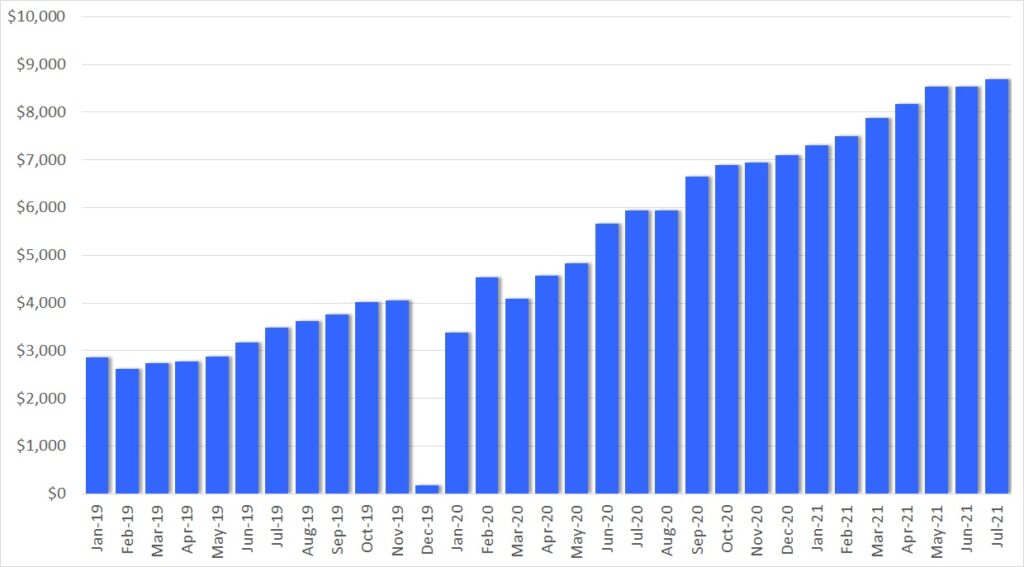

The above chart shows my monthly dividend income over time. In July 2021 I received $730.28 compared to July 2020 with $542.09 of income. This is an increase of $188.19 or 35%. This is still a great growth rate and I expect to keep pushing myself.

Year over year I managed to increase my income from $3,012.79 in the period January to July 2020 to $4,646.51 in the same period in 2021. That is an increase of $1,633.72 or 54%.

Check out my current Dividend Income Table for 2021 and the full overview of all the stocks.

Dividend Changes

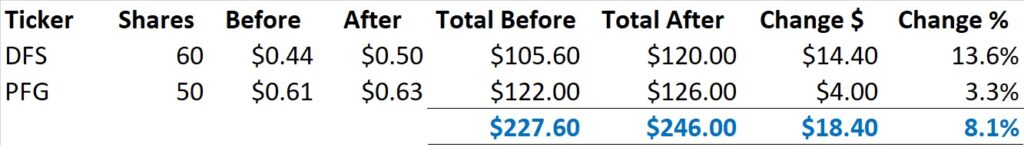

In July there have been two dividend increases in my portfolio. The table below summarizes the total impact of $18.40, with an average increase of 8.1%. Clearly, this was a very low number but then again every dollar counts on my journey.

DFS increased their dividend by 13.6%: this is a remarkable increase. Who says you cannot have both value appreciation and dividend growth. DFS is my best performing stock and now I get to enjoy a juicy dividend increase.

PFG was absolutely not on the radar. They already increased their dividend in April from $0.56 to $0.61, and now again to $0.63. That is 3.3% for this increase and 12.5% for the year. This is just amazing.

As a result of this change, my PADI increased by $18.40. At a yield of 3.0%, to achieve this dividend income I would have to deploy $613. But this is not necessary. The dividend increases take care of that and that’s the beauty of dividend growth investing and the compound effect in action.

Expected Dividend Increases for August

In this section I look ahead and estimate what the dividend raises for the coming month are of stocks that I hold in my for dividend growth portfolio.

As Altria (MO) has not announced their annual dividend increase yet. I would expect a raise of one cent to $0.87 on a quarterly basis. That’s a 1.2% increase.

Other than that August is a quite month.

The Dividend Growth Portfolio

In the Dividend Growth Portfolio I hold 56 different companies. Here is an overview of the status as of July 30th. I have excluded the stocks that I hold for my wheel strategy.

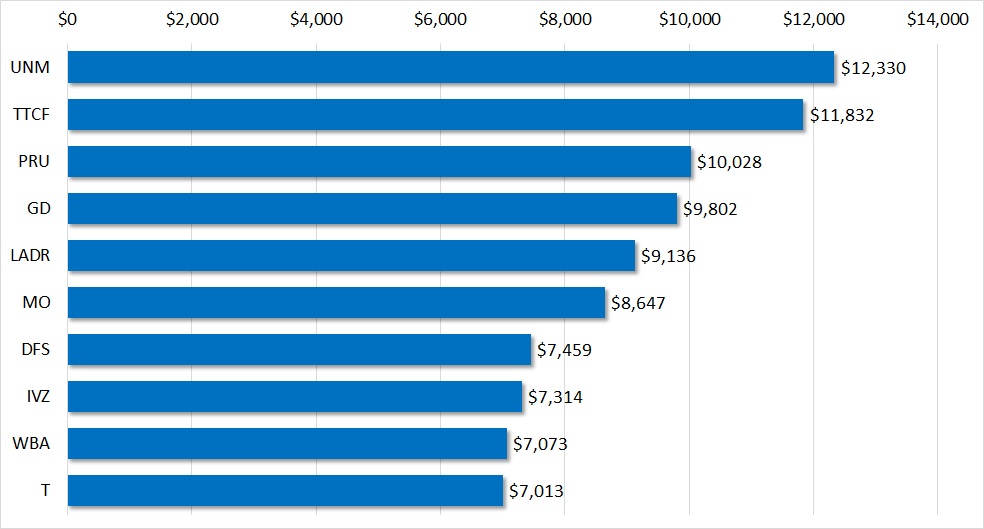

Here is the Top-10 holding overview. In total, these 10 stocks make up 37.9% of my dividend growth portfolio. UNM is ranked first with 5.16% and DFS is the one with the most appreciation. TTCF is a growth stock and does not pay any dividends. T is the only one sitting on a small loss on my initial investment (not counting dividends as I do not employ DRiP).

Purchases

In July returned to my main strategy and added to three existing positions of high quality dividend growth stocks. With new maximums reached surely the overall market is richly valued but my main focus is to only invest in undervalued stocks to take advantage of the margin of safety.

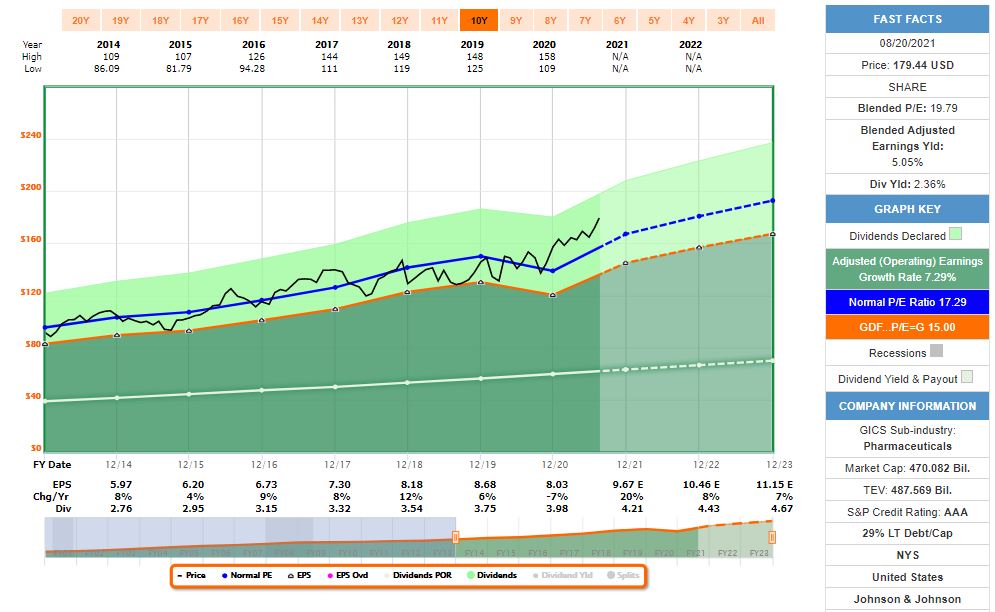

Johnson & Johnson

Johnson & Johnson is the world’s largest and most diverse healthcare firm. Three divisions make up the firm: pharmaceutical, medical devices and diagnostics, and consumer. The drug and device groups represent close to 80% of sales and drive the majority of cash flows for the firm. The drug division focuses on the following therapeutic areas, the device segment focuses on orthopedics, surgery tools, vision care, and a few smaller areas, while the last segment of consumer focuses on baby care, beauty, oral care, over-the-counter drugs, and women’s health. Geographically, just over half of total revenue is generated in the United States.

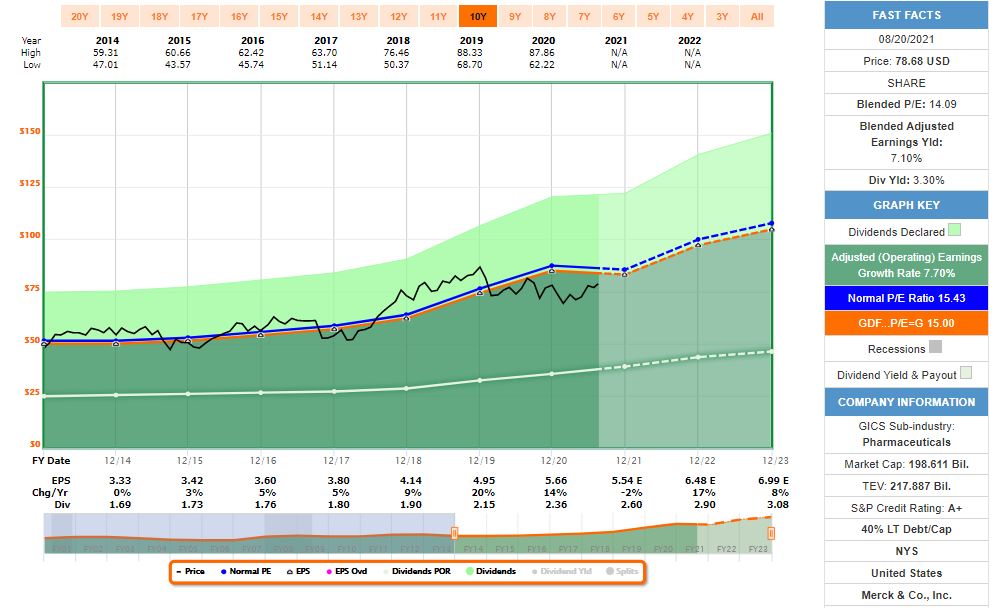

Merck & Co Inc (MRK)

Merck is a leading pharmaceutical company that makes products to treat several conditions in a number of therapeutic areas, including cardio-metabolic disease, cancer, and infections. Within cancer, the firm’s immuno-oncology platform is growing as a major contributor to overall sales. The company also has a substantial vaccine business, with treatments to prevent hepatitis B and pediatric diseases as well as HPV and shingles. Additionally, Merck sells animal health-related drugs. From a geographical perspective, close to 40% of the firm’s sales are generated in the United States.

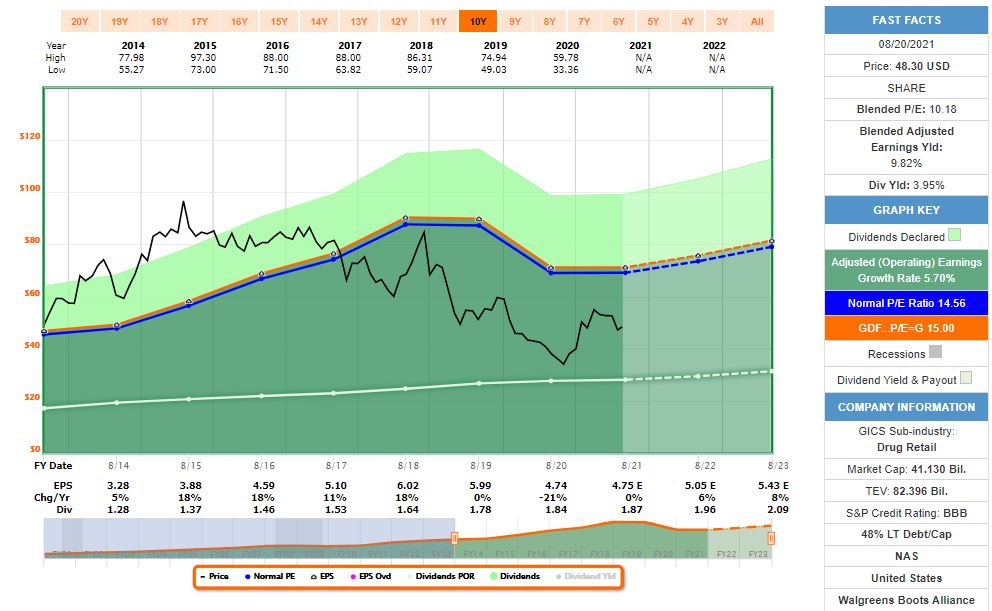

Walgreens Boots Alliance (WBA)

Walgreens Boots Alliance is a leading retail pharmacy chain, with over 21,000 stores in 50 states and 11 countries. Walgreens’ core strategy involves brick-and-mortar retail pharmacy locations in high-traffic areas. Currently, the company has a leading market share of the domestic prescription drug market at about 20%. In 2021, the company sold off a majority of its Alliance Healthcare wholesale business to AmerisourceBergen for $6.5 billion, doubling down on its core pharmacy efforts and ventures in strategic growth areas in primary care (VillageMD) and digital offerings. The company also has equity stakes in AmerisourceBergen (29%) and Sinopharm Holding Guoda Drugstores (40%).

These are the companies I invested in this month. I am particularly happy about the high dividend safety score, an average of 92%. As you know one of my goals it to build a solid, high quality dividend growth portfolio. The dividend safety is a key element of this strategy.

As a result, I have added $111.40 of dividend income to my Projected Annual Dividend Income (PADI). On an investment amount of $3,279.12 including fees it comes to an average dividend yield of 3.40%. For such high quality stocks this is a very good starting yield.

Sales

There has been no stock sale in July.

However, I may consider selling EBIX as the outlook and quality of this stock is questionable. Additionally, the dividend income is very low. Update: as of the date of publishing this article I already executed on the sale of EBIX – all details in the August update.

Another candidate for selling is PPL. It has a risk of cutting the dividend.

Check out my current Dividend Growth Portfolio and the full overview of all the stocks I hold in it. You can see now two sections: the dividend portfolio and the holdings on stock option wheel trading.

Dividend Safety

One of the key metrics for my future passive income is how safe it is. For this reason I track my portfolio average Dividend Safety Score. For this score I use the weighted dividend safety punctuation from Simply Save Dividends combined with the dividend income of each of my stocks. The higher the score the safer the dividend income.

Dividend Safety Score

For July, the Dividend Safety Score increased to 57.8 for my dividend growth portfolio, a change of 4.8 points compared to June.

This increase is due to the deployment of money into the above mentioned high quality, high safety score stocks.

I consider the score of below 60 as not acceptable end and my target is a score of 70. My goal was to reach this target by the end of 2021. However, the investments in alternative assets plus the drop of AT&T’s (T) dividend safety score have pushed this target out of reach.

Nonetheless, I will keep focusing on adding high quality stocks for the foreseeable future. My plan is not to sell low rated stocks but instead re-balance to high scoring ones when deploying more money. For July we are back on this plan.

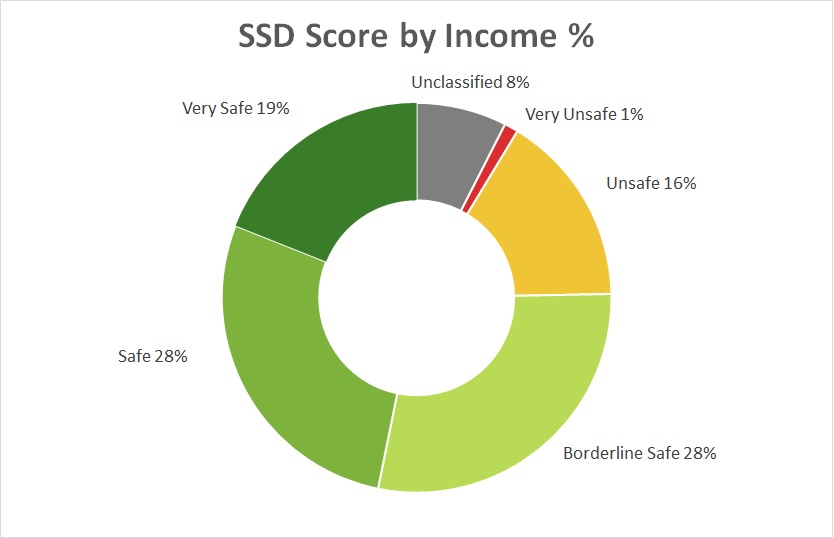

Let’s look at the actual distribution. I use the same classification as Simply Safe Dividends as it makes it easy to spot the categories. You see that the unclassified category has increased quite a bit.

The different categories and their respective score ranges from very unsafe to very safe are:

In my portfolio 47% is in the Safe and Very Safe category which has very little risk of being cut. Another 28% is Borderline Safe. The remaining 17% are Unsafe or Very Unsafe. 8% are unclassified and have a score of 0. I need to monitor especially the unsafe positions closely.

In July there has been no significant shift between categories.

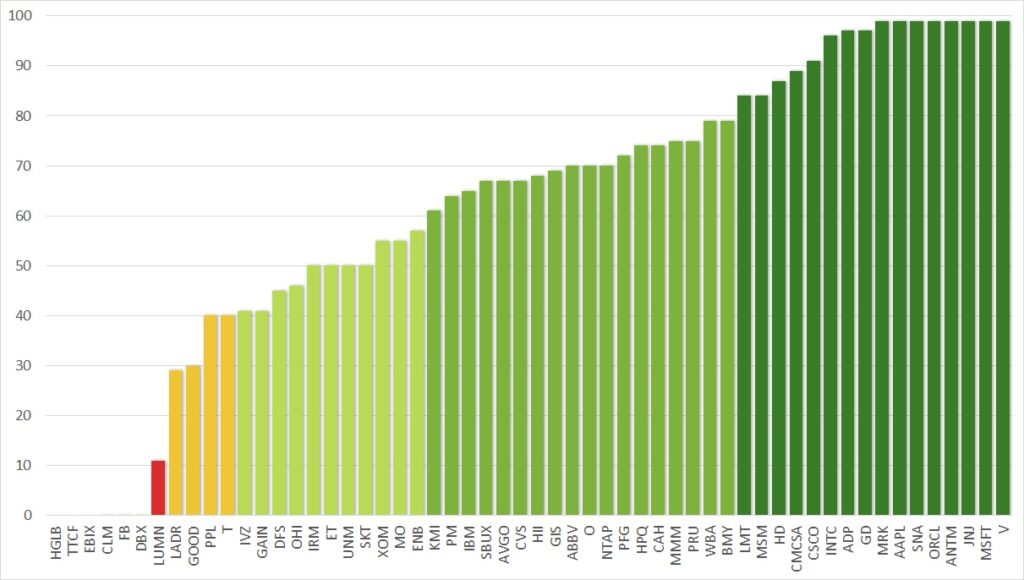

Dividend Safety Score Stock by Stock

For each individual stock in my portfolio the current score is as follows:

I hold now 17 companies in the highest category of Very Safe, of which 8 actually have the highest score of 99, and another 18 companies is the second highest category Safe. Overall, my portfolio contains many high quality dividend stocks with a safe dividend score.

On the other end we see the red alarming light with LUMN (formerly CTL). It is only a small position and I am not concerned about this one.

LADR as it is my largest position for dividend income and as such gives me the most exposure to a potential dividend cut. PPL is smaller positions and has a risk of a dividend cut. I consider selling out of this position. I will have to monitor closely if there are any negative signs.

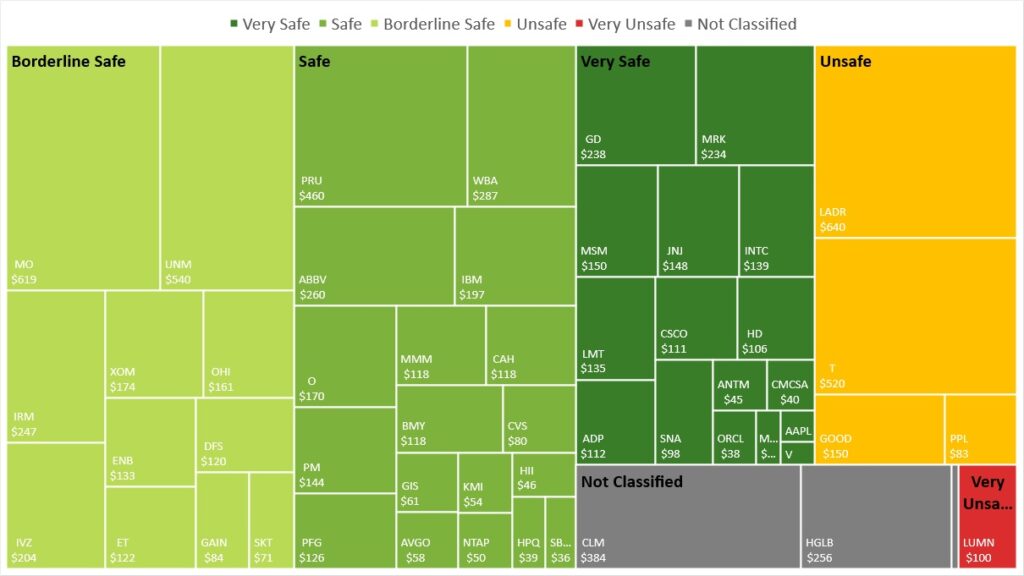

Dividend Safety of Income Distribution

When combining the dividend safety score with the income the picture looks as follows:

You can see that the largest group remains the Borderline Safe category, closely followed by the Safe one. However, the Very Safe category has become a sizable portion of my portfolio. I am very happy with this and expect this one to grow over time.

With T having moved to the Unsafe category its size has increased significantly. I am still not sure what the best course of action is for this stock: holding or selling.

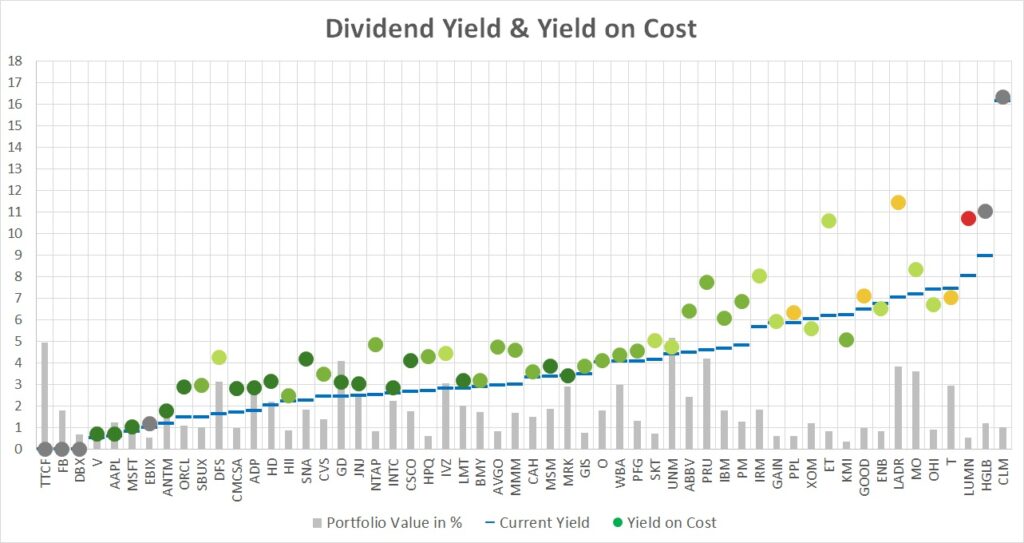

Dividend Safety and Yield

Another way of looking at the dividend safety is by yield and score. For each of my holdings I compare these values to visualize the figures which clearly lets you draw some general conclusions.

The dots represent my yield-on-cost with the color of the dividend safety score. The blue lines indicate the current yield of these stocks. The grey dots represent companies that either do not pay a dividend or are not covered by SSD. The light grey bars represent the percentage of the stock value in my portfolio.

There is a clear correlation between yield and safety score. On the left hand side (apart from the grey dots) we have the low yield, high safety score companies. The further we go to the right, the lower the dividend safety score becomes but it typically comes with a higher yield.

If the blue line (current yield) is below the dot (yield on cost) it means that either the stock has appreciated in price or the dividend was raised or both. Companies recovered quite nicely after the lows in March 2020 and most of my stocks have a lower current yield than my yield on cost.

On the right hand side you can also see the extreme values that stocks can take on. CLM, HGLB, LUMN, ET and LADR have a yield on cost of above 10%. However, one of my goals going forward is not to chase the yield as we can so clearly see that it comes with a lot of risk. Still if I see an opportunity I am open to explore it.

Projected Annual Dividend Income (PADI)

My Projected Annual Dividend Income (PADI) increased to $8,687 in July compared to $8,528 at the end of June. This is a rise of $159 or 1.9%.

In large the increase was fueled by newly deployed money with $111 and further $18 by dividend raises. Additionally, there was a delay in the SSD record for the UNM dividend increase to be recorded, accounting for $27.

This month is a special month because I hit my target of $8,600 for this year. The best thing about this is that it is only July and I have plenty of opportunities to deploy more money for the rest of the year. Can I get the $9,000?

My journey continues to invest in high quality dividend growth stocks. However, the stock market shows less and less opportunities. I maintain myself firm to invest in undervalued stocks.

Portfolio Dividend Yield

The current yield of the shares in my portfolio is 3.60%, an increase of 0.12 compared to last month. A result of further highs in the market but mostly due to the elimination of options wheel stocks for the statistics.

The investment yield for my dividend growth portfolio is 4.62% and also this value is affected by the exclusion of options wheel strategy. For this yield I compare the current dividend income with the purchase price of the underlying shares.

My yield on cost (YoC) is higher this month at 5.26%, up 0.09%, because of new dividend and option income as well as further dividend raises.

Conclusion

The dividend income for July was $730.28 from 19 different companies, a 35% increase compared to July last year. My PADI stands at $8,687 and has surpassed my 2021 target of $8,600.

The dividend safety score of my portfolio is 60.8, a drop of two points over March and still significantly below my set target of 70. My analysis has shown that 46% of my dividend income is categorized as safe, but there are still a few stocks with a high risk of being cut.

If you find the information provided helpful and inspiring please consider subscribing to my email list and you will never miss another update. I am also happy to receive comments either on the stocks I hold or other views you want to express. Thank you for having taken the time to read this post.

Disclosure: At time of writing long on all above mentioned. EBIX was sold at the beginning of August.

Disclaimer: I am not a professional investment or financial advisor. The information presented on this site represents my personal dividend growth journey and it is for informational purposes only. Opinions expressed are my own and should NOT be relied on or taken as investing advice. I have no knowledge about your personal situation and before you make any investment decision you should exercise due diligence and must do your own research. Always consider seeking advice from a professional financial and tax advisor.

That is one large and detailed monthly report, awesome work.

I really like your dividend safety ranking, I haven’t seen anyone in the dgi community (yet) that also shows his or her portfolio that way.

A 54% increase with your numbers is very good, congratulations! We share 6 companies paying us and we also share a buy, namely WBA since I also increased my position recently.

I share your concerns on PPL, I’m probably selling after the ex dividend date in September and replacing it with either PNW or ED.