With the markets reaching new maximums my portfolio also shows some really nice gains. And with it also Snap-On Incorporated (Ticker: SNA) which I first bought last year in April on a limit order. At market close on Friday, 9th of April, it had gone up by $235.59, making it my third home run!

I designate stocks whose total returns exceed my initial capital outlay, home runs. For dividend growth stocks, total returns include both unrealized gains and dividends received.

Home Run #3

It’s been a while since I recorded my first ever home run with Discovery Financial Services (Ticker: DFS) given the markets seem to know only one direction and that means going up. Today I can call my third home run on Snap-On Incorporated (Ticker: SNA).

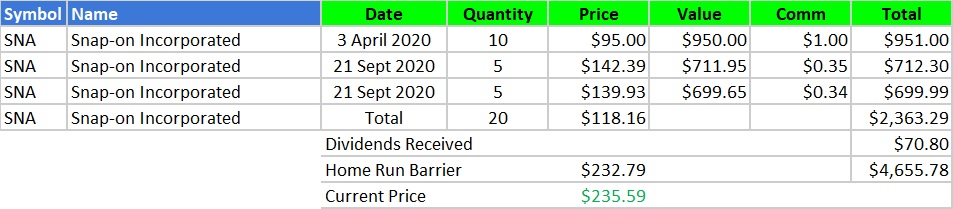

On Friday, 9th of April, the market closed at $235.59 for the stock, enough to surpass the threshold of $232.79 to become a home run in my portfolio.

My average cost basis for SNA is $118.16 and I’ve received dividend income totaling $70.80 since first buying the stock in April 2020. Actually, I think I could have recorded this holding earlier as a home run but I did not take the March dividend payment into consideration until this weekend.

Here is a table showing the buy dates, number of shares, and the average cost basis of my EBIX shares:

Here is a price chart of SNA indicating my buys and current price level:

Home Run Contenders

There are two currently no stock close to approaching home run status.

SBUX at 85%

HPQ at 82%

DGJ’s Home Runs

Here is a list of DGJ’s home runs with updated total returns (and annualized total returns if held longer that one year):

- Home run #1: Discovery Financial Services (DFS) — up 114% (83%)

- Home run #2: Ebix Inc. (EBIX) — up 15% (crashed massively after reaching home run status)

- Home run #3: Snap-On Incorporated (SNA) — up 102% (146%)

Once a position reaches home run status, it retains that status even if the stock price drops and the total returns dip below the 100% mark. Also, if I buy additional shares of a home run stock at a higher cost basis, the calculated total returns could also drop below 100%.

Concluding Remarks

With total returns exceeding my initial investment, SNA is the third home run stock in my Dividend Growth Journey portfolio. I’m looking forward to seeing if I can continue this streak with further home runs in 2021.