The first quarter of 2021 is over and the markets do not let me take breath. I maintain a focus on any signs of market weakness but there is non. As counterweight I have my dividend stocks which generate a steady income stream month after month.

In March a total of 24 companies paid me and I received $686.58 in dividends.

I really enjoy looking at all the payments throughout the month. It is a confirmation that I am on the right track. It is a pleasure to see the fruits of your hard work every single month.

It is time to review the earnings of my dividend growth strategy. My March Dividend Income comes from:

Anthem (ANTM) – income of $11.30

Broadcom (AVGO) – income of $14.40

Discovery Financial Services (DFS) – income of $26.40

Ebix (EBIX) – income of $3.00

Enbridge (ENB) – income of $32.96

Gladstone Investment Corp (GAIN) – income of $7.00

Gladstone Commercial Corp (GOOD) – income of $12.52

Home Depot (HD) – income of $26.40

International Business Machines (IBM) – income of $48.90

Intel (INTC) – income of $34.75

Invesco (IVZ) – income of $46.50

Johnson & Johnson (JNJ) – income of $30.30

Lockheed Martin (LMT) – income of $33.80

Lumen (LUMN), formerly CenturyLink (CTL) – income of $25.00

3M (MMM) – income of $29.40

Microsoft (MSFT) – income of $5.60

Realty (O) – income of $14.07

Principal Financial Group (PFG) – income of $28.00

Prudential (PRU) – income of $115.00

Starbucks (SBUX) – income of $9.00

Snap-on (SNA) – income of $24.60

Visa (V) – income of $3.20

Walgreens Boots Alliance (WBA) – income of $60.78

Exxon (XOM) – income of $43.50

PRU and WBA are my main contributors with $115 and $60.78 respectively. PRU has become a significant position in my portfolio after the recovery.

Overall, I have a nice split across many of my holdings and reduce the impact of any potential dividend cuts.

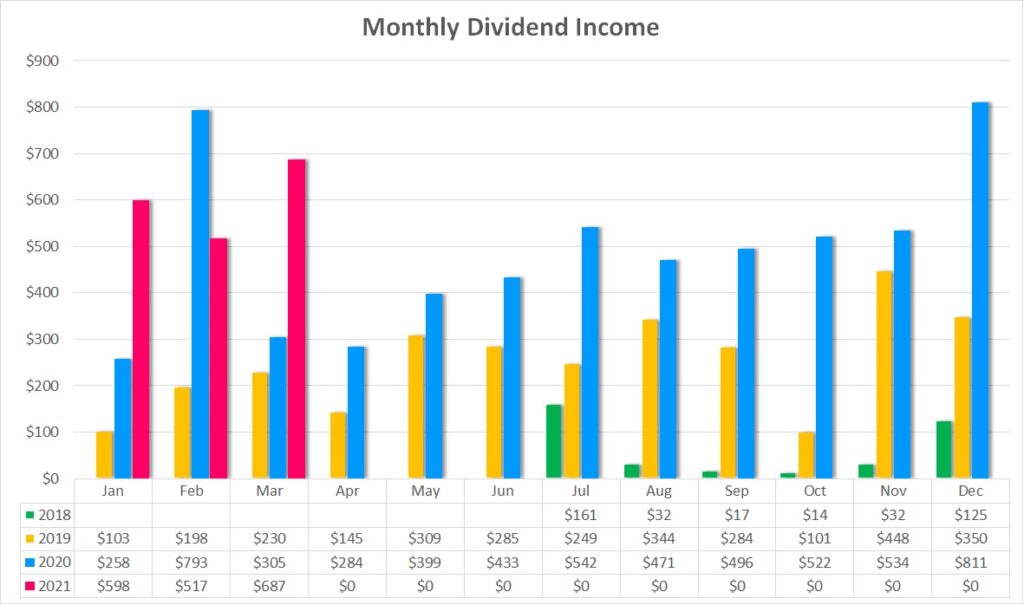

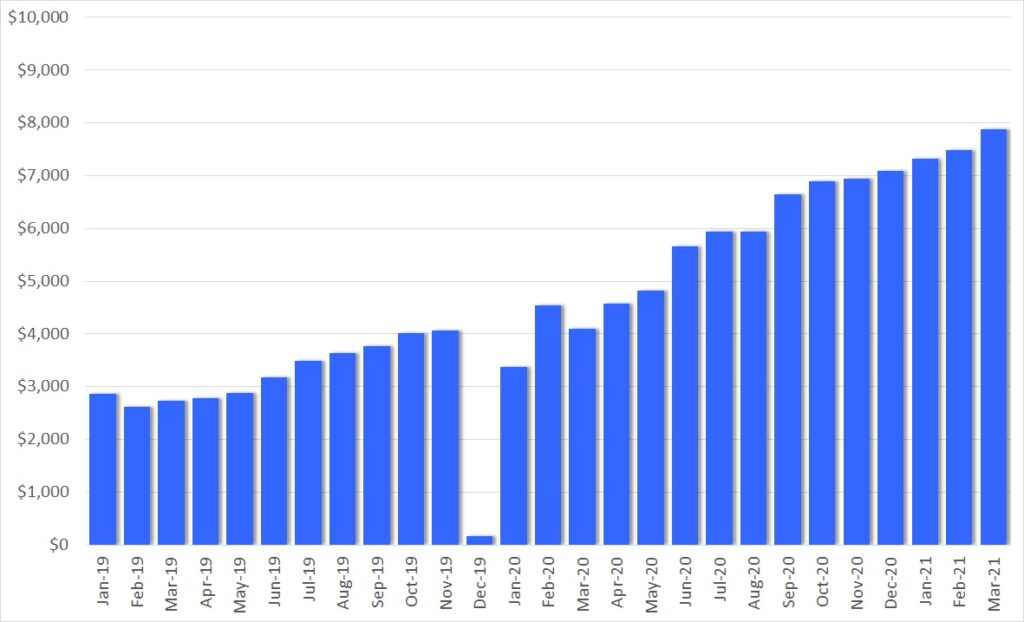

The above chart shows my monthly dividend income over time. In March 2021 I received $686.58 compared to March 2020 with $305.35 of income. This is an increase of $381.23 or 125%. That is insane!

Actually, taken out the special dividends in February 2020 and December 2020, March has been my highest ever dividend income month.

Year over year I managed to increase my income from $1,355.74 in the first quarter of 2020 to $1,801.53 in the same period in 2021. That is an increase of 33%.

That’s the way I like it.

Check out my current Dividend Income Table for 2021 and the full overview of all the stocks.

Dividend Changes

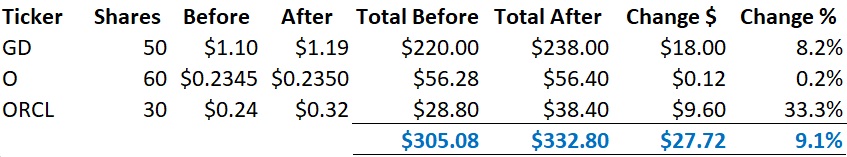

In March there have been two dividend increases in my portfolio. The table below summarizes the total impact of $18.12, with an average increase of 6.6%.

GD increased their dividend by 8.2% – very nice and in line with expectations.

O delivered another small increase. Let’s see how many will be this year.

Oracle (ORCL) – there was no dividend increase last year but March but this year the company pulled the trigger. A whopping 33.3% increase.

I am looking to receive an average increase of 7% to outrank inflation by a large margin. March surpassed that with 9.1% and O raises the dividend several times a year, so it looks pretty good.

As a result of this change, my PADI increased by $27.72. At a yield of 3.0%, to achieve this dividend income I would have to deploy $924. But this is not necessary. The dividend increases take care of that and that’s the beauty of dividend growth investing and the compound effect in action.

Expected Dividend Increases for April

The following companies in my dividend growth portfolio have raised their dividend typically in April:

International Business Machines (IBM) – It could be anything from one cent to five cents.

Invesco (IVZ) – is there room for an increase – I believe so. After the cut last year, I think it’s time to bring the dividends up again. Is 10% feasible?

Johnson & Johnson (JNJ) – Another 5% increase this year?

Kinder Morgan (KMI) – truth to be told, I don’t think we can expect a dividend increase here

Exxon (XOM) – another oil company and I don’t expect a raise

The Dividend Growth Portfolio

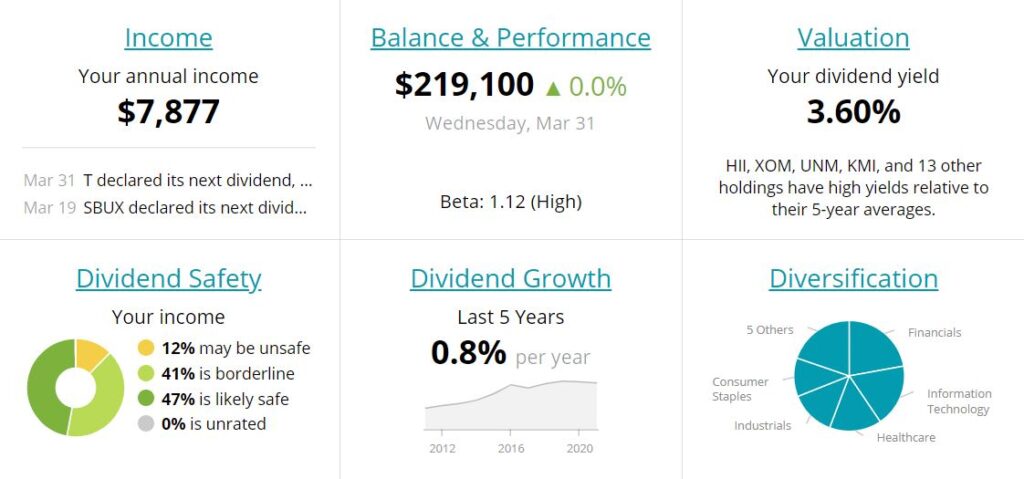

In the Dividend Growth Portfolio I hold 57 different companies. Here is an overview of the status as of March 31st.

Purchases

In March I added to several existing positions in my dividend growth portfolio. Surely the overall market is richly valued but my main focus is to only invest in undervalued stock to use that margin of safety. Additionally, I invest selectively into growth stocks.

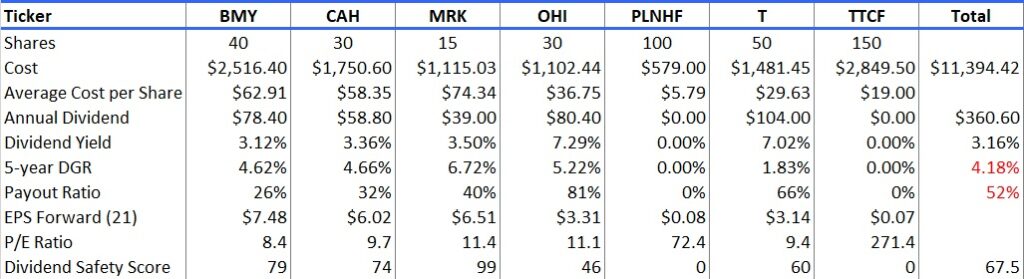

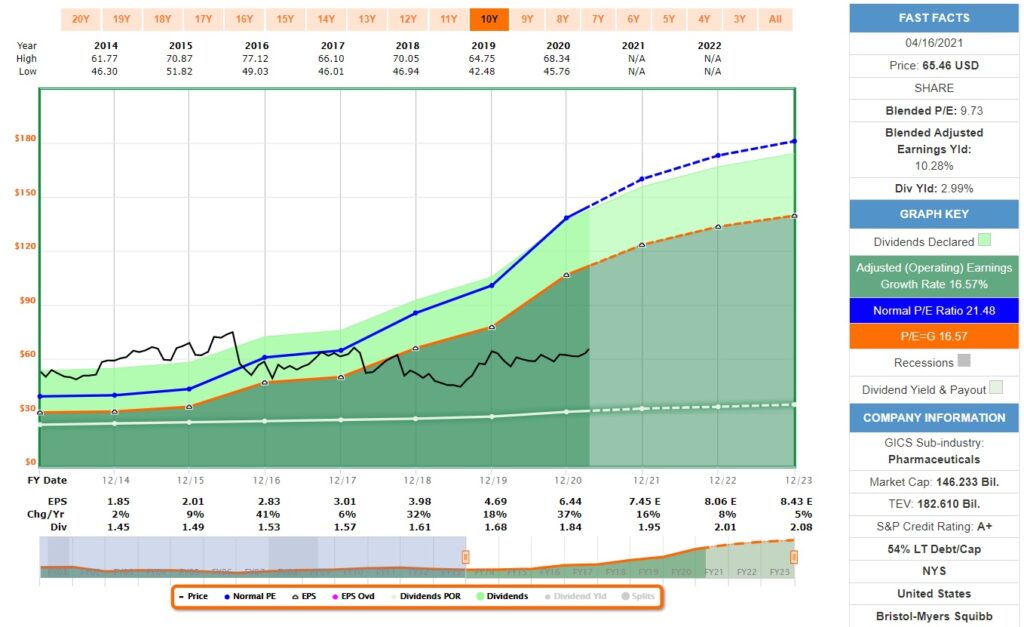

Bristol-Myers Squibb (BMY)

Bristol-Myers Squibb discovers, develops, and markets drugs for various therapeutic areas, such as cardiovascular, oncology, and immune disorders. A key focus for Bristol is immuno-oncology, where the firm is leading in drug development. Unlike some of its more diversified peers, Bristol has exited several non-pharmaceutical businesses to focus on branded specialty drugs, which tend to support strong pricing power.

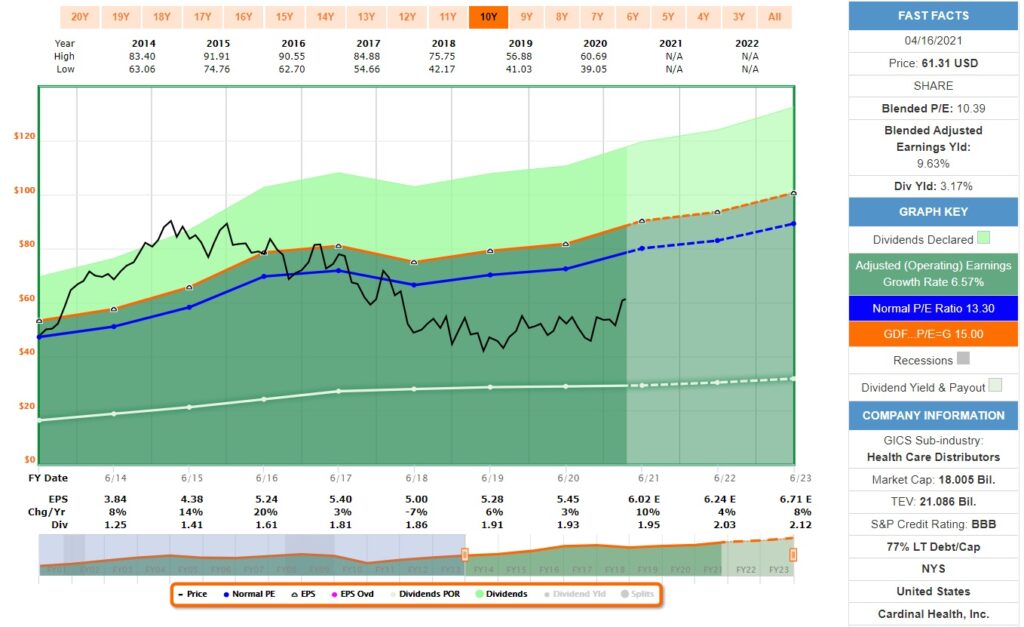

Cardinal Health Inc (CAH)

Cardinal Health Inc is the third- largest global logistics provider engaged in wholesale pharmaceutical and medical products. Similar to the other two peers, the company has evolved over time and has become entrenched in the sourcing and distribution of brand-name and generic pharmaceuticals and related services to hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, and physician offices. Through acquisitions, Cardinal Health has the ability to manufacture commodity products and certain medical devices.

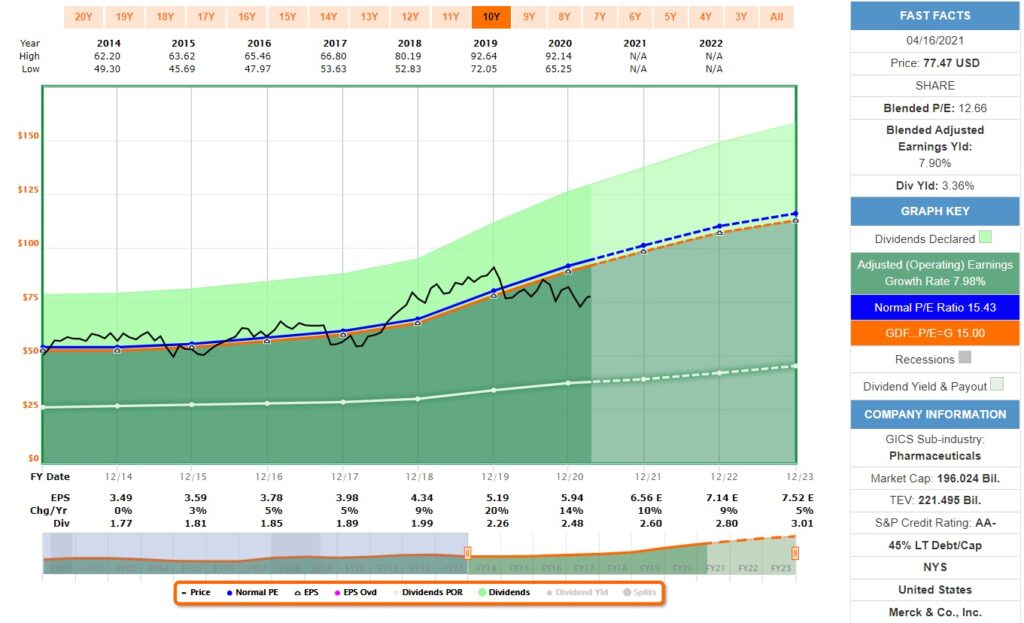

Merck & Co Inc (MRK)

Merck makes pharmaceutical products to treat several conditions in a number of therapeutic areas, including cardiometabolic disease, cancer, and infections. Within cancer, the firm’s immuno-oncology platform is growing as a major contributor to overall sales. The company also has a substantial vaccine business, with treatments to prevent hepatitis B and pediatric diseases as well as HPV and shingles. Additionally, Merck sells animal health-related drugs. From a geographical perspective, close to 40% of the firm’s sales are generated in the United States.

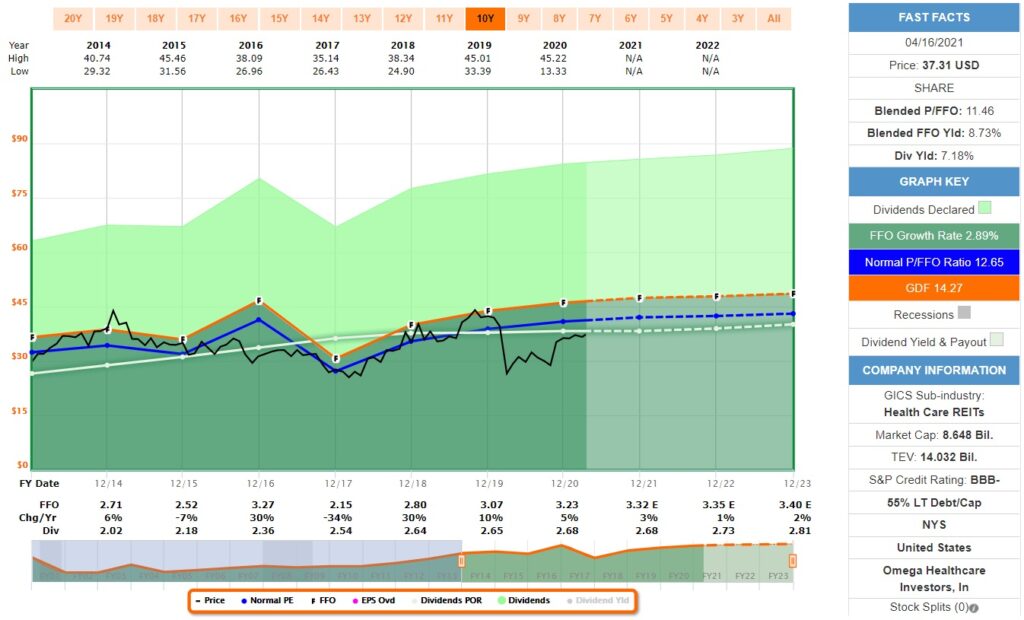

Omega Healthcare Investors Inc (OHI)

Omega Healthcare Investors Inc is a healthcare facility real estate investment trust that invests in the United States real estate markets. Omega’s portfolio focuses on long-term healthcare facilities. The company maintains dual goals of increasing its returns to investors while also maintaining a high level of care for residents. Omega works to obtain contractual rent escalations under long-term leases, along with fixed-rate mortgage loans. The company considers merger and acquisition investment as a component of its operational growth strategy.

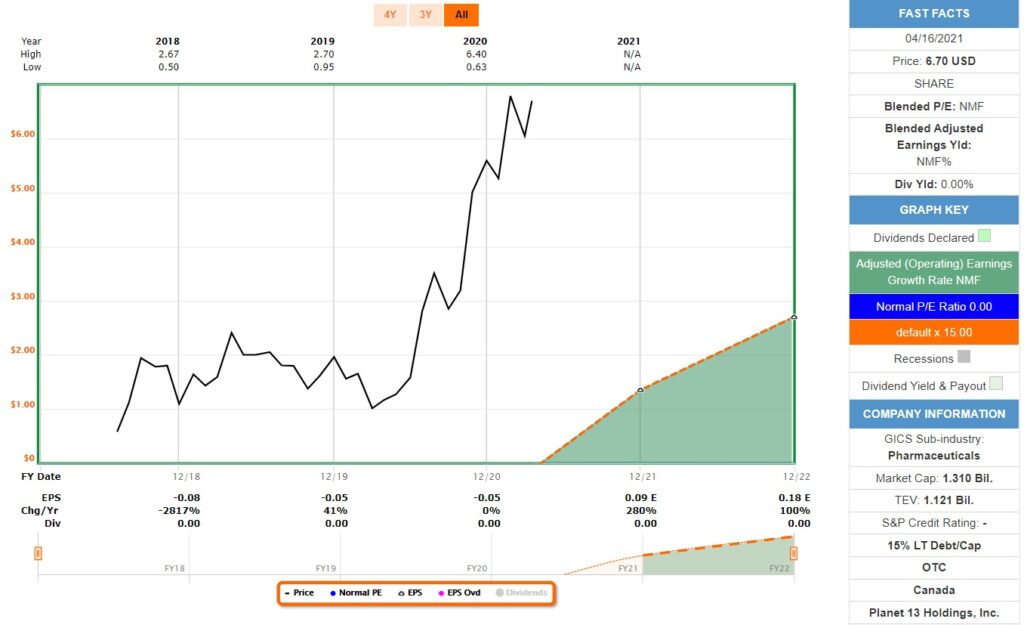

Planet 13 Holdings Inc (PLNHF)

Planet 13 Holdings Inc operate as an integrated cannabis company based in Nevada, with cultivation, production and dispensary operations in Las Vegas. The company is focused on providing an unparalleled dispensary experience and optimizing cultivation efficiencies through its technology as the vanguard of cannabis. Planet 13 Holdings is headquartered in Las Vegas, Nevada.

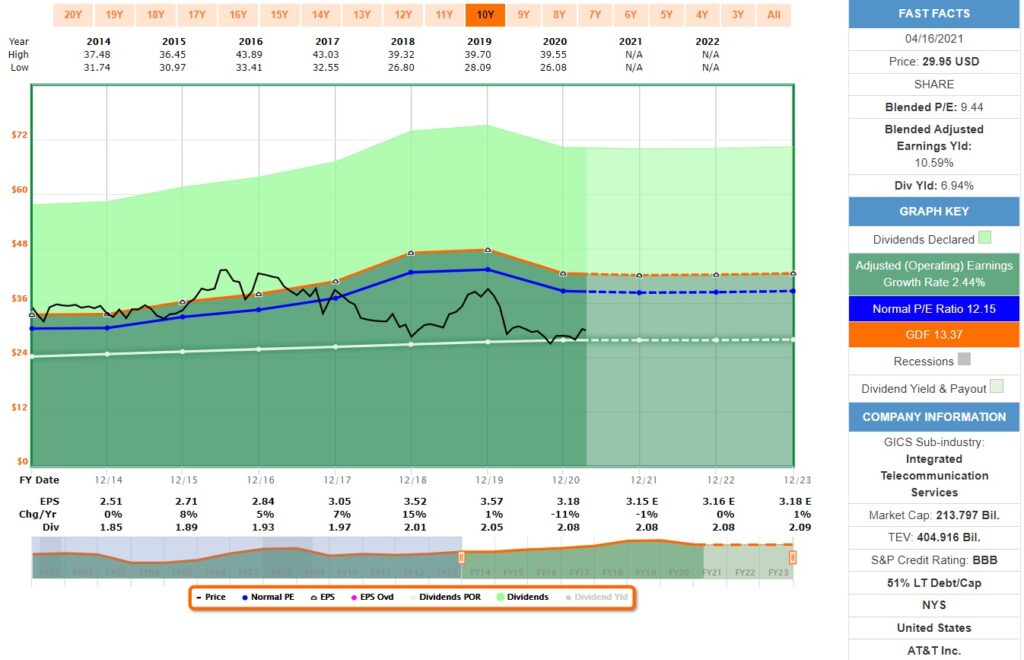

AT&T (T)

AT&T is a national communications and broadband service provider. Wireless is AT&T’s largest business, contributing about 40% of revenue. The firm is the third-largest U.S. wireless carrier, connecting 64 million postpaid and 17 million prepaid phone customers. WarnerMedia contributes a bit less than 20% of revenue with media assets that include HBO, the Turner cable networks, and the Warner Brothers studios. Fixed-line business communications services, provided to a wide range of entities, provide about 15% of revenue. The consumer broadband segment (about 7% of revenue) primarily provides broadband service to 15 million households. AT&T is headquartered in Dallas, Texas.

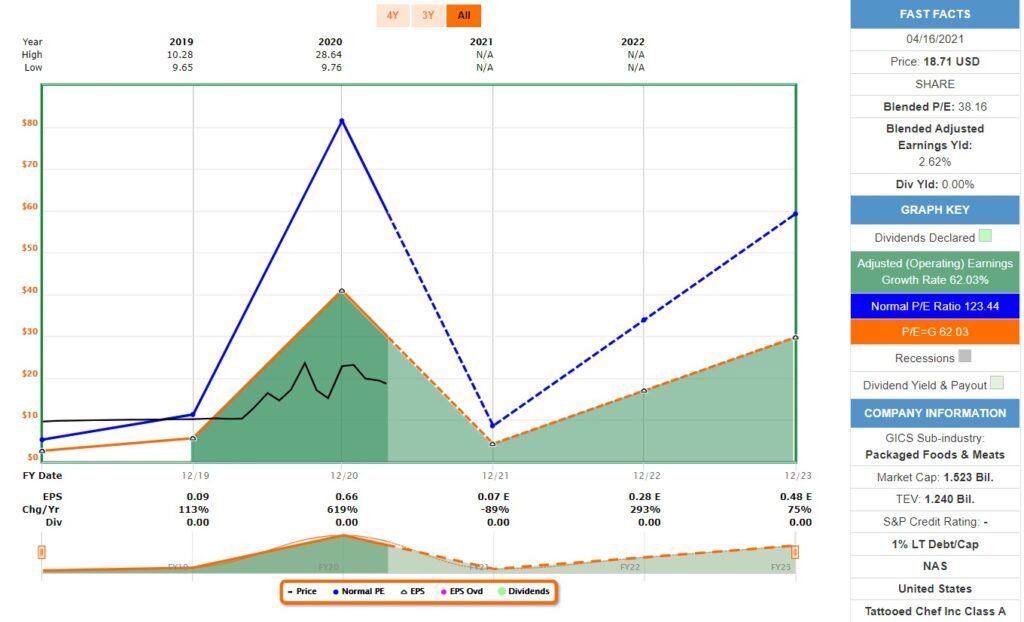

Tattooed Chef Inc (TTCF)

Tattooed Chef Inc is a plant-based food company offering a broad portfolio of plant-based food products that taste great and are sustainably sourced. The company’s signature products include ready-to-cook bowls, zucchini spirals, riced cauliflower, acai and smoothie bowls, and cauliflower pizza crusts, which are available in the frozen food sections of national retail food stores across the United States. Tattooed Chef provides great-tasting, approachable, and innovative products not only to the growing group of consumers who seek to adopt a plant-based lifestyle, but to any of the People Who Give a Crop. Tattooed Chef was founded in 2018 and is headquartered in Paramount, California.

These are the companies I invested in this month. As a result, I have added $360.60 of dividend income to my Projected Annual Dividend Income (PADI). On an investment amount of $11,394.42 including fees it comes to an average dividend yield of 3.16% and a weighted Dividend Safety Score of 67.5 points. The Dividend Safety Score is slightly below my target of 70 but still higher than my current portfolio score. If I only consider the dividend paying companies for the yield calculation the average dividend yield increases to 4.53%

Sales

This month I sold MDP as part of my covered call strategy. I held 200 shares and had sold two call options. These options expired in the money and the shares were called. MDP did not pay a dividend and, therefore, my PADI is not reduced.

Check out my current Dividend Growth Portfolio and the full overview of all the stocks I hold in it.

Dividend Safety

One of the key metrics for my future passive income is how safe it is. For this reason I have started to track my Dividend Safety Score. For this score I use the weighted dividend safety punctuation from Simply Save Dividends combined with the dividend income of each of my stocks. The higher the score the safer the dividend income.

Dividend Safety Score

For March, the Dividend Safety Score is 62.8 for my dividend growth portfolio and remained unchanged compared to February.

An increase is due to the deployment of money into stocks with a higher than previous average score and the raises of dividends.

At the same time, in my portfolio AT&T received a dividend safety score drop from 65 to 60. This means that the category changed from Safe to Borderline Safe.

I consider the score of below 60 somewhat at the lower acceptable end and my target is a score of 70. I want to have achieved this by the end of 2021. My plan is not to sell low rated stocks but instead re-balance to high scoring ones when deploying more money.

I strive to continuously add to my portfolio and here really the focus is on high quality stocks. The re-balancing happens over time as new money deployed lowers the proportion of the low scoring stocks. I have seen that this works just fine for other dividend growth investor portfolios.

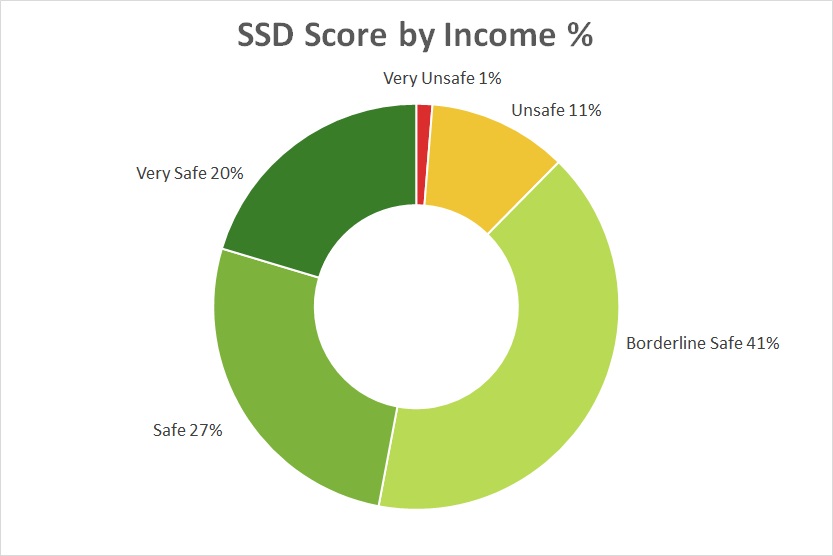

Let’s look at the actual distribution. I use the same classification as Simply Safe Dividends as it makes it easy to spot the categories.

The different categories and their respective score ranges from very unsafe to very safe are:

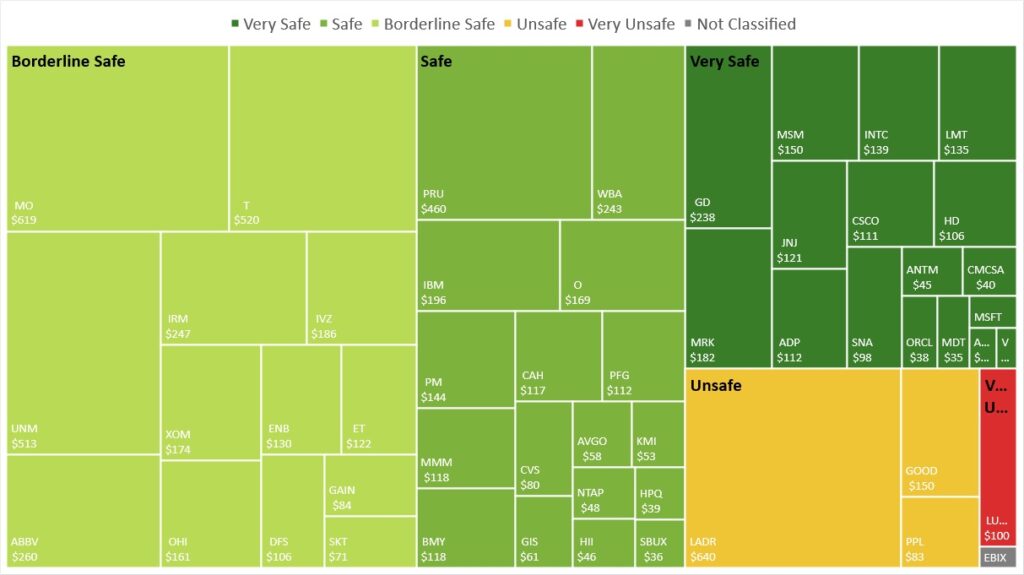

In my portfolio 47% is in the Safe and Very Safe category which has very little risk of being cut. Another 41% is Borderline Safe. The remaining 12% are Unsafe or Very Unsafe. I need to monitor especially the unsafe positions closely.

In March there has been a significant shift from Safe (-5.1%) to Borderline Safe (+5.9%). This is basically linked to the above mentioned downgrading of AT&T of which I added more shares to my portfolio.

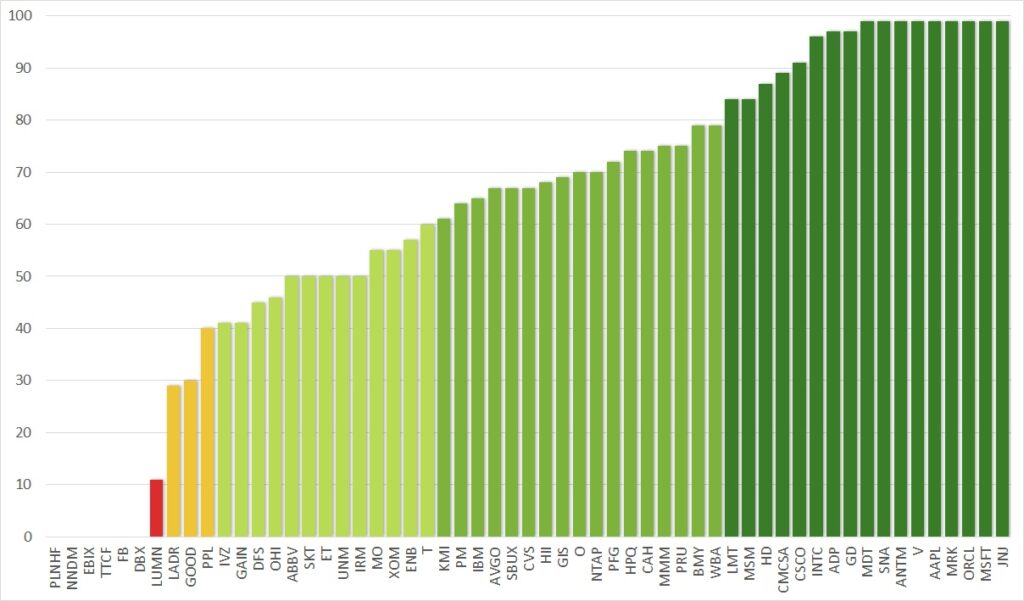

For each individual stock in my portfolio the current score is as follows:

I hold now 17 companies in the highest category of Very Safe, of which 9 actually have the highest score of 99, and another 17 companies is the second highest category Safe. Overall, my portfolio contains many high quality dividend stocks with a safe dividend score.

On the other end we see the red alarming light with LUMN (formerly CTL). Luckily this is only a small position and I have also a sold option which boosts the return. I am not concerned about this one.

LADR as it is my largest position for dividend income and as such gives me the most exposure to a potential dividend cut. GOOD and PPL are also smaller positions and do not require any further attention. I will have to monitor closely if there are any negative signs.

When combining the dividend safety score with the income the picture looks as follows:

You can see that the largest group remains the Borderline Safe category, closely followed by the Safe one. However, the Very Safe category has become a sizable portion of my portfolio. I am very happy with this and expect this one to grow over time.

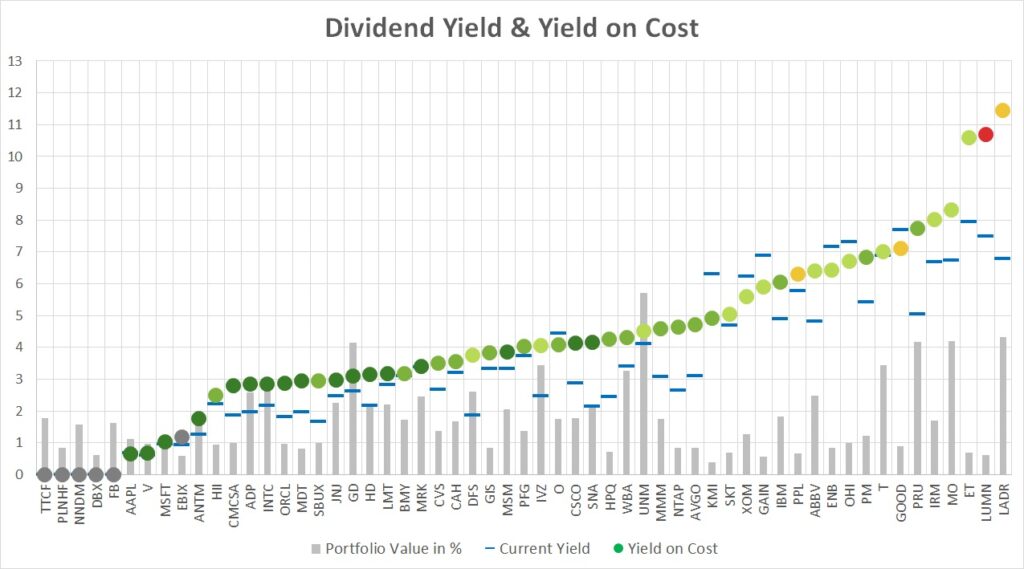

Another way of looking at the dividend safety is by yield and score. For each of my holdings I compare these values to visualize the figures which clearly lets you draw some general conclusions.

The dots represent my yield-on-cost with the color of the dividend safety score. The blue lines indicate the current yield of these stocks. The grey dots represent companies that either do not pay a dividend or are not covered by SSD. The light grey bars represent the percentage of the stock value in my portfolio.

There is a clear correlation between yield and safety score. On the left hand side (apart from the grey dots) we have the low yield, high safety score companies. The further we go to the right, the lower the dividend safety score becomes but it typically comes with a higher yield.

If the blue line (current yield) is below the dot (yield on cost) it means that either the stock has appreciated in price or the dividend was raised or both. Companies recovered quite nicely after the lows in March 2020 and most of my stocks have a lower current yield than my yield on cost.

On the right hand side you can also see the extreme values that stocks can take on. ET and LADR have still a yield on cost of above 10%, even after the dividend cuts. However, one of my goals going forward is not to chase the yield as we can so clearly see that it comes with a lot of risk.

Projected Annual Dividend Income (PADI)

My Projected Annual Dividend Income (PADI) increased to $7,877 in March compared to $7,489 at the end of February. This is a rise of $388 or 5.2%.

In large the increase was fueled by newly deployed money with $360 and further $28 by dividend raises.

My journey continues to invest in high quality dividend growth stocks. However, the stock market shows less and less opportunities. I maintain myself firm to invest in undervalued stocks and this month these include BMY, CAH, MRK, OHI and T – clearly the pharma sector is my focus right now.

At the same time, I try to boost my returns by selling options. I also give a monthly Options update. Check out my latest one here.

For my target of $8,600 for this year I am very well on the way of reaching it early. It only took me three months to go from $7,092 to $7,877 which is an increase of $785 in total or $262 per month. In order to hit my target I planned for $126 per month on average. This means this year I am racing at twice the pace originally planned.

Portfolio Dividend Yield

The current yield of the shares in my portfolio is 3.60%, an increase of 0.09 compared to last month. A result of my investment into T counteracting another strong month in the stock markets pushing my portfolio value to new record highs.

The investment yield for my dividend growth portfolio is 4.47%, an increase of 0.01 compared to February. For this yield I compare the current dividend income with the purchase price of the underlying shares.

My yield on cost (YoC) is higher this month at 5.03%, up 0.10%, because of further dividend raises and new option income.

Conclusion

The dividend income for March was $686.58 from 24 different companies, a 125% increase compared to March last year. My PADI stands at $7,877 which marks again a new record.

The dividend safety score of my portfolio is 62.8, unchanged over February and still significantly below my set target of 70 for the end of the year 2021. My analysis has shown that 47% of my dividend income is categorized as safe, but there are still a few stocks with a high risk of being cut.

If you find the information provided helpful and inspiring please consider subscribing to my email list and you will never miss another update. I am also happy to receive comments either on the stocks I hold or other views you want to express. Thank you for having taken the time to read this post.

Disclosure: At time of writing long on all above mentioned

Disclaimer: I am not a professional investment or financial advisor. The information presented on this site represents my personal dividend growth journey and it is for informational purposes only. Opinions expressed are my own and should NOT be relied on or taken as investing advice. I have no knowledge about your personal situation and before you make any investment decision you should exercise due diligence and must do your own research. Always consider seeking advice from a professional financial and tax advisor.