The market’s big move on Wednesday, 6th of January, for Discovery Financial Services (Ticker: DFS) was just the push the stock needed to hit my first home run!

I designate stocks whose total returns exceed my initial capital outlay, home runs. For dividend growth stocks, total returns include both unrealized gains and dividends received.

Home Run #1

My first ever home run stock is Discovery Financial Services (Ticker: DFS).

On Wednesday, 6th of January, the market opened already at $92.50, enough to surpass the threshold of $92.37 to become my home run in my portfolio. However, I only consider closing price data for home run verification. And as it happens the markets closed at $95.46 for the day.

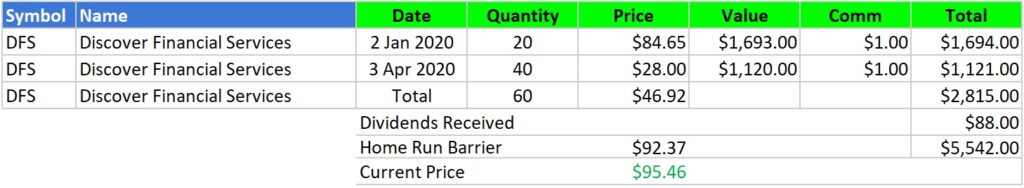

My average cost basis for DFS is $46.92 and I’ve received dividend income totaling $88.00 since first buying the stock in January 2020.

Here is a table showing the buy dates, number of shares, the average cost basis of my DFS shares and with dividends taken into account the home run barrier:

Here is a price chart of DFS indicating my buys and current price level:

Home Run Contenders

There is currently no stock close to approaching home run status. The next best in line is: Starbucks (SBUX) with a total return of 74%.

DGJ’s Home Runs

Here is a list of DGJ’s home runs with updated total returns (and annualized total returns if held longer that one year):

Home run #1: Discovery Financial Services (DFS) — up 103%

Once a position reaches home run status, it retains that status even if the stock price drops and the total returns dip below the 100% mark. Also, if I buy additional shares of a home run stock at a higher cost basis, the calculated total returns could also drop below 100%.

Concluding Remarks

With total returns exceeding my initial investment, DFS is the first home run stock in my Dividend Growth Journey portfolio. I’m looking forward to seeing which stock becomes my 2nd home run!