We are at the half-year point and June has been a good month. The dividends come rolling in. The purpose of my dividend growth portfolio is to generate enough and truly passive income to be financially independent.

I love these monthly reviews. The constant flow of income combined with a little bit of tracking makes you stay on top of the game.

With dividend growth investing you are not concerned with the latest hot stock and what the markets are doing. No need to deal with buy or sell decisions on a constant basis. The typical stock that goes into my dividend growth portfolio will stay there for a long time, if not forever. It’s all about building a solid portfolio with high quality dividend stocks.

And not only that, I specifically look for dividend stocks that are undervalued. Price is what you pay, value is what you get. If you focus on these undervalued stocks you build in a margin of safety. I always have a shortlist of companies that meet all my quality stock criteria and are at least 10% undervalued.

Dividend Income June

Last month I received dividends from 21 different companies. This is a new record. I currently strive but diversify more and also get more exposure to sectors that are somewhat under-weighted in my dividend growth portfolio.

During the month of June I received $432.57 in dividends from 21 different companies:

- Broadcom (AVGO) – income of $13.00

- CenturyLink (CTL) – income of $25.00

- Discovery Financial Services (DFS) – income of $26.40

- Enbridge (ENB) – income of $29.76

- Gladstone Investment Corp (GAIN) – income of $16.00, including the $9.00 extraordinary dividend

- Gladstone Commercial Corp (GOOD) – income of $12.52

- Home Depot (HD) – income of $24.00

- International Business Machines (IBM) – income of $16.30

- Intel (INTC) – income of $8.25

- Invesco (IVZ) – income of $46.50, after the 50% dividend cut

- Johnson & Johnson (JNJ) – income of $10.10

- Lockheed Martin (LMT) – income of $9.60

- 3M (MMM) – income of $29.40

- NVIDIA (NVDA) – income of $0.48

- Realty (O) – income of $13.98

- Principal Financial Group (PFG) – income of $28.00

- Prudential (PRU) – income of $44.00

- Snap-on (SNA) – income of $10.80

- Visa (V) – income of $2.10

- Walgreens Boots Alliance (WBA) – income of $22.88

- Exxon (XOM) – income of $43.50

A solid month surpassing the $400 mark. First time contributors to my dividend income are Intel (INTL), Johnson & Johnson (JNJ), Lockheed Martin (LMT), Snap-On (SNA) and Visa (V). This is my new way of looking to diversify into more high quality stock in my dividend growth portfolio. Most of these I picked up at the lower prices in the crash in March.

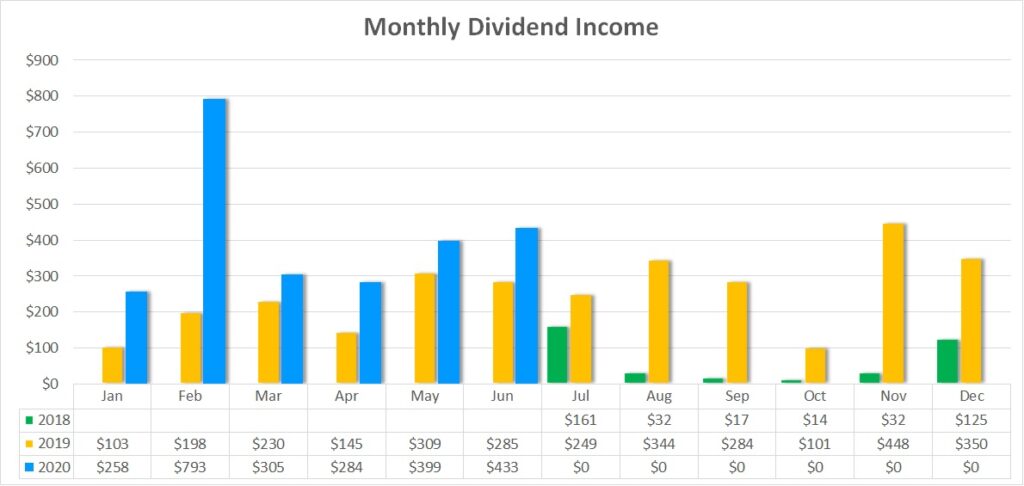

The following chart shows my monthly dividend income over time. In June 2020 I received $432.57 compared to June 2019 with $285.30 of income. This is a staggering increase of $147.27 or 52%. On a year-to-date basis, from January to June I increased my dividend income from $1,269.95 in 2019 to $2,470.70 in 2020, an increase of $1,200.75 or 95%. This means at half time for this year I still almost doubled my dividend income over the previous year! Wow.

Dividend Changes

In June the following stocks in my portfolio announced dividend changes around their dividend policy:

Realty Income (O) – increase from $0.2330 to $0.2335 (0.2%) – I hold 60 shares so that my PADI increases by $0.36

That’s it. No further increases. The good thing is there have also been no further dividend cut on any of the holdings in my dividend growth portfolio. As a result of this change, my PADI decreases by $0.36. At a yield of 3.0%, to recover this dividend income I would have to deploy $12.00.

I like to see dividend increases above 7%, and the criteria has not been met.

Expected Dividend Increases for July

The following companies in my dividend growth portfolio have raised their dividend last year:

Discovery Financial Services (DFS) – no raise expected, they already announced their plans to continue its $0.44/share dividend in Q3

MSC Industrial Direct (MSM) – no raise expected, they already announced their plans to continue its $0.44/share dividend in Q3

Unum Group (UNM) – last year they raised the dividend by 9.6%, I am afraid it is not going to be such an increase if one is announced at all

Projected Annual Dividend Income (PADI)

Even though I had the plan to invest only about 50% of my fresh contributions, I open new positions and increased existing ones which led to a significant increase of my PADI. It has grown to $5,659 at the end of June, up from $4,825 in May. This is a rise of $834 or 17.3%.

Again, I saw some great opportunities in undervalued stocks and could not resist. True, I am not reducing my margin exposure in a way that I had anticipated. At the same time, with extremely low interest rates and great returns from some of the companies in my dividend growth portfolio, I prefer getting in now and paying it off later.

Last year in June my PADI stood at $3,171. That’s a fantastic increase of $2,488 or 78% year over year. I couldn’t be prouder of myself. Sure, I am taking some additional risk in building this growth on debt and the percentage increase unfortunately will drop soon as I need to reduce the risk in my dividend growth portfolio with future contributions, not being able to buy much more stock.

My plan is to use 50% of my contribution to just refund my portfolio, the other 50% to continue to invest in high quality dividend stock which I deem undervalued. I went over the 50% on the investing side again in June so for the second half of the year I will have to be stricter on pumping in cash to reduce margin exposure.

The investment yield for my dividend growth portfolio is 5.3%. For this I compare the current dividend income with the purchase price of the underlying shares. My yield on cost (YoC) is lower at 4.8% because of losses taken from options which also required additional funding without adding new dividend income. The current yield of the shares in my portfolio is 5.6% and, therefore, higher than my investment yield. This is due to some of my positions still with a significant, but unrealized loss.

Conclusion

The dividend income for June was $432.57 from 21 different companies. Five companies paid me dividends for the first time – my diversification into high quality dividend growth stock continues. There was only one dividend increase from Realty Income (O) and no further dividend cuts. My PADI stands at $5,659 which marks both a new record and having hit my target for this year of $5,000 already at the half-point.

Disclosure: At time of writing long on all above mentioned

Disclaimer: I am not a professional investment or financial advisor. The information presented on this site represents my personal dividend growth journey and it is for informational purposes only. Opinions expressed are my own and should NOT be relied on or taken as investing advice. I have no knowledge about your personal situation and before you make any investment decision you should exercise due diligence and must do your own research. Always consider seeking advice from a professional financial and tax advisor.

Congrats on a solid month. I’m starting over with dividend investing, so I have a long way to go.