Another month has gone by and the dividends come rolling in. What a great feeling. Dividend income is truly passive income. That is what I love about dividend growth investing. You harvest your gains bit by bit one at a time and just reinvest. The constant flow of income combined with a little bit of tracking makes you stay on top of the game.

With dividend growth investing you are not concerned with the latest hot stock and what the markets are doing. No need to deal with buy or sell decisions on typical market myths like “Sell in May and go away!”. It’s all about building a solid portfolio with high quality dividend stocks.

With high quality I mean that the business model is sound, the management has proven to adapt to market changes, the financial position is strong and the cash flow generation is intact. If you purchase them below fair value you add an additional margin of safety for your returns.

I typically look for companies that are highly ranked on their financial and the credit rating is good. The dividend yield should be 3% or higher. If it is below than the dividend growth rate should be higher than 10% to compensate. I consider the payout ratio critical to ensure the dividends and their growth are somewhat safe and look at both earnings and free cash flow. Last but not least, I always have a shortlist of companies that meet these criteria and are at least 10% undervalued.

The CCC list is always a good starting point and it’s for free. Ferdi from DivGro has come up with a Dividend Radar which is shared for free on a weekly basis. Amongst the dividend growth community there are many who also share their portfolio details (like I do). There, is so much reference material from other bloggers (check out my short but true value blogroll).

Dividend Income May

Last month I received dividends from new additions to my portfolio, mostly in the Tech sector. This month we are back to my classic portfolio stocks.

During the month of May I received $398.60 in dividends from 13 different companies:

- AbbVie (ABBV) – income of $59.00

- Energy Transfer (ET) – income of $61.00

- Gladstone Investment Corp (GAIN) – income of $7.00

- General Dynamics (GD) – income of $22.00

- General Mills (GIS) – income of $14.70

- Gladstone Commercial Corp (GOOD) – income of $12.52

- Kinder Morgan (KMI) – income of $13.13

- Realty (O) – income of $11.65

- Omega Health Care (OHI) – income of $20.10

- Starbucks (SBUX) – income of $8.20

- Tanger Factory Outlet Centers (SKT) – income of $35.75

- AT&T (T) – income of $33.80

- Unum Group (UNM) – income of $99.75

A solid month just shy of $400. First time contributor to my dividend income is only Starbucks (SBUX). I opened a starting position of 20 shares at $61.03 but now I consider them already slightly overvalued at $78. Then again, they have a strong business model and I may add some shares in the future.

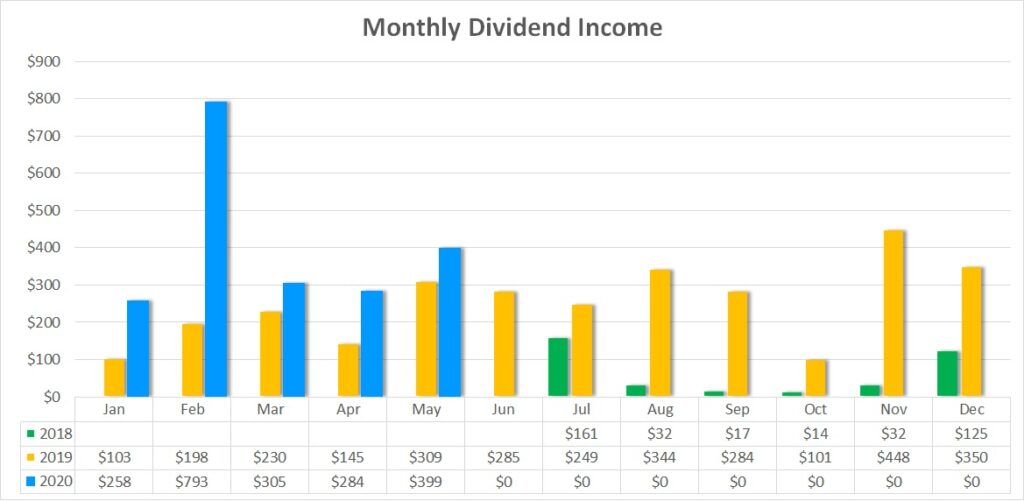

The following chart shows my monthly dividend income over time. In May 2020 I received $398.60 compared to May 2019 with $309.24 of income. This is an increase of $89.36 or 29%. On a year-to-date basis, from January to May I increase my dividend income from $984.65 in 2019 to $2,038.14 in 2020, an increase of $1,053.49 or 107%. This means until now this year more than double from the previous year! Wow.

Dividend Changes

In May the following stocks in my portfolio announced dividend changes around their dividend policy:

Ladder Capital (LADR) – decrease from $0.34 to $0.20 (-41.2%) – I hold 400 shares so that my PADI decreases by $256.00.

This is a huge cut but at the same time, as I mentioned in my last April Dividend Income report, I took a speculative move on Ladder based on its valuation, not for the dividends. When buying LADR my yield-on-cost would have been almost 38%, now with the cut it is still a breathtaking 22%. On top, the stock is more than 100% up on my initial investment.

Medtronic (MDT) – increase from $0.54 to $0.58 (7.4%) – I hold 15 shares so that my PADI increases by $2.40

Tanger Factory Outlet Centers (SKT) – decrease from $0.3575 to $0.00 (-100.0%) – Tanger declared a suspension of its dividend which may lead to being reinstalled at some point in the future, but the question is when and at what amount. For the moment I take it as a full elimination. I hold 100 shares so that my PADI decreases by $143.00. I consider selling the stock, not directly but by selling a call option. If it goes over the strike price and is exercised than I still get to keep the option premium. If not, I just continue to sell another option and try to compensate for the dividend income loss.

As a result of this change, my PADI decreases by $396.60. At a yield of 3.0%, to recover this dividend income I would have to deploy $13,220.

Another month with a heavy impact from dividend cuts. This comes to show that building your dividend growth portfolio around high quality stocks is essential. True, in times of a recession or impactful events like the Covid pandemic there may be some cuts, but it will be limited.

I like to see dividend increases above 7%, and the criteria has been met by Medtronic (MDT). However, the dividend cuts just wipe that off the table and thinking about keeping up with inflation in not in scope.

Expected Dividend Increases for June

There is not a single company in my portfolio which last year raised the dividend in June. So, unfortunately, I don’t expect any positive news.

Projected Annual Dividend Income (PADI)

Despite of the cuts my new PADI is has grown up to $4,825 at the end of May, up from $4,567 in March. This is a rise of $401 or 8.8%. The main reason is that I added some shares with the market drop in May. Hopefully I will get around to give you a proper portfolio update this month, including the options impact.

Last year in April my PADI stood at $2,871. That’s a fantastic increase of $1,954 or 68% year over year. This percentage increase unfortunately will drop soon as some great opportunities have passed, and I need to reduce the risk in my portfolio with future contributions, not being able to buy much more stock.

My plan is to use 50% of my contribution to just refund my portfolio, the other 50% to continue to invest in high quality dividend stock which I deem undervalued. I went over the 50% on the investing side in May so June will have to be more just pumping in cash to reduce margin exposure.

The investment yield for my dividend growth portfolio is 5.1%. For this I compare the current dividend income with the purchase price of the underlying shares. My yield on cost (YoC) is lower at 4.5% because of losses taken from options which also required additional funding without adding new dividend income. The current yield of the shares in my portfolio is 5.3% and, therefore, higher than my investment yield. This is due to the significant drop in the markets and some of my positions still with a significant, but unrealized loss.

Conclusion

The dividend income for May was $398.60 from 13 companies. There were two impactful dividend cuts this month resting $399 of income and only one dividend increase, though a good percentage value, adding only $2.40. New additions to my portfolio have offset the dividend cuts and allowed me to raise my PADI again. My PADI stands at $4,825 and it looks like I am still on track for the target set at $5,000 for this year.

Disclosure: At time of writing long on all above mentioned stocks

Disclaimer: I am not a professional investment or financial advisor. The information presented on this site represents my personal dividend growth journey and it is for informational purposes only. Opinions expressed are my own and should NOT be relied on or taken as investing advice. I have no knowledge about your personal situation and before you make any investment decision you should exercise due diligence and must do your own research. Always consider seeking advice from a professional financial and tax advisor.