March is over and it’s time to review my dividend income. It has been a crazy month for me. Unfortunately, my exposure with options hit me hard and I had to take significant losses to close positions. At the same time, the dividend stream is still intact, even though slightly reduced. So let’s look first at the dividends for March.

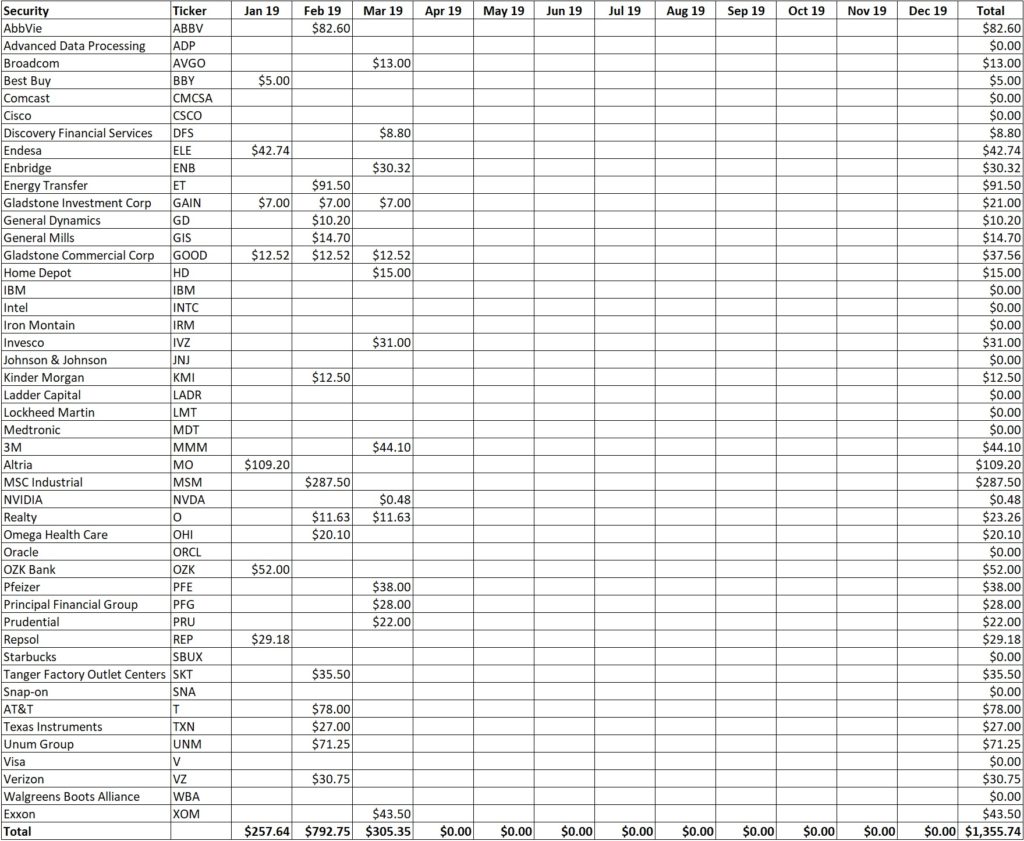

During the month of March I received $305.35 in dividends from 14 different companies:

Broadcom (AVGO) – income of $13.00

Discovery Financial Services (DFS) – income of $8.80

Enbridge (ENB) – income of $30.32

Gladstone Commercial Corp (GOOD) – income of $12.52

Gladstone Investment Corp (GAIN) – income of $7.00

Home Depot (HD) – income of $15.00

Invesco (IVZ) – income of $31.00

3M (MMM) – income of $44.10

Nvidia (NVDA) – income of $0.48

Realty (O) – income of $11.63

Pfeizer (PFE) – income of $38.00

Principal Financial Group (PFG) – income of $28.00

Prudential (PRU) – income of $22.00

Exxon (XOM) – income of $43.50

I received income from several new companies in my portfolio which started to pay me dividends for the first time: Broadcom (AVGO), Invesco (IVZ), Nvidia (NVDA) and Exxon (XOM).

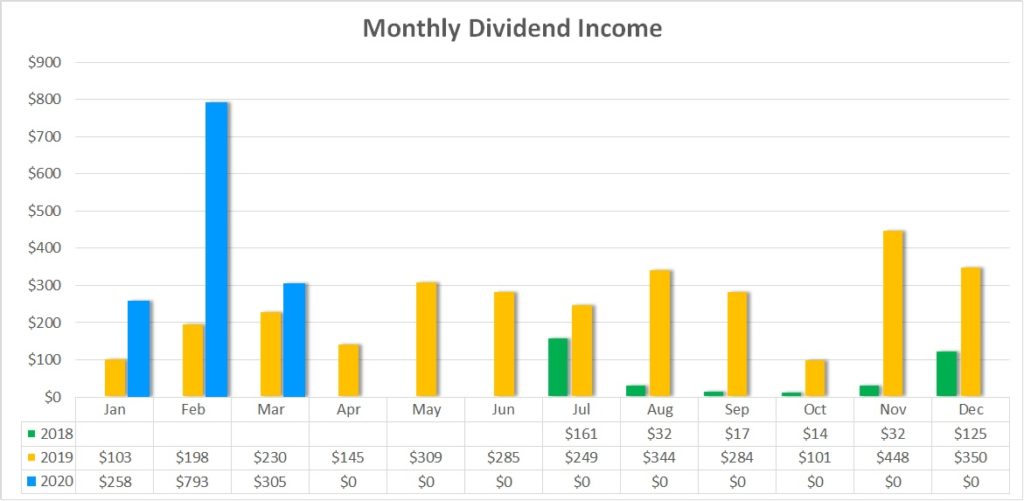

The following chart shows my monthly dividend income over time. In March 2020 I received $305.35 compared to March 2019 with $229.65. This is an increase of $75.70 or 33%. I am happy with the progress!

Dividend Increases

In March the following stocks in my portfolio announced dividend increases:

General Dynamics (GD) – increase from $1.02 to $1.10 (7.8%) – I hold 20 shares so that my PADI increases by $6.40

Realty Income (O) – increase from $0.2325 to $0.2330 (0.2%) – I hold 50 shares so that my PADI increases by $0.30, however this is Realty Income’s second increase for the year 2020

These are the only companies in my portfolio which still have increased its dividend. One of the reasons I added GD was the track record on dividend increases combined with a low payout ratio. As a result of this change, my PADI increases by $6.70 for as long as I keep holding these shares. At a yield of 3.0% this would have required me to deploy $223, but I did not invest any new money for this. That is dividend investing at its finest.

I like to see dividend increases above 7%, and the criteria has been met by GD. The weighted average of this month’s dividend increases is also 7.6%, which easily beats inflation!

Oracle (ORCL) last year raised their dividend by 26.3% in March, this year so far, no increase and it looks like it might not happen anymore. Gladstone Investment Corp (GAIN) has so far confirmed to maintain their dividend for the next 3 months.

Expected Dividend Increases for April

There are several companies in my portfolio which last year raised their dividend in April and I hope to see these again this year. However, with the Covid-19 impact not yet fully visible for everyone, there will be big question marks around each and every company.

I would like to see raised by:

- International Business Machines (IBM) – likely to happen

- Invesco (IVZ) – unlikely

- Johnson & Johnson – likely to happen

- Kinder Morgan (KMI) – very unlikely

- Exxon (XOM) – very unlikely

MARGIN CALL

As mentioned in the introduction of this article I had to take some heavy losses to close options that I sold. I’ve been hit, actually, I’ve been hit very hard. I started this blog to document my journey to Financial Independence with Dividend Growth Investing. I want to stay true to the real journey and not only write about my successes, but also show my mistakes and errors. I am still at the very beginning and it seems like I need to make many known mistakes by myself to fully grasp the impact. So, what happened was …

I had taken on a lot of risk in selling put options without fully looking at the amount of risk I was taking. In hindsight, it seems so obvious but when things go well the risk is easily forgotten. In February, my portfolio value was about 85-90k$ but the options I sold amounted to an absolute amount of the underlying value of $264,250 (I had not disclosed any of my options trades as I had not come around to set it up properly). This is roughly three times my total portfolio value. Meaning if the markets crashed by 30% my whole portfolio would be wiped out. And you all know what happened February 24th, the markets really went under putting almost all my positions immediately into a heavy loss.

But not only that, the options require a collateral which in my case were the stocks I hold in my portfolio. With their value going down, too, my margin kept shrinking and shrinking until I had no liquidity. Even the positions that had still a wide gap on the actual strike price I had chosen, the value of the options went up almost 1-to-1 as the price of the stock went down. I closed a few positions to reduce the exposure and collateral to be put against, but it was not enough when the markets took another deep dive in the last hours of trading. And the next step is a MARGIN CALL.

Long story short, many of my stock positions were sold by my broker to have enough liquidity to respond to the margin requirements for the options I still held. At some point I had to draw the line and close all positions that I was not able to cover with cash and were not willing to take the shares if exercised. I will go into full depth with another article (I haven’t come around to analyze all my trades yet), but obviously this affected my projected dividend income.

Projected Annual Dividend Income (PADI)

My new PADI stands at $4,089 at the end of March, down from $4,538 in February. This is a drop of -$449 or -9.9%. This is not as I wanted to start the year, but we are just finished Q1 and there is still time in the year to recover. Last March my PADI stood at $2,733. That’s still an increase of $1,356 or 49% year over year. Nothing to complain about here, but a drop from previous month.

The investment yield for my dividend growth portfolio is 5.0%. For this I compare the current dividend income with the purchase price of the underlying shares. My yield on cost (YoC) is higher at 5.4% because of dividend increases and options income which is in turn deployed in new dividend paying stocks. The current yield of the shares in my portfolio is 6.5% and, therefore, higher than my investment yield. This is due to the significant drop in the markets we have experienced in last few weeks of the crash.

Conclusion

I had deployed all my remaining funds in February and was short on cash to attend some of the option obligations which led to the sale of some of my dividend stocks. The dividend income for March was $305.35 well spread out from 14 compnaies. My PADI stands at $4,089 and took a dip which I need to recover during 2020.

Disclosure: At time of writing long on all above mentioned

Disclaimer: I am not a professional investment or financial advisor. The information presented on this site represents my personal dividend growth journey and it is for informational purposes only. Opinions expressed are my own and should NOT be relied on or taken as investing advice. I have no knowledge about your personal situation and before you make any investment decision you should exercise due diligence and must do your own research. Always consider seeking advice from a professional financial and tax advisor.

DGJ –

Very anxious about IBM…

-Lanny

There should be no surprises here – Bloomberg expects an increase to 1.69$ for the quarterly dividend. We’ll find out next week …

DGJ

Congrats on a solid month. Very happy to see JNJ increase their dividend payout.

Hi Tawcan, thanks for the comment. Obviously you’re far ahead in your journey. it’s good to have some reassurance that quality pays off in these days. This is one of the reasons I took this crisis and the drop in the market to shift my portfolio in high quality dividend growth stocks.