February is over and it’s time to review my dividend income. It has been a very busy month for me. Dividend Growth Investing has its strong point in situations as we experience them right now in the markets. Unless dividends are being cut, the passive income will flow into your pockets no matter what the stock prices do.

During the month of February I received $792.75 in dividends from 15 different companies:

- AbbVie (ABBV) – income of $82.60

- AT&T (T) – income of $78.00

- Energy Transfer (ET) – income of $91.50

- General Dynamics (GD) – income of $10.20

- General Mills (GIS) – income of $14.70

- Gladstone Commercial Corp (GOOD) – income of $12.52

- Gladstone Investment Corp (GAIN) – income of $7.00

- Kinder Morgan (KMI) – income of $12.50

- MSC Industrial (MSM) – income of $287.50, including bonus dividend of $250.00 ($5.00 per share)

- Omega Health Care (OHI) – income of $20.10

- Realty (O) – income of $11.63

- Tanger Factory Outlet Centers (SKT) – income of $35.50

- Texas Instruments (TXN) – income of $27.00

- Unum Group (UNM) – income of $71.25

- Verizon (VZ) – income of $30.75

As you can see I received a bonus dividend of $250.00 from MSC Industrial (MSM) which I did not expect at all. I added MSC Industrial to my portfolio last year after the juicy 19% dividend increase in July. And now on top I benefit from this rather large bonus dividend. Great!

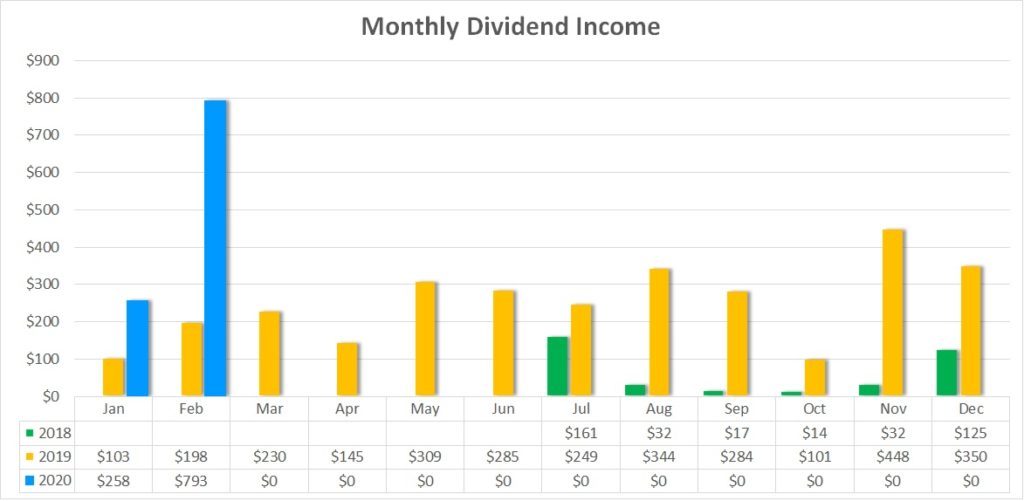

The following chart shows my monthly dividend income over time. In February 2020 I received $792.75 compared to February 2019 with $198.28. This is an increase of $594.47 or 300%. Incredible! The February bar jumps almost out of the chart. And even without the bonus dividend from MSC Industrial the increase would have been $344.47 or 174%. This would have been a magnificent increase, too.

Dividend Increases

In February the following stocks in my portfolio announced dividend increases:

- 3M (MMM) – increase from $1.44 to $1.47 (2.1%) – I hold 30 shares so that my PADI increases by $3.60

- Home Depot (HD) – increase from $1.36 to $1.50 (10.3%) – I hold 10 shares so that my PADI increase by $5.60

- Prudential (PRU) – increase from $1.00 to $1.10 (10.0%) – I hold 20 shares so that my PADI increase by $8.00

As a result of these changes, my PADI increases by $17.20 for as long as I keep holding these shares. At a yield of 3.0% this would have required me to deploy $573, but I did not invest any new money for this. That is dividend investing at its finest.

I like to see dividend increases above 7%, and two out of three of these increases top my expectations. The weighted average of this month’s dividend increases is 7.1%, which easily beats inflation!

Projected Annual Dividend Income (PADI)

My new PADI stands at $4,538 at the end of February. I deployed all my remaining funds which explains the increase over last month’s $3,285. It looks like we are back on track. Last February my PADI stood at $2,618. That’s an increase of 73% year over year. Nothing to complain about here.

The investment yield for my dividend growth portfolio is 5.1%. For this I compare the current dividend income with the purchase price of the underlying shares. My yield on cost (YoC) is higher at 5.8% because of dividend increases and options income which is in turn deployed in new dividend paying stocks. The current yield of the shares in my portfolio is 5.4% and, therefore, higher than my investment yield. This is due to the significant drop in the markets we have experienced in the last week of February.

Conclusion

February has been a great month with a new record of $792.75 of dividend income. This one will be a hard to beat one in the near future considering the $250 bonus dividend payment from MSM. My PADI stands at $4,538 and is right on track for reaching my annual goal.

Disclosure: At time of writing long on all above mentioned

Disclaimer: I am not a professional investment or financial advisor. The information presented on this site represents my personal dividend growth journey and it is for informational purposes only. Opinions expressed are my own and should NOT be relied on or taken as investing advice. I have no knowledge about your personal situation and before you make any investment decision you should exercise due diligence and must do your own research. Always consider seeking advice from a professional financial and tax advisor.

I mean. Holy freaking cow DGJ. With, or without, that special dividend, you absolutely crushed it! Thanks for the inspiration to continue moving forward and investing as much as possible. I want THOSE kind of dividend growth rates.

Bert

Thanks Bert, February has been amazing and I am putting everything into dividend growth investing since I discovered it as THE strategy to follow. It’s great to get some monthly/quarterly feedback from the companies you invest in.