January is over and it’s time to review my dividend income. I am particularly excited because after completing my first full year of dividend growth investing I am eager to see what my income compare to last year is. So, without further ado lets have a look at the figures.

During the month of January I received $257.64 in dividends from 7 different companies:

- Altria (MO) – income of $109.20

- Best Buy (BBY) – income of $5.00

- Endesa (ELE) – income of $42.74

- Gladstone Commercial Corp (GOOD) – income of $12.52

- Gladstone Investment Corp (GAIN) – income of $7.00

- OZK Bank (OZK) – income of $52.00

- Repsol (REP) – income of $29.18

As you probably know I moved my portfolio from one brokerage firm to another in December and sold all my shares and rebuild from scratch the new dividend growth portfolio. For this reason, some of the companies that I held in the past and should have paid a dividend in January are not on the list.

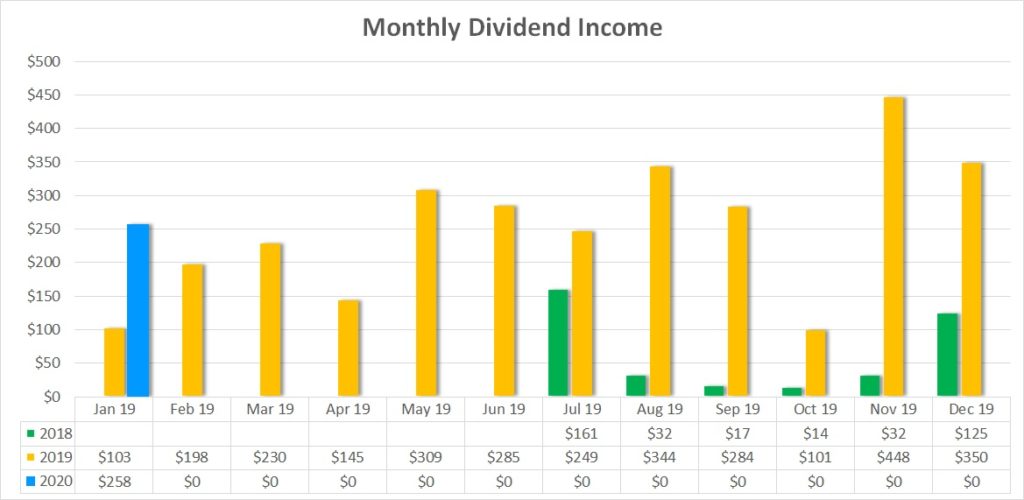

The following chart shows my monthly dividend income over time. In January 2020 I received $257.64 compared to January 2019 with $102.93. This is an increase of $154.71 or 150%. That’s the way I like it.

Dividend Increases

In January the following stock in my portfolio announced dividend increases:

- Gladstone Investment (NASDAQ:GAIN) – increase from $0.068 to $0.07 (2.9%)

- Gladstone Commercial (NASDAQ:GOOD) – increase from $0.1250 to $0.12515 (0.11.8%%)

- Bank OZK (NASDAQ:OZK) – increase from $0.25 to $0.26 (4.0%)

- Principal Financial Group (NASDAQ:PFG) – increase from $0.55 to $0.56 (1.8%)

- Realty Income (NYSE:O) – increase from $0.2275 to $0.2325 (2.2%)

- Tanger Factory Outlet Centers (NYSE:SKT) – increase from $0.355 to 0.3575 (0.7%)

These increases have added $18.28 to my PADI. My projected PADI stands at $3,285 at the end of January. This is significantly lower than my PADI of $4.069 before selling all shares in the old brokerage account. However, there are two reasons for this. The first one is that I have not directly purchased all the stocks again as I held them before and still have some cash available. The second reason is that I want to move to higher quality stocks and many of them have a lower starting yield but better growth projections. The current yield for my dividend growth portfolio is 4.7%.

Conclusion

January has been a good start with a 150% increase of dividend income over January last year. My PADI stands at $3,285 with cash to invest still in my pockets which should help increase this figure in the near future.

Disclosure: At time of writing long on all above mentioned

Disclaimer: I am not a professional investment or financial advisor. The information presented on this site represents my personal dividend growth journey and it is for informational purposes only. Opinions expressed are my own and should NOT be relied on or taken as investing advice. I have no knowledge about your personal situation and before you make any investment decision you should exercise due diligence and must do your own research. Always consider seeking advice from a professional financial and tax advisor.

Wow! That is the biggest increase I have seen around this month! Killer. Way to go!

Yeah, a pretty good result. The main reason is though that I started in 2018 and in December with the big drop in the market really pushed everything to dividend growth investing. The impact was not yet visible in the January to follow. However, this year with all this money deployed the dividend income follows.