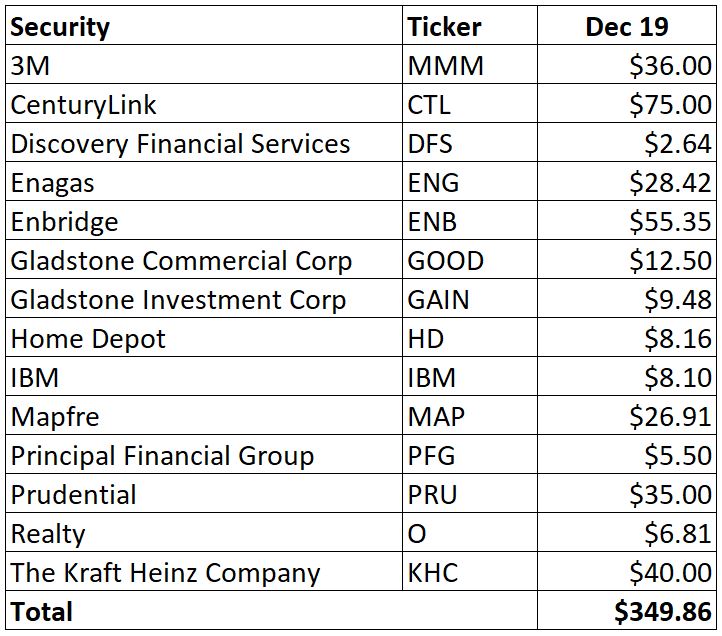

The year has come to an end and my first full year of dividend growth investing is completed. During the month of December I received $349.86 in dividends from 14 different companies. In the table below are the details of which company contributed to my passive income. What a fanstastic result to close the year 2019! I couldn’d be more happy.

This is an increase of 179% compared to last years’ December income with $125.47. I was still in the setup phase of my Dividend Growth Journey last december but boosted my portfolio with fresh capital early on in 2019.

December was my second highest dividend income month just after November. On a quarterly comparison there has also been an increase of 23%. Not bad! In December some of my larger positions paid dividends like CTL and ENB, accompanied by some other great contributors like MMM, PRU and KHC.

I had increased my position in MMM and PRU as well as received an additional pay-out from GAIN. In December I also received dividends from some of my European holdings which pay dividends every 6 months: ENG and MAP.

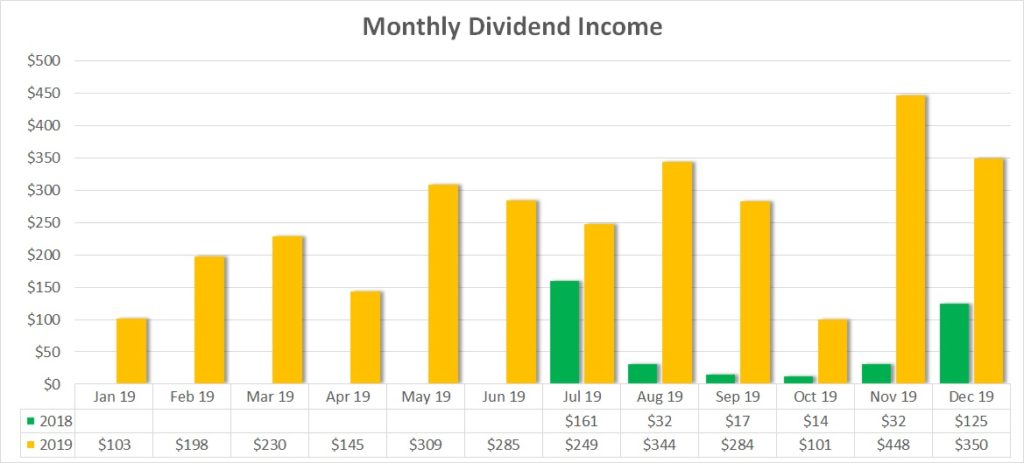

Total Dividend Income for 2019

The year 2019 has been incredible for my Dividend Growth Journey. I seized the opportunity in December 2018 to enter the US stock market and learned more and more about the key elements of dividend growth investing. A few hiccups along the way like dividend cuts and options risks taken early on in my journey will help me set the right parameters and criteria for the future and avoid taking larger losses.

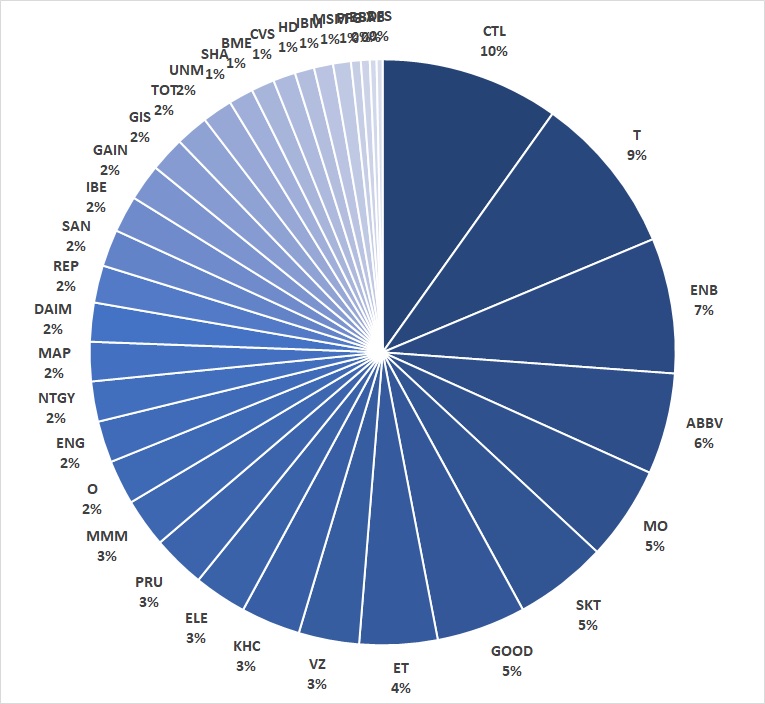

In 2019 I received a total of $3,046 in dividends. I received these dividends from 35 different companies. The top three are CTL with $300 – including the dividend cut (10%), T with $269 (9%) and ENB with $227 (7%).

Conclusion

December has been another great month. I am really looking forward to getting into 2020 with full steam and an ever-growing dividend income. The results of 2019 have really convinced me that this dividend growth strategy is working for me. With fresh money planned for 2020 and all dividends being reinvested to grow the snowball I should see some great result next year.

Disclosure: At time of writing long on all above mentioned

Disclaimer: I am not a professional investment or financial advisor. The information presented on this site represents my personal dividend growth journey and it is for informational purposes only. Opinions expressed are my own and should NOT be relied on or taken as investing advice. I have no knowledge about your personal situation and before you make any investment decision you should exercise due diligence and must do your own research. Always consider seeking advice from a professional financial and tax advisor.