The monthly review of my Dividend Growth portfolio helps me to keep track of my journey to financial independence. Another month with the markets going up, up, and further up. Nevertheless, there are always oportunities to find quality stocks undervalued. As a dividend growth investor the dividend income generation is the key driver, but it makes me happy to have invested in stocks that demonstrate growth, too. Buying undervalued stocks reduced the downside risk of the investment.

The highlight of this month is to have reached the $ 4,000 PADI (Predicted Annual Dividend Income), up from $3,763 last month (+$249 or 6.6%). This is huge. I started just about a year ago to really focus on dividend growth investing and have already a visible impact that keeps me going. I couldn’t be happier. How I made such a jump in one month I explained in this post.

At the end of October, my investment fund has increased to $73,282 up from $66,130. A plus of $7,152 or 10.8% that is. The current dividend Yield on Cost (YoC) of my purchases is 5.70%, down from 5.77% last month. It is hard to find stocks that have an entry level dividend yield of 5.7% or more, so a drop makes sense. Additionally, I boost my returns by selling stock options and I reinvest this money directly into more shares. For this reason, the overall Yield on Cost of my money injected is 6.64%. Check out my portfolio summary on the PORTFOLIO page.

Stock Purchases

During the month of October we have seen a lot of stock increases and finding a suitable investment opportunity was not easy. However, I really pushed the accelerator this month with several purchases. Again, I invested my hard earned capital only into a companies I already own. There are two reasons I add to current positions. On the one hand, I believe that once I decided to invest into a company and the fundamentals have not changed, I will pick up more shares as long as the company remains at or below fair value. On the other hand, I do not want to inflate the number of companies I hold to a number that becomes difficult to track and manage. Diversification is important but at the same time once you hold a significant number of stocks the benefit for a highly diversified portfolio is only marginal.

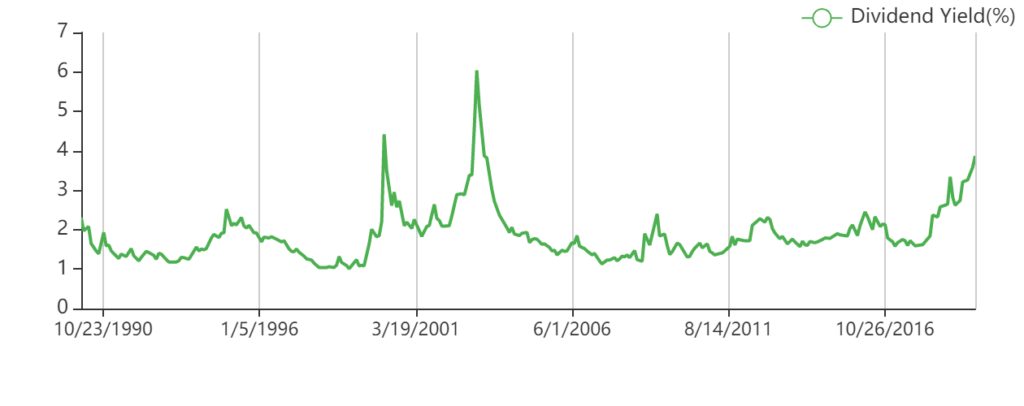

Purchase #1: Unum Group (ticker: UNM)

Number of shares: 70

Average cost: $27.72

Annual dividend: $1.14

Dividend yield: 4.11%

5-year growth rate: 12.25%

EPS Forward: $5.41

P/E: 5.1

Payout Ratio: 21%

Current porfolio value: $3.856 (5.3%)

Current porfolio PADI: $160 (4.0%)

Source: Gurufocus

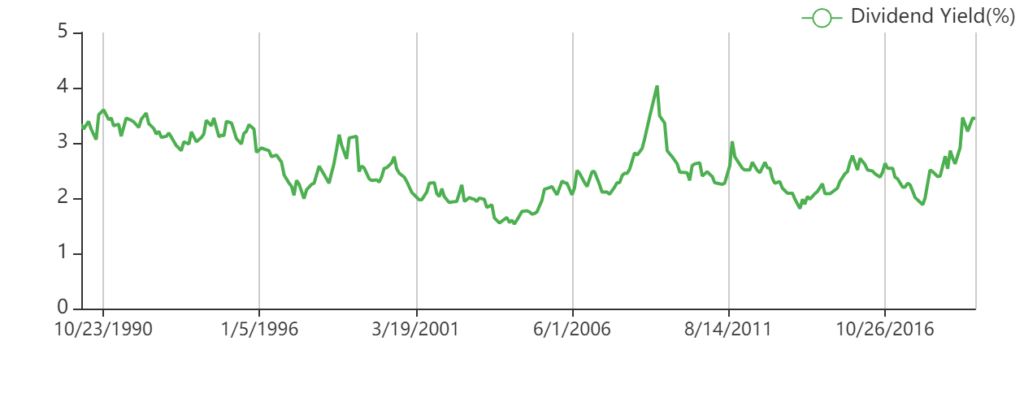

Purchase #2: 3M Company (ticker: MMM)

Number of shares: 9

Average cost: $152.78

Annual dividend: $5.76

Dividend yield: 3.77%

5-year growth rate: 16.45%

EPS Forward: $9.04

P/E: 16.9

Payout Ratio: 63%

Current porfolio value: $4.124 (5.6%)

Current porfolio PADI: $144 (3.6%)

Source: Gurufocus

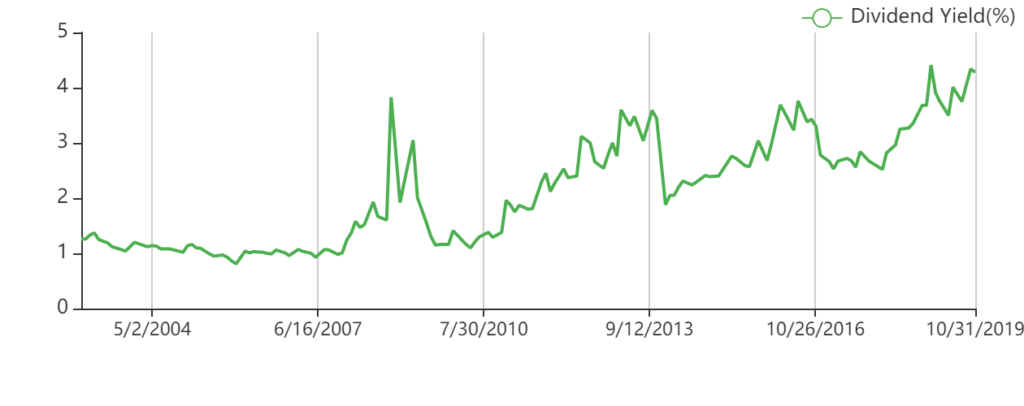

Purchase #3: Energy Transfer LP (ticker: ET)

Number of shares: 50

Average cost: $12.61

Annual dividend: $1.22

Dividend yield: 9.76%

5-year growth rate: 13.35%

EPS Forward: $1.39

P/E: 9.1

Payout Ratio: 88%

Current porfolio value: $2.518 (3.4%)

Current porfolio PADI: $244 (6.1%)

Source: Gurufocus

Purchase #4: Prudential Financial, Inc (ticker: PRU)

Number of shares: 10

Average cost: $91.30

Annual dividend: $4.00

Dividend yield: 4.38%

5-year growth rate: 15.78%

EPS Forward: $11.95

P/E: 7.6

Payout Ratio: 33%

Current porfolio value: $3.189 (4.4%)

Current porfolio PADI: $140 (3.5%)

Source: Gurufocus

There you have it. Four companies topped up for an average yield of 4.79%. This is a great starting yield for companies with low or reasonable dividend payout ratio. I consider anything below 50% as low and below 70% as reasonable. ET for its nature of business tends to have a higher payout ratio but figures over the last 2 years have improved and I feel more comfortable with it.

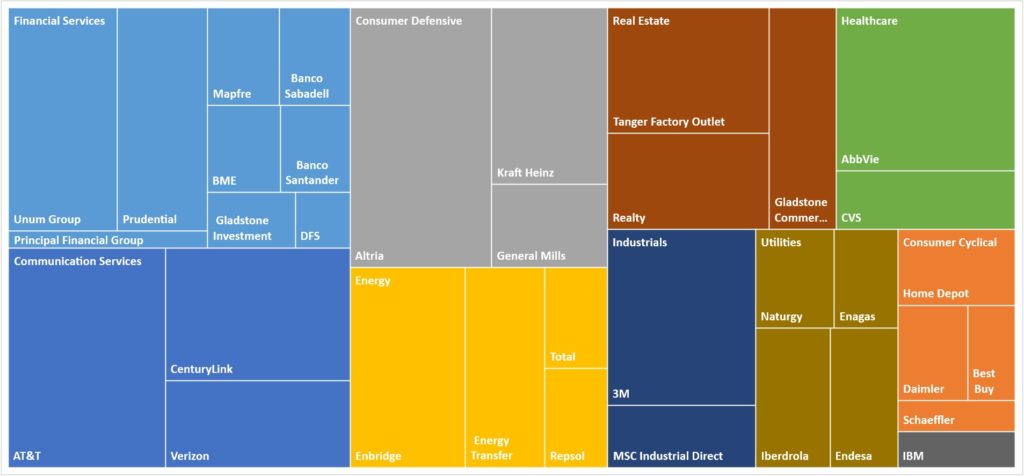

This is the summary of my portfolio sector distribution. Financial Services remains the largest with 18%. The growth of AT&T (ticker: T) keeps Communication Services in close second. ET has grown further in the energy sector. MMM has become my third largest holding in the portfolio.

Conclusion

These 139 shares purchased during October have added a total of $232.64 to my proyected annual dividend income (PADI) which now stands at $4,012. A new milestone hit. Reaching the $70k figure of my portfolio value has also been a new high. As they say, the first 100,000 are the most difficult one. My expectation is that with the fresh money injections and the markets not going sour, I should see hitting the $100k by the end of 2020.

Awarded as TOP-100 Dividend Blogs

Disclosure: At time of writing long ET, MMM, PRU, T, UNM

Disclaimer: I am not a professional investment or financial advisor. The information presented on this site represents my personal dividend growth journey and it is for informational purposes only. Opinions expressed are my own and should NOT be relied on or taken as investing advice. I have no knowledge about your personal situation and before you make any investment decision you should exercise due diligence and must do your own research. Always consider seeking advice from a professional financial and tax advisor.