I have some great news! With my latest purchase I reached the mark of $4,000 projected annual dividend income. This is a fastastic result! I couldn´t be more happy. Just some weeks ago I was looking at my Projected Annual Dividend Income Figure (PADI) and it stood at just above 3,900 dollars. I estimated that maybe by the end of the year I would be possibly able to do it if I injected another $3,000 into stocks with a starting yield of 3%.

And than this: BOOM! 4,000 dollars milestone hit, baby!

How did this all happen? Reaching a PADI of $4,000 by the end of the year seemed a rather streched target, but October has been a very intense month with several purchases. Right on the first day of October I purchased 30 stocks of Unum Group (ticker: UNM) at a cost of $28.50 adding $34.20 to my PADI.

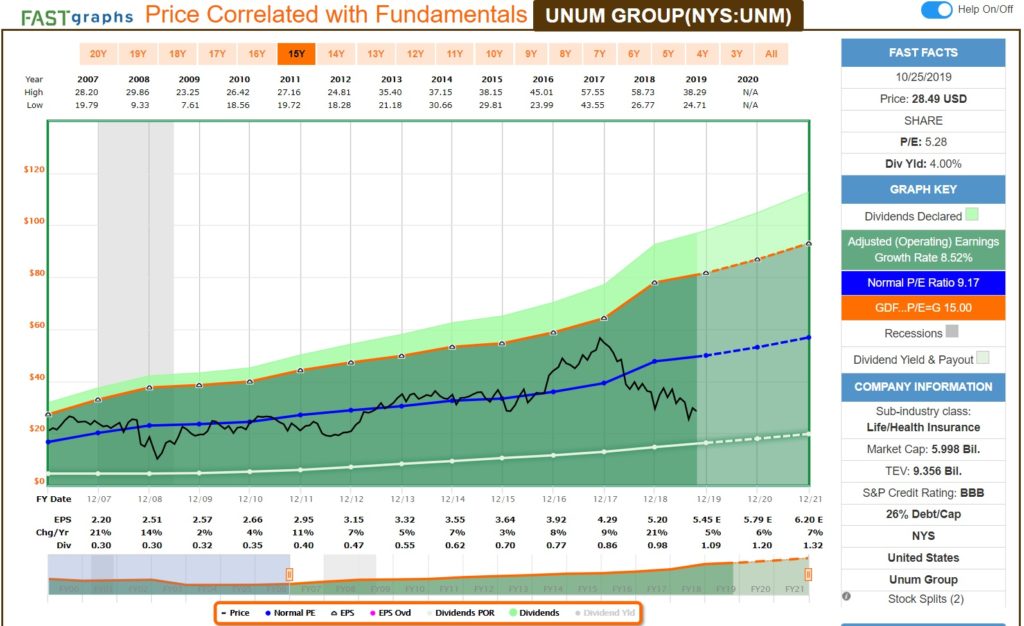

Unum Group is a provider of group and individual income-protection insurance products in the United States and United Kingdom. It is the largest domestic disability insurer, with the majority of premiums generated from employer plans. The company also offers a complementary portfolio of other insurance products, including long-term care insurance, life insurance, and employer- and employee-paid group benefits. As such the revenue stream is relatively predictable.

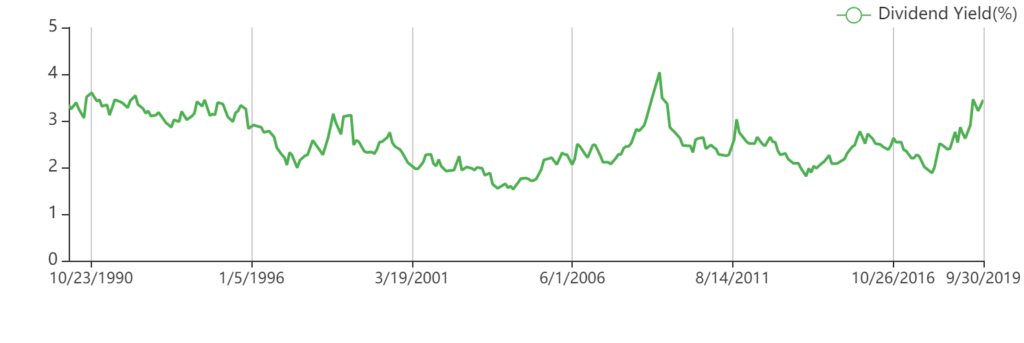

With a forward P/E of just 5.2, a dividend yield of 4.0% and a payout ratio of just 21%, I believe it is a bargain. The dividend was just raised 9.6% in the previous quarter and I expect further growth in this range over the next years. Even though it only has a BBB credit rating, the debt level stands at just 26% of capital. What’s not to love about this boring stock?

The FastGraphs charts indicates to me that the stock is currently significantly undervalued, even though its normal P/E ration is already low at under 10. So, I was happy to add to my existing position.

And than just the next day the stock fell even further and I purchased on October, 2nd another 20 shares at $27.25 and 20 shares at $27.00. This added $45.60 to my PADI. I now hold 140 shares at an average cost of $30.09 and Unum Group has grown to 5.5% of my portfolio. My direct yield on cost (YoC) for Unum Group is 3.79%, a fair starting point for a stock with high single digit dividend growth rates. For now I think this position will not be extended.

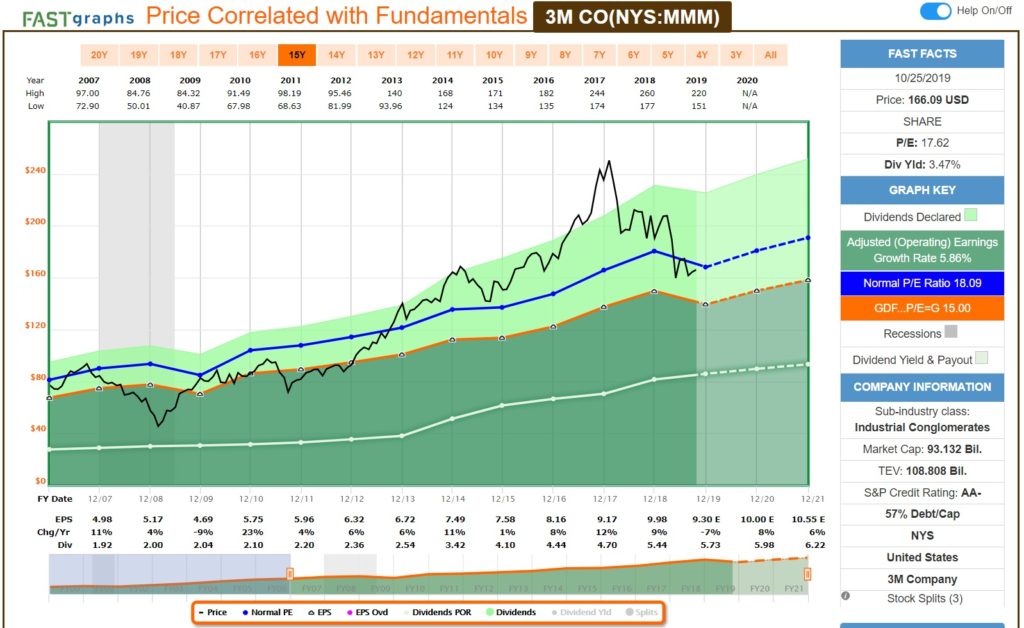

While I was already on a shopping spree, why not add something else. This something was 3M (ticker: MMM). Also on October, 2nd I bought 4 shares at $155.00. There is not really much to say to 3M anymore and at 3.72% dividend yield it is a great entry point. These 4 shares added $23.04 to my PADI.

A also left an order for another 5 shares of MMM with a limit $151.00 standing which was executed on October, 8th. Again, $28.80 added to my PADI. 3M is not the cheapest stock out there. Nevertheless, a P/E of about 16 at this share price in my eyes is very good value for a high quality stock. The payout ratio stands at 61%, an acceptable level. But most importantly, 3M has been paying and raising dividends for 60 years. Yes, they struggle this year but is plenty of room to keep growing in the future. I now hold 25 shares of 3M.

BUY, BUY, BUY

Would you believe it, this week I pulled the trigger again. I reviewed a few of my option positions during mid-October and closed some of those positions early to secure the income. With that I decided to sell new options on currently highly volatile car manufacturer shares Daimler and BMW (tickers DAI and BMW). This additional income gave me the cash to invest in further stocks.

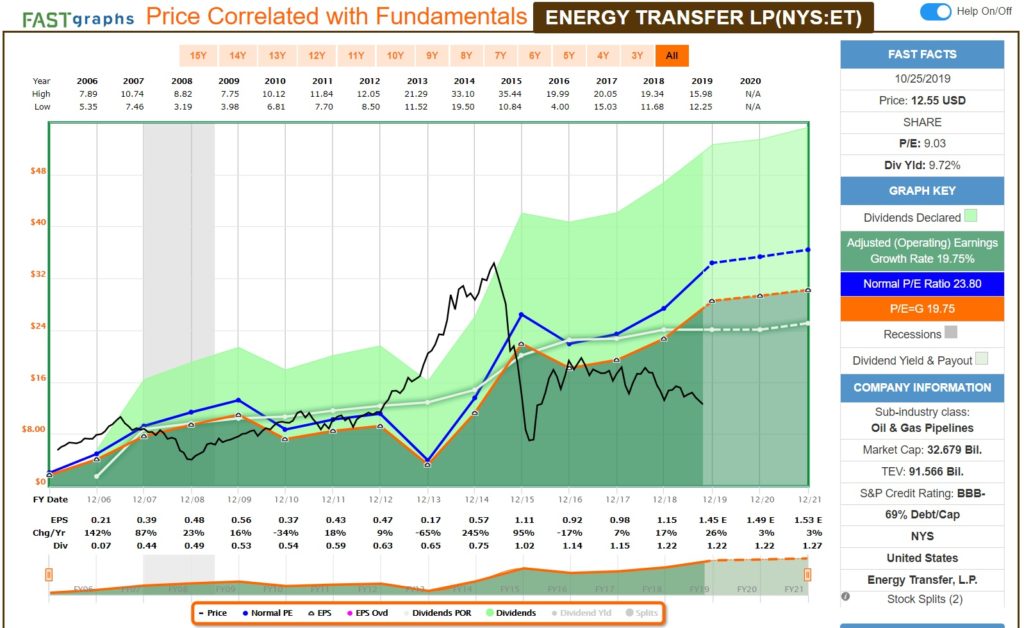

On October, 23rd, I bought 50 shares of Energy Transfer LP (ticker ET) at $12.61, adding to my 150 shares I already held before. This purchase added $61.00 to my PADI. Energy Transfer is as indicated in the name an energy company that owns a large platform of crude oil, natural gas, and natural gas liquid assets primarily in Texas and the U.S. midcontinent region after combining its two partnerships in October 2018. It also has gathering and processing facilities, one of the largest fractionation facilities in the U.S., and fuel distribution. Energy Transfer also owns the Lake Charles gas liquefaction facility, which it plans to convert into one of the largest LNG export facilities.

This is a higher risk, high yield stock. In fact, it is the highest yield on cost (YoC) stock I own at 8.79%. The payout ratio is high at 85% but the trend is downwards. The dividend growth is currently null, but I expect this to turn into a mid single digit number for next year. The starting yield of almost 9% compensates partially. This stock is to be closely watched. The FastGraphs chart indicates that we are on the way to better dividend coverage and the stock seems undervalued.

And then some more …

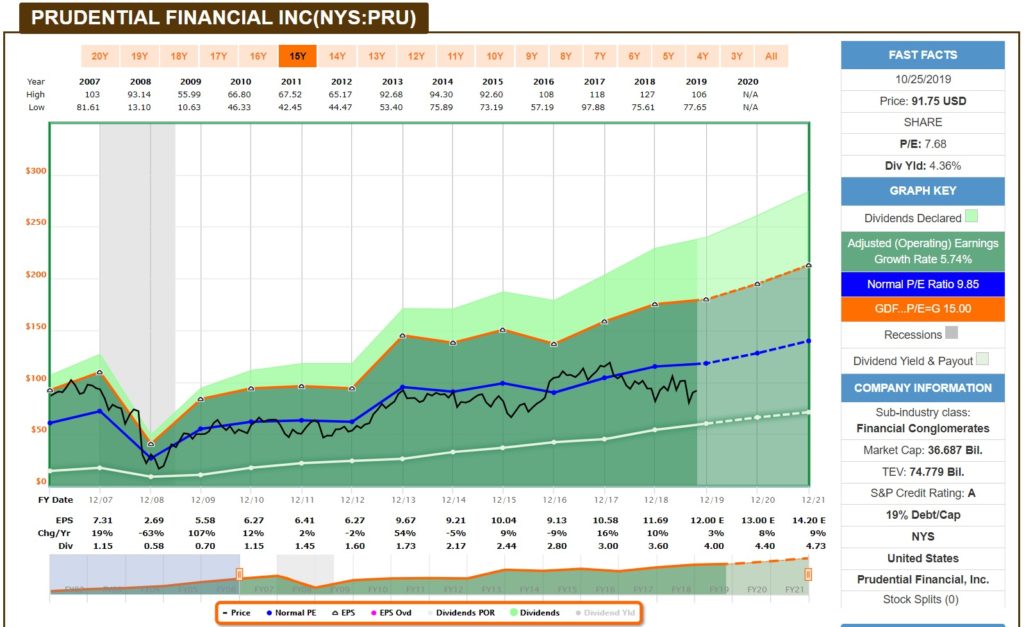

Last but not least I added 10 shares of Prudential Financial (ticker PRU) at $91.30 on October, 23rd. This adds another $40.00 to my annual dividend income. Prudential Financial is a large, diversified insurance company offering annuities, life insurance, retirement plan services, and asset management products. While it operates in a number of countries, the vast majority of revenue is generated in the United States and Japan. Prudential is the second-largest life insurance company in the US.

I like this kind of boring business model because it is relatively predictable, especially the life insurance and retirement planning is a field where changes do not happen over night. This is great for my dividend growth if the management controls the risks and debt. For Prudential Financial this is the case. A 19% debt/capital ratio and an A rating confirms it.

The dividend yield is at 4.38% and the 5-year AGR is 15.8% while the payout ratio is a low 32%. There is potential for further growth as in the last 10 years of consecutive dividend increases. A P/E ratio of 7.6 shows that the stock is currently undervalued.

Conclusion

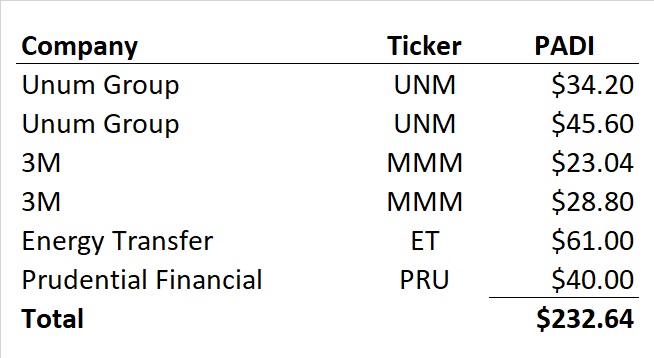

Let’s do the math! This month I added:

There you have it! This is how I managed to pass the $4.000 milestone for my projected annual dividend income (PADI). I am over the moon. I started my journey last year. With several months figuring out how this dividend growth investing works, finding the right information on websites and blogs, understanding the key metrics, I really kicked things off in December last year. And now in less than a year I have come such a long way. My savings rate has gone up since I am all in for dividend growth investing and it just comes to show that it is possible.

My blog was also recently awarded and included in the TOP100 Dividend Blog list.

Disclosure: At time of writing long EP, MMM, PRU, UNM, DAI. I do not own shares of BMW.

Disclaimer: I am not a professional investment or financial advisor. The information presented on this site represents my personal dividend growth journey and it is for informational purposes only. Opinions expressed are my own and should NOT be relied on or taken as investing advice. I have no knowledge about your personal situation and before you make any investment decision you should exercise due diligence and must do your own research. Always consider seeking advice from a professional financial and tax advisor.