The monthly review of my Dividend Growth portfolio helps me to keep track of my journey to financial independence. I am still at the very beginning but the evolution over the past 9 months has been spectacular. The growth of both dividend income and portfolio value are well above my expectation. As a dividend growth investor the dividend income generation is the key driver, but it makes me happy to have invested in stocks that demonstrate growth, too.

At the moment my investment portfolio amounts to $66,130 and my PADI (Predicted Annual Dividend Income) stands at $3,763. The current dividend Yield on Cost (YoC) of my purchases is 5.77%. Additionally I boost my returns by selling stock option and I reinvest this money directly into more shares. For this reason, the overall Yield on Cost of my money injected is 6.22%.

Stock Purchases

During the month of September we have seen a lot of stock increases and finding a suitable investment opportunity was not evident. This month, I invested my hard earned capital into a company I already own. There are two reasons I add to current positions. On the one hand, I believe that once I decided to invest into a company and the fundamentals have not changed, I will pick up more shares as long as the company remains at or below fair value. On the other hand, I do not want to inflate the number of companies I hold too much so that it would become difficult to track and manage. Diversification is important but at the same time the benefit of a new, additional stock for a highly diversified portfolio is only marginal.

In September I invested more money into Altria (Ticker: MO). On September, 13th I bought a total of 60 shares for an average cost of $42.89 including fees. The recent development of the stock price went against the market with doubts about the future revenue generation valume on vaping products and the potential merger with Philip Morris (Ticker: PM). Additional purchases is a good way to bring down the average cost. With this purchase I lowered my average cost to $45.26. In total, I hold now 130 shares of Altria.

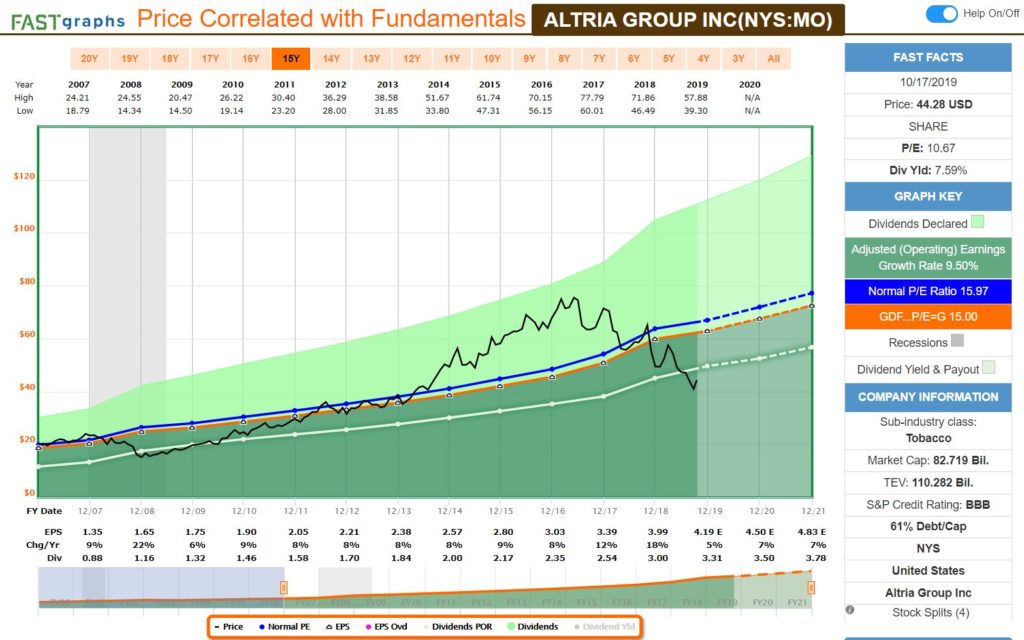

Looking at the FastGraphs chart the stock is trading significantly below its fair value. Surely, the rumors and speculative environment about the future of the business model have taken their toll of the share price. However, Altria can raise the price for the products to their customers which makes up for any decline in overall demand and, thus far, Altria has managed to generate suficient cash flow for its rather juicy dividend.

Altria’s current dividend yield stands at 7.59%. On the historical chart this is even for Altria a high value. Part of it is due to the fact that Altria just raised its quarterly payment from $0.80 to $0.84, a 5% increase. The dividend payout is on the high side with roughly 80% but the cash flow situation looks ok, so it should be relatively safe. I also do not expect any significant change in interest rates that may impact taking into consideration the large debt level.

The 60 new shares add $201.60 of annual dividends to my portfolio. Altria now represents 11.3% of my total proyected annual dividend income (PADI). This is more than I want it to be. With my current portfolio size I have set myself a limit to 10% share value but also 10% of dividend income for any given stock. As I continuously inject more money to my portfolio I will not sell shares now just to bring the level down to 10%. I will just not add any more shares for now. Over the next months, the percentage will drop back to 10%.

Conclusion

Slowly but surely I am building a core portfolio with some heavy weights, Altria being one of them, and define my strategy better over time. I also still have a steep learning curve on how to build a long-lasting, safe portfolio for financial independence. So far, it looks quite promissing.

Disclosure: At time of writing long MO

Disclaimer: I am not a professional investment or financial advisor. The information presented on this site represents my personal dividend growth journey and it is for informational purposes only. Opinions expressed are my own and should NOT be relied on or taken as investing advice. I have no knowledge about your personal situation and before you make any investment decision you should exercise due diligence and must do your own research. Always consider seeking advice from a professional financial and tax advisor.