In my blog launch post I stated that it would be a good idea to go through my portfolio and review purchases so far. Currently my portfolio consists of 35 different stocks. In terms of value 80% is listed in the US and 20% in Europe. At the moment, the largest sector in my portfolio is the Communication Services sector. I think it makes sense to start with this one.

The Communication Services sector makes up 17.7% of my portfolio. I hold 3 stocks of this sector with an investment of just above $11,000. The overall yield on cost is 6.27%, a very good starting point. The performance so far is -$229 (-2%), not a big deal, but the devil is in the detail. So, let´s go through them one by one.

AT&T (T)

AT&T is the world’s largest telecommunications company, the largest provider of mobile telephone services, and the largest provider of fixed telephone services in the United States through AT&T Communications. It made a mayor acquisition in 2018 with Warner Media, making it the world’s largest media and entertainment company in the world.

I bought 122 shares in three orders at different dates in December 2018 with an average cost of $28.64. In April 2019, I added another 20 shares at $30.72, which brings my total to 142 shares at $28.93.

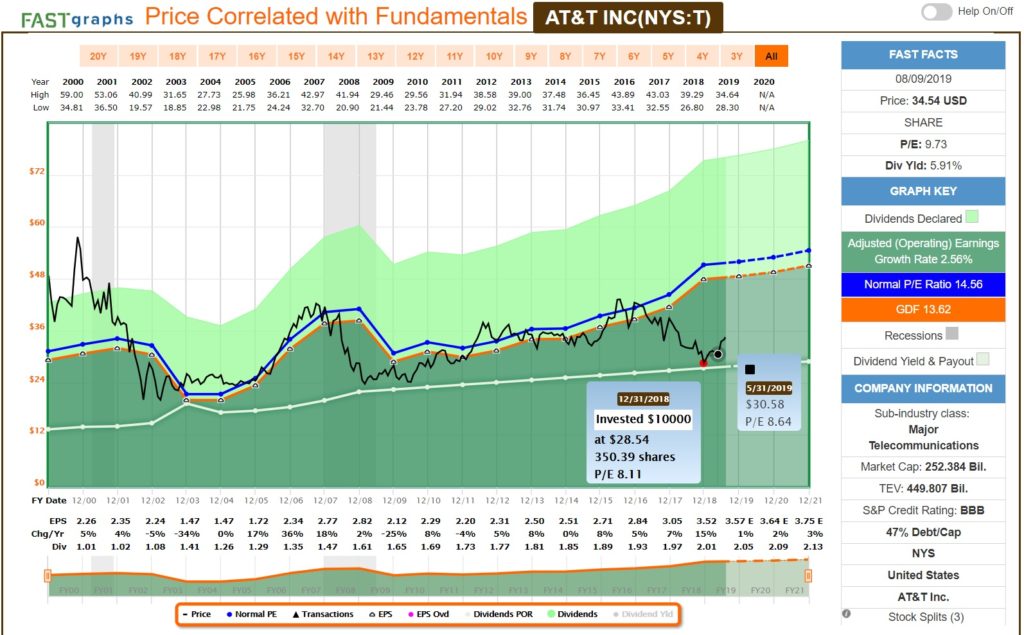

Source: FastGraphs

Looking at the FastGraph chart it appears that the stock is currently significantly undervalued. The red dot indicates roughly when I bought and the black one for the final (as FastGraphs only uses monthly data the actual transaction values differ). At a P/E of under 10 I am happy with this purchase. Even better though is its dividend, which stands currently at 5.91%. For me the YoC is 7.05%. This adds $289 to my PADI, making it 8.0% of my total dividend income. The payout ratio last year was at 38%, this year it is higher, but the dividend should not be at risk with a Simply Safe Dividends score of 55, but I need to review the status from time to time.

Century Link (CTL)

CenturyLink is a global technology company that provides communications, network services, security, cloud solutions, voice and managed services to customers worldwide.

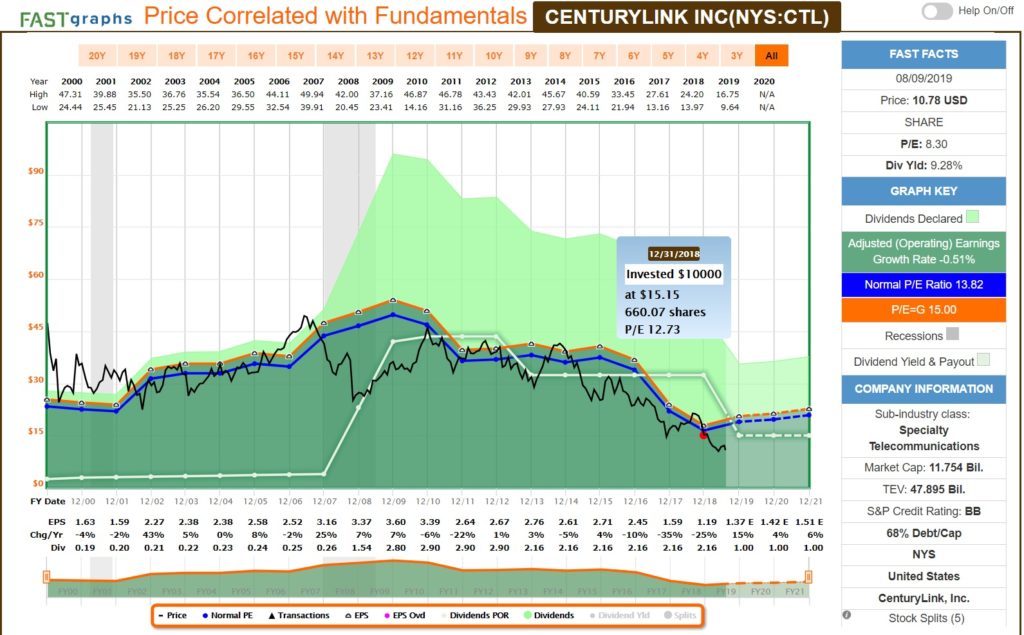

Source: FastGraphs

The FastGraphs chart tells it all. I purchased in total 300 shares for an average cost of $15.57 with the market dip in December 2018. Just after I had purchased this stock the big dividend cut from $2.16 to $1.00 was announced. This not only hit me hard for the dividend income but also send the stock even further down. I did not like that at all. I made a typical beginners mistake to focus too much on the dividend yield and not on the underlying fundamentals. With a payout ratio above 100%, coming from even higher levels in the years before that, it was a high risk.

I know in many blogs one of the rules people tend to give themselves is to sell a stock if the dividend is cut. I will hold on to these shares as a reminder. The stock currently trades at around 11 dollars. This is an unrealized loss of $1,300. At the same time, the current valuation does not look too bad and the income I generate from this stock is $300 for my PADI. It will take me about 4 years of dividends just to recover the loss on the share price. Then again, the main target is the income, not the actual portfolio value. My YoC is 6.32% and it is still my largest dividend position with 8.27% of PADI.

Verizon (VZ)

Verizon Communications is an American multinational telecommunications company. In 2015, Verizon acquired AOL and two years later it acquired Yahoo!. As of 2017, it is the second largest telecommunications company by revenue after AT&T.

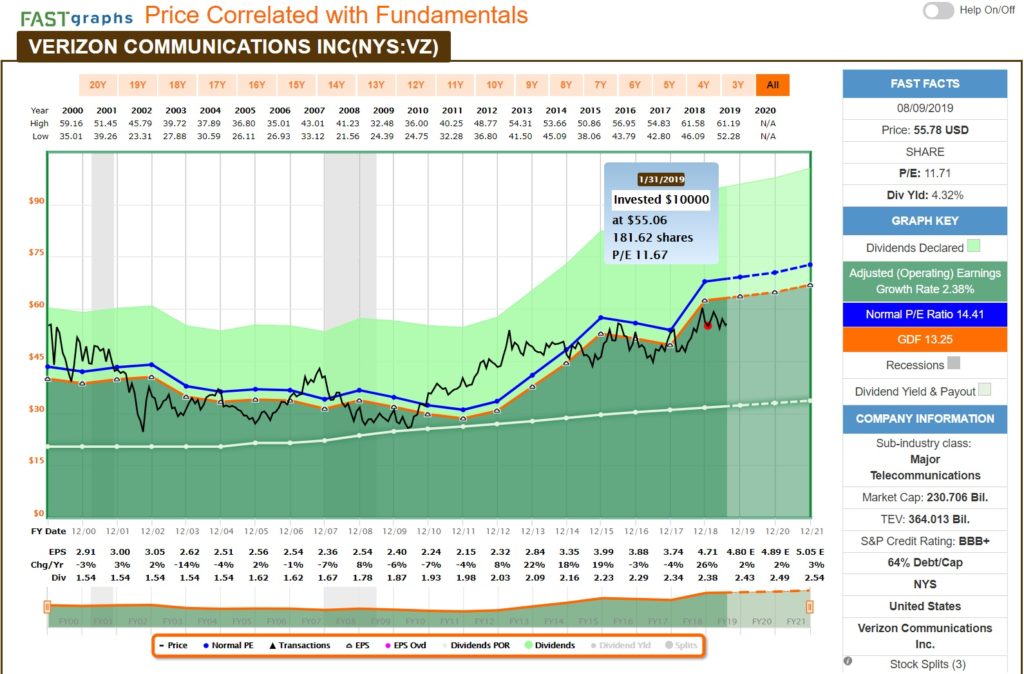

I bought 42 shares at a cost of $53.33 on Christmas Eve. With improved results in 2018 the company looked slightly undervalued. The YoC is 4.52% and the payout ratio is 62%, there is room for coverage. This dividend is rated by Simply Safe Dividends as Very Safe with a score of 84.

Source: FastGraphs

Conclusion

The Communication Sector is a heavyweight in my portfolio accounting for 17.7% in value and 19.1% in dividend income. The average YoC is 6.27%, which is very juicy. At the same time, dividend growth is slow (or negative) but as long as they will be paid this is fine for me. I believe that this sector has a long way to go and the mobile and wireless market is far from saturated. For this reason, I expect these 3 companies to stick around for quite some time.

From a dividend investment point of view, I have learned not to focus too much on the yield only. Also, understanding better the financial situation and doing some more research before investing is needed. Otherwise a surprise like CTL will not be the only one.

Thanks for reading and I hope you continue to follow me on this journey.

Disclosure: long on T, VZ, CTL

Disclaimer: I am not a professional investment or financial advisor. The information presented on this site represents my personal dividend growth journey and it is for informational purposes only. Opinions expressed are my own and should NOT be relied on or taken as investing advice. I have no knowledge about your personal situation and before you make any investment decision you should exercise due diligence and must do your own research. Always consider seeking advice from a professional financial and tax advisor.